Education > Strategies > Private equity

Private equity

Explore the opportunity investing in private companies

Why invest in private equity?

Overview

Private equity (PE) investing refers to investing in shares of companies not publicly traded or listed on a stock exchange.

Pension funds, endowments and other large institutions have long turned to private equity to help enhance returns and diversify their portfolios.

Trends driving private equity growth

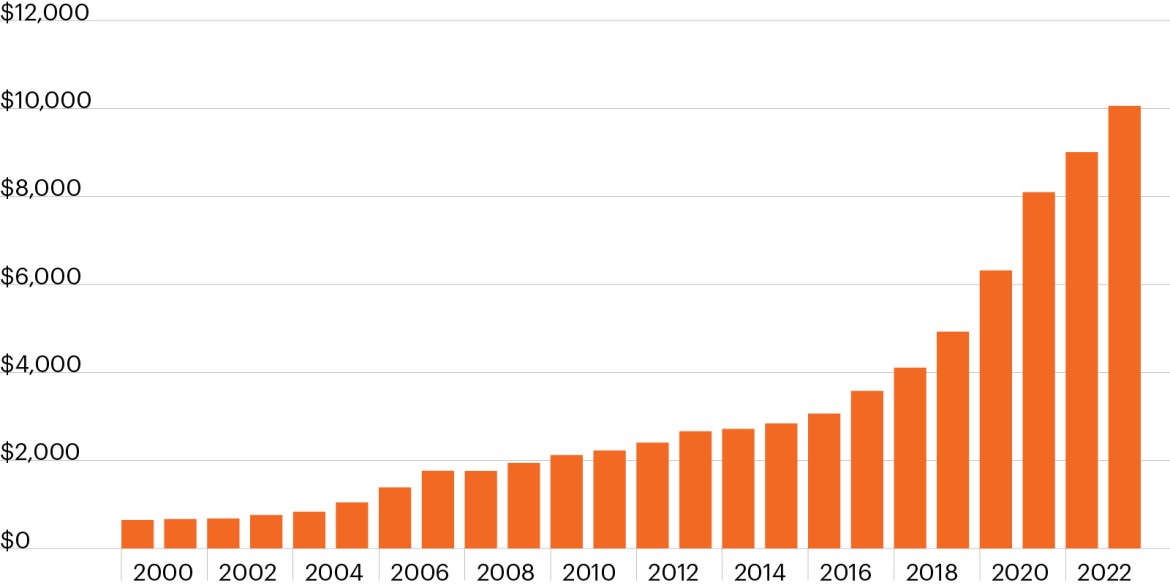

The global private equity market has grown to over $10 trillion in assets, driven by strong performance compared to public markets, a rising opportunity set in private companies and increased investor demand amid the emergence of investment vehicles focused on expanding access to the private equity market.1

Strong historical performance

Private equity has provided strong performance over the past 5, 10, 15 and 20 years.

Source: Pitchbook North America PE benchmark as of 6/30/2022. To be included in pooled calculations, a fund must have: (i) at least one LP report within two years of the fund’s vintage and (ii) LP reports in at least 45% of applicable reporting periods.

Note: Investors cannot directly invest in either of the indices presented above.

1. As of 6/30/2023

Diverse opportunity set in private markets

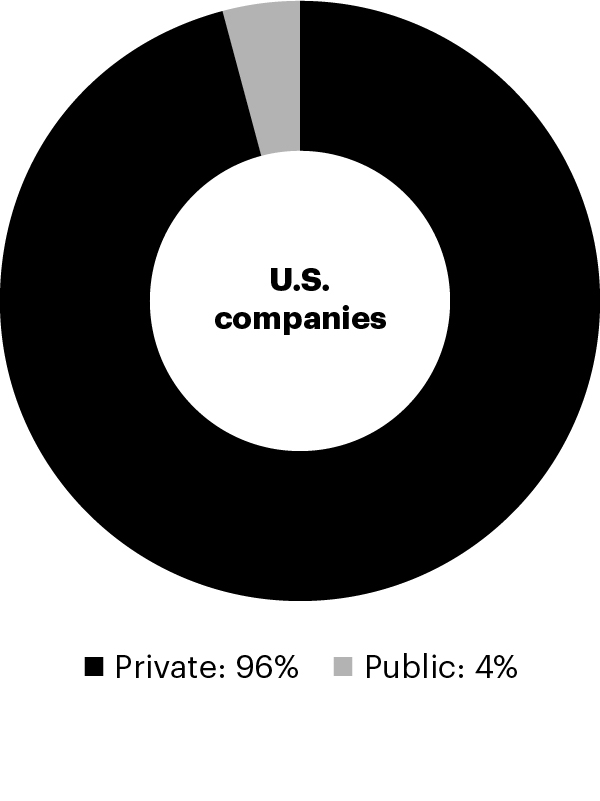

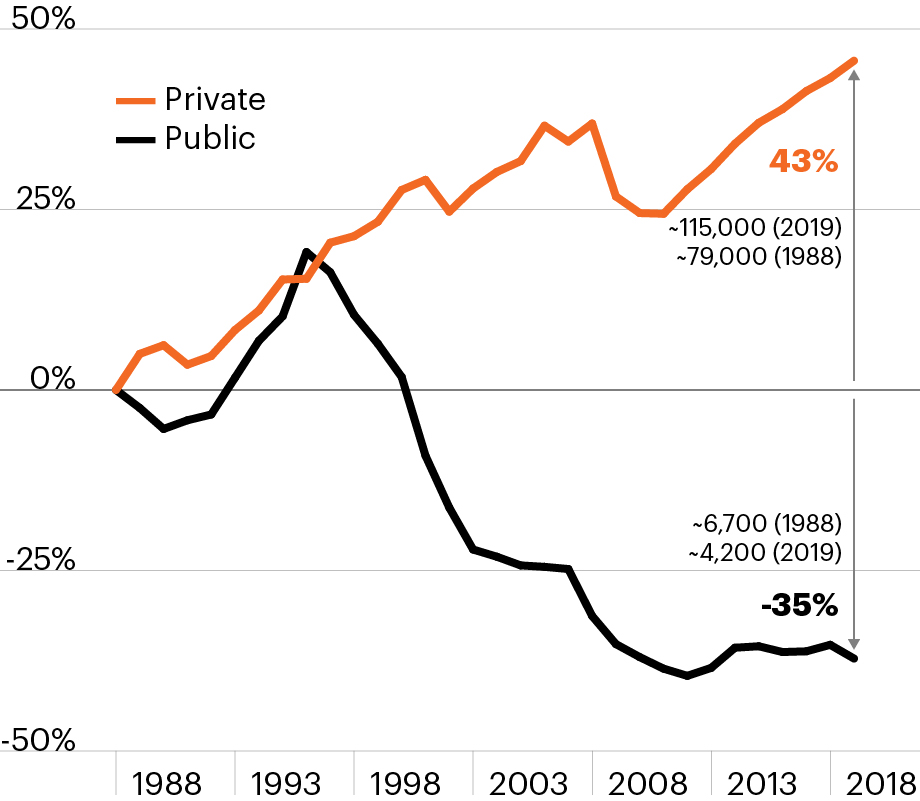

Since the late 1990s, the number of publicly traded companies has fallen by 35% while the number of private companies has increased by over 40%.

In fact, 96% of all U.S. companies are private. Companies are staying private longer for many reasons, including the high tax and regulatory costs of being a public company and the the growing role of private equity managers in helping management teams execute growth plans and provide the capital needed to fund their growth.

1. U.S. Census Bureau; U.S.-based private companies with more than 100 employees for years 1988–2019.

2. World Bank; US-based listed companies for years 1988–2019.

Rising investor demand

The rise in private equity assets under management over the last 10 to 15 years has been fueled by rising demand from institutional investors alongside the advent of investment vehicles designed to provide individual investors with greater access to private equity.

Global private equity assets under management ($ billions)

A deeper dive

The latest research and insights on alternatives.

What does good news for the U.S. economy mean for private equity?

Read the latest strategy note from our Chief Market Strategist Troy Gayeski.

Lara Rhame’s 5 for 5

Chief U.S. Economist Lara Rhame discuss five key challenges facing investors in 2024 and five opportunities that may provide income, growth and diversification.

Research report: Private equity secondaries

Get an in depth primer on the private equity secondaries market from the Investment Research team.

Know your alternatives

At FS Investments, we are committed to furthering education on alternative investments—empowering our partners with the latest on new solutions, potential opportunities and key market trends.

Discover our offerings for financial professionals.

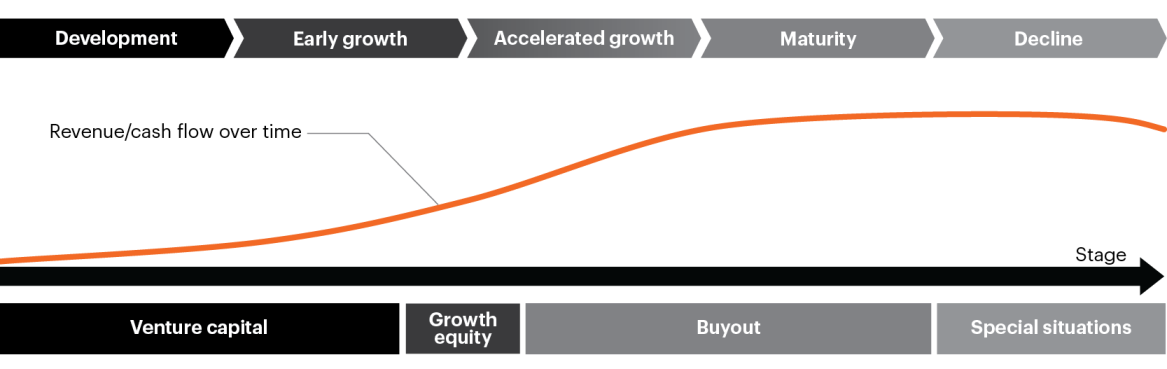

Life cycle of private equity investing

Private equity includes a range of investment strategies that correspond to a specific stage of a company’s life cycle from early-stage venture capital to later-stage buyouts and special situations.

Venture capital

Start-up or early-stage companies with high growth expectations

Growth equity

Companies that are still typically early in their life cycle but are closer to being profitable than venture capital

Buyout

Established profitable companies

Special situations

Typically involves a company undergoing some form of financial stress

Stages of investment along the business cycle

Private equity landscape in the business cycle framework

For illustrative purposes only.

Source: Mercer “Understanding Private Equity, A Primer” September 2015.

Ways to invest in private equity

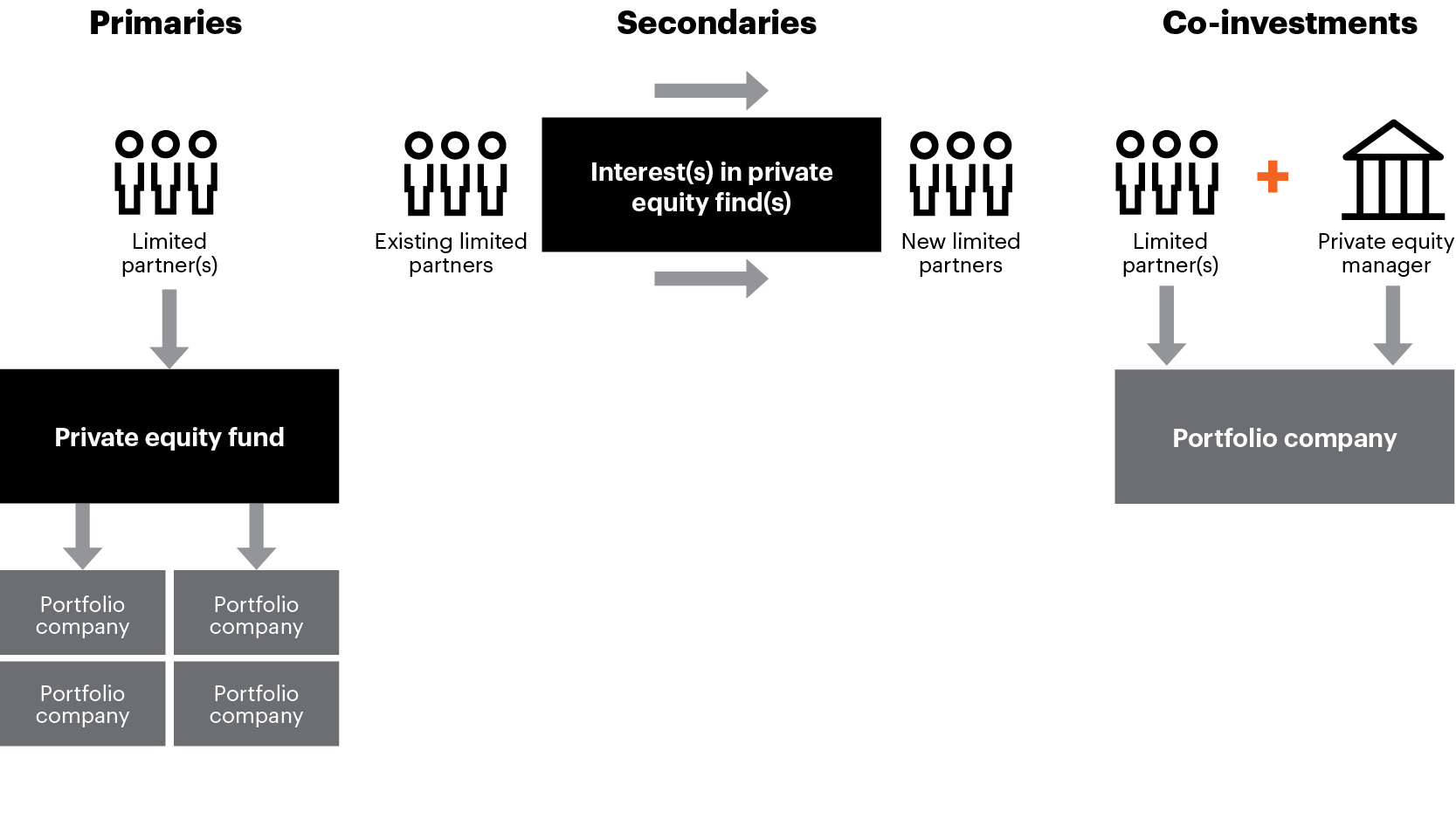

There are three main ways to invest in private equity:

Primaries

Investments in new private equity funds

Primary investments are when a limited partner invests in a newly established private equity fund. Limited partners typically invest in a “blind pool,” which means they are the first investors in the fund before investments have been made by the general partner. As the general partner identifies new investments over several years, the limited partners contribute additional capital to the fund.

Secondaries

Investments in existing private equity funds

Secondary investing refers to the purchase of existing interests or assets from primary private equity funds. The secondary market for private equity funds has grown significantly in recent years driven by many factors, including a deeper and wider PE investor base, public stock market performance and portfolio construction considerations for both limited partners (LPs) and general partners (GPs). There are two primary types of secondary investments:

LP-led secondaries: Limited partners may have a desire to exit their investment in a primary fund ahead of the fund’s final maturity date. LP-led secondaries involve an LP seeking to sell their interest in a primary fund (or funds) to a new LP. In most cases, a secondary transaction requires the approval of the GP.

GP-led secondaries: General partners may assist their limited partners in selling their interests in a primary fund. This is called a GP-led secondary. In recent years, GP-led secondaries have been used by GP’s to retain ownership in portfolio companies they believe have further growth opportunities but may be reaching the end of the primary fund’s life cycle. In those cases, the general partner will create a new fund, referred to as continuation fund, with the sole purpose of acquiring the interests in the portfolio company (or companies), providing the GP more time to grow and eventually exit its investment in the company.

Co-investments

Direct investments in private companies

In certain cases, a general partner may invest alongside a limited partner directly in the equity of a private company—as opposed to the LP investing in the GP’s private equity fund. This is referred to as a co-investment. For LPs, co-investments offer direct access to portfolio companies, typically at a reduced cost compared to investing in a primary fund. For GPs, co-investments help strengthen the relationship with an LP.

Investor considerations

Investing in alternatives is different than investing in traditional investments such as stocks and bonds. Alternatives tend to be illiquid and highly specialized. In the context of alternative investments, higher returns may be accompanied by increased risk and, like any investment, the possibility of a partial or total investment loss. Investments made in alternatives may be less liquid and harder to value than investments made in large, publicly traded corporations. When building a portfolio that includes alternative investments, financial professionals and their investors should first consider an individual’s financial objectives. Investment constraints such as risk tolerance, liquidity needs and investment time horizon should be determined.

This information is educational in nature and does not constitute a financial promotion, investment advice or an inducement or incitement to participate in any product, offering or investment. FS Investments is not adopting, making a recommendation for or endorsing any investment strategy or particular security. All views, opinions and positions expressed herein are that of the author and do not necessarily reflect the views, opinions or positions of FS Investments. All opinions are subject to change without notice, and you should always obtain current information and perform due diligence before participating in any investment. FS Investments does not provide legal or tax advice and the information herein should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact any investment result. FS Investments cannot guarantee that the information herein is accurate, complete, or timely. FS Investments makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information.

Any projections, forecasts and estimates contained herein are based upon certain assumptions that the author considers reasonable. Projections are necessarily speculative in nature, and it can be expected that some or all of the assumptions underlying the projections will not materialize or will vary significantly from actual results. The inclusion of projections herein should not be regarded as a representation or guarantee regarding the reliability, accuracy or completeness of the information contained herein, and neither FS Investments nor the author are under any obligation to update or keep current such information.

All investing is subject to risk, including the possible loss of the money you invest.

Diversification does not ensure a profit or guarantee against a loss.