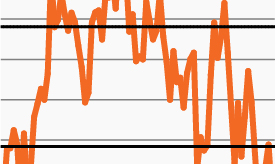

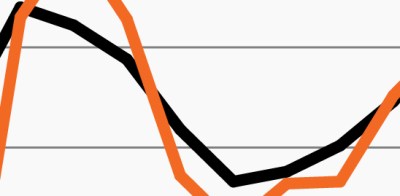

Weekly relative U.S. equity returns, value-growth

Source: Bloomberg Finance, L.P., as of January 12, 2022. Returns based on the S&P 500 Pure Value Index and S&P 500 Pure Growth Index.

- After a narrow group of U.S. large cap growth stocks led the broader equity markets higher through the second half of 2021, markets appear to be rapidly internalizing the combination of strong growth and tighter financial conditions.

- As this week’s chart highlights, 2022 has ushered in a violent rotation in equity market leadership with high-multiple growth stocks falling sharply and cyclicals enjoying a healthy start to the New Year. Value stocks have outperformed growth stocks by approximately 10% year-to-date driven largely by energy and financials.1

- The Nasdaq 100 plunged 4.46% in the first week of January, its worst week since February 2021, highlighting the significant downward pressure on mega cap tech stocks. The selling pressures continued this week with the index down -0.62% through Thursday.

- Given the backdrop of rising inflation, evolving central bank policy and the prospect for generally strong economic growth, 2022 may provide an optimal environment for active, skilled managers to leverage their expertise to identify opportunities among a wide and changing opportunity set.