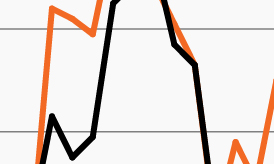

Share of non-agency CRE loan originations

Source: CBRE as of June 30, 2024, latest data available. Chart shows average loan origination by lender type during the first half of 2023 and 2024.

- Sentiment among commercial real estate market participants notably improved in recent quarters as optimism has grown that the market is nearing the nadir of its years-long correction.

- Monthly CRE property prices turned slightly higher in May 2024 and have seen steady but modest increases in the three months since, as fundamentals outside of Office continue to lend support to the market. Meanwhile, transaction volume has shown signs of thawing as investors prepare for the Fed to enact a new rate cutting cycle in September.

- As deal volume picks up, borrowers will likely find a different lending environment from that of several years ago. Banks have maintained a cautious approach to CRE lending, with some freeing up risk capacity through risk transfers and outright loan sales this year.

- While banks’ share of CRE loan originations nearly halved during the first half of 2024 compared to the same period in 2023, alternative lenders have increasingly stepped in.1 As the chart shows, alternative lenders’ share of CRE loan origination jumped from just 23% during the first half of 2023 to 40% during the same period in 2024.1

- The income potential in CRE lending continues to be as attractive as it has been in years as base rates remain elevated. Within this environment, alternative lenders are in an excellent position to take advantage of income opportunities as the outlook for transaction volume improves.