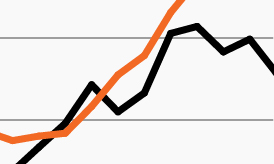

Real yields, growth and value stocks

Source: Bloomberg Finance, L.P., FS Investments, as of April 20, 2022. The S&P 500 Growth Index draws the highest growth-oriented companies from the S&P 500. The S&P 500 Value Index tracks value-oriented companies from the S&P 500. TIPS refers to Treasury Inflation-Protected Securities, whose par, or face, value rises with inflation as measured by the consumer price index.

- Amid the many quickly evolving market themes investors are watching—the ongoing war in Europe, a volatile commodities complex, expectations for rapid tightening from the Fed, among others—real (inflation-adjusted) yields’ rapid rise may rank among the most important.

- Real yields, which fell at the onset of the pandemic and remained negative since, have helped support outsized returns among core fixed income and other low-duration investments, including a handful of mega-cap technology stocks.

- Real yields’ continued rise could create ongoing volatility and threatens to reverse many of the same themes that have driven markets in recent years.

- For one, it calls into question growth stocks’ return outlook. As the chart shows, growth stocks strongly outperformed value as real yields plummeted in April 2020.1 Since real yields have risen, however, they have traded well off their Q4 2021 high while value has generally moved sideways.

- As the market and economic environment have evolved the past several years, investors may increasingly have to find new and different sources of return. Today’s backdrop may provide an optimal environment for active, skilled managers to leverage their expertise to identify potential possibilities across a wide and quickly changing opportunity set.