Just like when Ashton Kutcher and Seann William Scott woke up to find that unexpected circumstances caused their car to go “missing,” commercial real estate investors received a shock earlier this year when the COVID-19 pandemic quickly changed the underlying landscape for what most expected to be a ho-hum year for CRE investing. The fate of the office has been a prominent subtheme throughout 2020 as many Americans quickly left their offices behind and transitioned to working from home, with varying levels of success. As we move forward in this new environment, a question on many investors’ minds remains: What does the future of the office look like? And what is the outlook for investing in the CRE office sector?

A diverse market with differing demand drivers

First, a refresher on the U.S. commercial real estate market: The $2.5 trillion office market is the second-largest property type within the approximately $16 trillion U.S. CRE market.1 Office is a little smaller than multifamily but still about twice the size of the entire high yield bond market.1 Within this large and diverse property type, many different factors influence demand and pricing.

Most of the recent headlines around the office market have focused on towers in central business districts (CBDs). Because these are some of the largest and most iconic buildings, they tend to grab headlines, but they tell only part of the story. If we simply divide office into CBD and suburban, we start to see how important it is not to treat “office” as one monolithic sector.

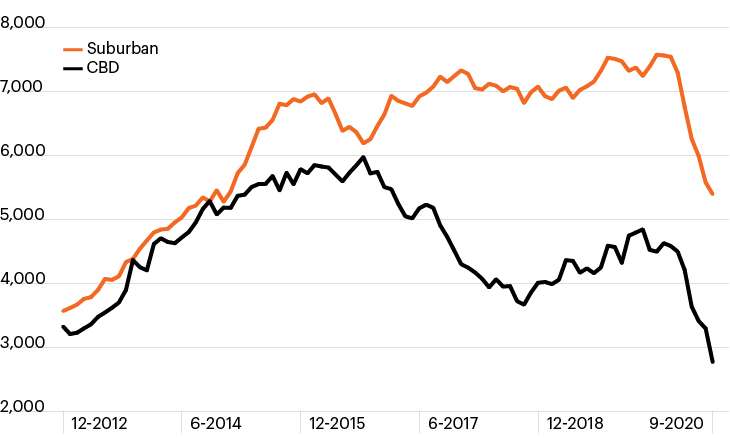

CBD vs. suburban office volume ($M)

(12-month rolling average)

Source: Real Capital Analytics, as of September 30, 2020.

Prior to the pandemic, for example, the CBD and suburban office markets showed significant differentiation. CBD office sales volume steadily rose in the years following the Global Financial Crisis (GFC) but began to decline starting in 2016. In contrast, suburban office sales volume had been steadily rising until Q2 2020.2 From a sheer transaction volume perspective, suburban office was clocking nearly double the quarterly volume, while suburban pricing has remained relatively steady over the past decade, unlike that of CBDs.

What we see is that CBD office volume was already decelerating prior to the pandemic-induced downturn. From a pricing perspective, CBD office has also become relatively more expensive (i.e., lower cap rates) with many large buyers searching for trophy properties. Further, leasing activity data shows that rent changes in the 15 largest markets were more severe than the national average as the COVID crisis has impacted big cities more acutely.

Despite the broader stresses this year, it is important to note that office is decidedly not facing the type of immense debt service crisis that other property types are. For example, office delinquency rates (the percentage of loans 30+ days past due) on commercial mortgage-backed securities (CMBS) ticked up slightly in 2020, from 1.72% in February to 2.28% in September. But delinquencies on office properties remain far below those of more distressed property types like retail or lodging. Office property owners have continued to pay their debt service on time, thanks in large part to longer-term leases and tenants paying rent as scheduled.

What lies ahead?

For office workers, some change, but much remains the same

The longer the pandemic has lasted, the louder the “office is dead” drumbeat has grown. We don’t discount that the office might be forever changed, in part because many employers are likely to provide greater workplace flexibility to their employees. But we also remain confident that the office will continue to play a vital role in how we work and that demand for office space will hold firm over the long term, despite the shorter-term pressures it faces. Consider several factors that point to the office remaining a fixture in a post-pandemic world:

- Employers don’t want 100% WFH. Offices play a critical role in helping companies foster culture and a collaborative work environment among employees, which can be difficult or impossible to reenact in an entirely virtual setting. Chief executives largely embraced working from home at the beginning of the pandemic, when they had little choice, but have increasingly expressed their misgivings as WFH has turned into a longer-term proposition.

- Many employees prefer a (partial) return to the office. It’s clear, according to survey data, that employees’ relationships with the office will change in a post-pandemic world as many have expressed an interest in greater flexibility. However, only about a third of workers (32%) would prefer not returning to the office at all.3 The large majority still prefer the office as a workplace over their bedroom. In fact, nearly three-quarters of all employees surveyed (72%) by PwC in June said they would like to move toward a model in which employees spend several days a week in the office and several working from home.3

- If workers trend toward spending part of their time in the office, employers will likely have to maintain similar levels of space in order to ensure appropriate social distancing while also having enough office space to deal with “peak load” days in which most employees come to the office at the same time.

- Companies will need more space per worker. Office tenants in the coming years will likely look to reverse the past decade’s trend of reducing each employee’s personal footprint. According to Cushman & Wakefield, square footage per employee fell by nearly 9% from 2009 through 2017.4

What lies ahead?

For office investors, a change in focus

The significant changes that COVID has produced for office workers will likely be just as large for investors, as demand for office CRE investments faces significant shorter-term headwinds. Against this backdrop, office investments in higher-demand areas could continue to fare well in the years ahead.

- Greater selectivity is key: All recessions are unique, but one corollary to the GFC that may apply today is that of a long and slow economic recovery, including the recovery in office values.

- A shift toward suburban office: Suburban office space came into 2020 with higher transaction volume and less cap rate compression compared to CBDs. Like many other areas of CRE investing, the pandemic could exaggerate this divergence. Certainly, in the coming few quarters and even in a post-pandemic world, suburban office seems poised to remain attractive to companies that value the extra space it can afford employees.

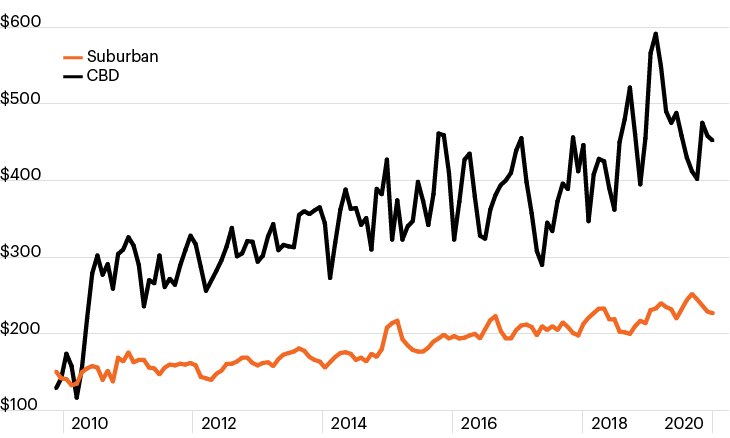

Office space: Average price/square foot

Source: Real Capital Analytics, as of August 31, 2020.

Nationally, the average price per square foot of suburban office space is slightly less than half that of CBDs. The prospect of cheaper office rents, combined with a more spacious environment, could act as a tailwind supporting new suburban office development and leasing activity as companies continue to enact cost-cutting measures wherever possible while also looking to support employees’ social distancing needs.

- Demand shift, rather than elimination: Near-term fundamentals clearly favor suburban markets. However, the diversity of talent, educational and career opportunities, as well as the concentration of wealth and industry in central business districts have taken decades to develop – think of Wall Street in New York or technology across Silicon Valley, Seattle and Austin – and won’t easily be broken apart or decentralized. With this in mind, we would never look past CBDs as a source of attractive long-term investment opportunities despite the challenges they face today.

In fact, new signs of CBD activity have already begun in the form of “groundscrapers,” or large urban buildings that extend horizontally instead vertically. Amid the pandemic, Amazon, Apple and Facebook have leased or bought large office spaces in Manhattan. Despite tech companies having taken the initial lead in allowing their employees to work from home, Facebook and Amazon have also announced plans for new office space in the Seattle area.

Clearly the pandemic has brought many significant and potentially long-lasting changes to both how we work in an office and how we invest in office CRE. However, despite the short-term pressures and the significant headline risks present in the sector at the moment, opportunities remain for selective investors focused on the long term.