Creating efficient access to private markets

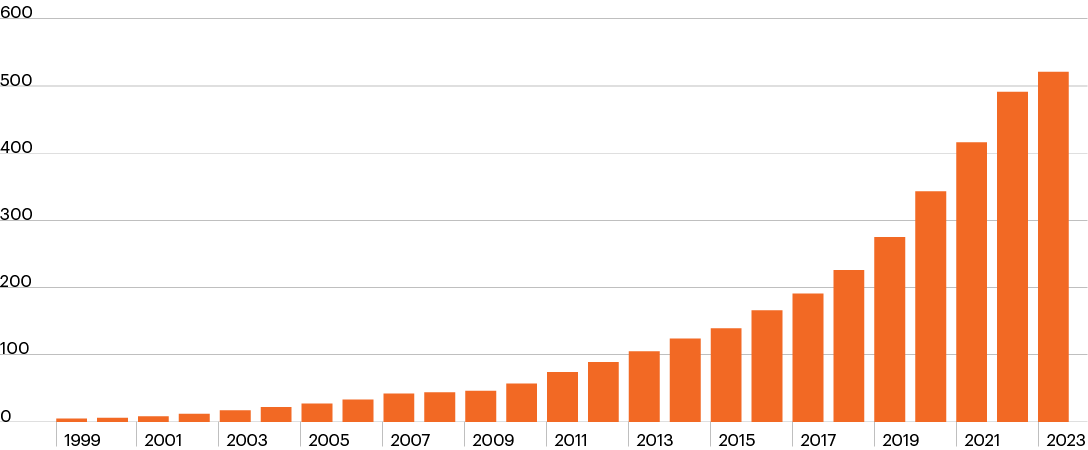

The evergreen label is broadly applied to funds that are perpetually offered and allow investors to purchase or redeem shares on a periodic basis — typically monthly or quarterly (Figure 1). Evergreen fund assets under management are estimated to be over $400 billion today.1

The emergence of evergreen funds over the last several years has helped address many of the historical challenges individuals have faced investing in private markets such as private debt, private equity and real estate.

Figure 1: Number of evergreen funds

Source: Prequin. Includes business development companies, interval funds, non-traded REITs, European long-term funds and long-term asset funds.

An evolution of private market access

Private market investing has historically been the domain of large institutional investors due to the high investment minimums and strict suitability requirements of the private drawdown funds commonly employed by investment managers in these markets. In addition, drawdown funds require a long-term investment horizon (10 years or more) with investors’ capital committed at a point in time but invested, or drawn down, over several years.

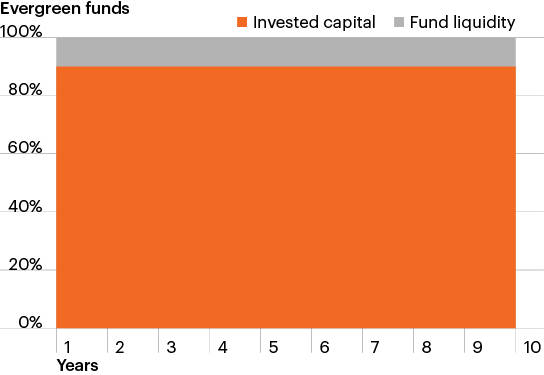

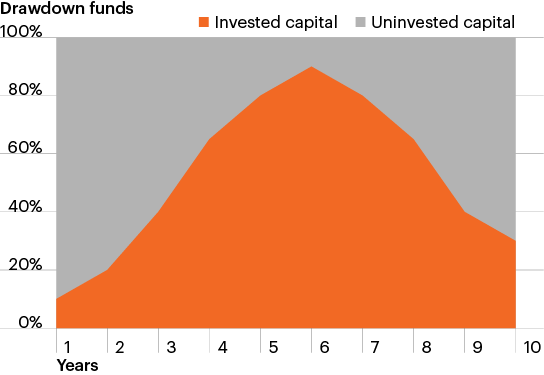

While drawdown funds have useful applications for large, institutional investors based on their long-term investment horizons and investment objections, individuals are accustomed to lower investment minimums, more frequent liquidity options and immediate deployment of their investment into return-generating assets (Figure 2).

Many evergreen fund offerings are registered with the U.S. Securities and Exchange Commission (SEC) and, therefore, provide enhanced investor oversight compared to closed-end drawdown funds.

Figure 2: Key differences between closed-end drawdown funds and evergreen funds

| Evergreen funds | Closed-end drawdown fund | |

|---|---|---|

| Fund structure | Perpetual offering | Closed-end, limited partnerships |

| Term | No fixed end date | Typically 10 years |

| Investor suitability | Accredited investor/Qualified client | Qualified purchaser ($5 million net worth) |

| Tax reporting | 1099 | K-1 |

| Capital calls | No | Yes |

| Minimum investment | As low as $25,000 | Typically $5 million or greater |

| Redemptions | Typically monthly or quarterly | None until maturity |

Addressing investment challenges

In addition to more user-friendly terms and liquidity options, evergreen funds help address some of the operational complexity inherent in drawdown funds.

- Immediate deployment of capital: Evergreen funds are perpetually offered with investor capital immediately deployed into return-generating investments compared to closed-end drawdown funds in which committed capital is drawn down over several years (Figure 3). Evergreen fund managers typically allocate a portion of capital to cash or other liquid securities to ensure the fund has liquidity to meet investor redemption requests at the stated intervals.

- Reduction of the J-curve effect: The J-curve effect is used to describe the return profile of drawdown funds where returns are typically negative in the first few years of the fund’s life cycle as the initial capital is invested and fees are paid to the managers. Returns begin to increase in the later years when investments are exited and distributions are paid to investors. As discussed above, evergreen funds help investors get and stay invested compared to drawdown funds.

- Mitigates blind pool risk: Given the perpetual nature of evergreen offerings, investors can allocate to a funded portfolio compared to drawdown funds, which often do not own any investments at the time that investor’s capital is committed to the fund.

Figure 3: Illustrative example of the investment cycle for private equity evergreen funds vs. drawdown funds2,3

For illustrative purposes only. There are many factors that could result in an investment not achieving these results, including market conditions, the illiquid nature of private equity investing, strategy risks, interest rate risk, and the use of leverage, among others.”

Summary

Evergreen funds may help deliver many of the historical challenges for individuals to access the yield, return and diversification potential of private market investing.

As with any investment decision, investors should consider the investment risks, expertise of managers and their ability to execute their strategy using different investment structures.