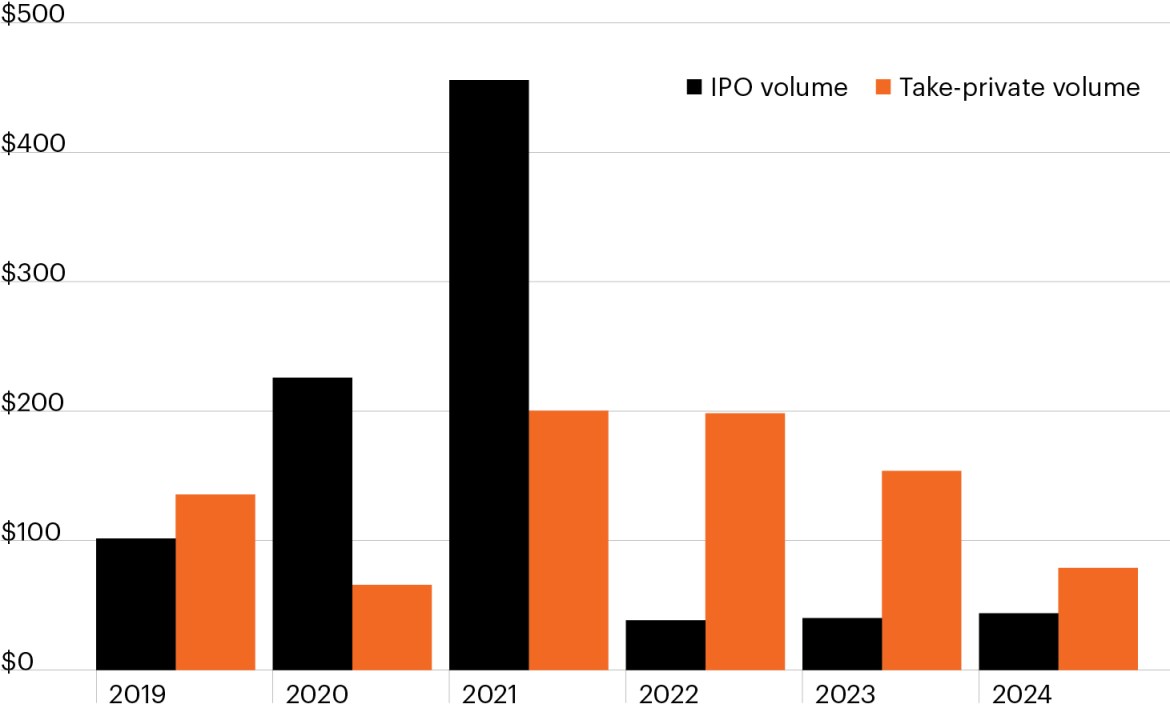

North American and European deal activity ($ billions)

Source: Pitchbook and Bloomberg Finance, L.P., as of June 30, 2024, latest data available.

- Markets have undergone a seismic shift since the 1990s as the opportunity set for investors has steadily moved from public to private markets.

- Over the past three decades, the number of publicly listed companies has fallen from more than 8,000 firms to just above 4,000, as companies opted either to stay private for longer or de-list from public markets altogether.1

- The chart shows how this trend has reaccelerated over the past five years. Despite a brief post-COVID boom in firms going public in 2020 and 2021, take-private volume ($431 billion) has outpaced initial public offering (IPO) volume ($123 billion) by more than 3.5x since 2022.2

- Reasons for companies to remain private are numerous, from a desire to avoid short-term pressure from public shareholders to a preference for opting out of costly and time-consuming disclosures required of public firms.

- Yet the shift has had profound implications for investors. Private markets were once the province of institutional investors such as pension funds, university endowments and sovereign wealth funds. Yet as retail demand has grown along with the opportunity set there, private investment opportunities have increasingly become available to individual investors.

- Against the backdrop of a slowly shrinking public market with historically high valuations, the case for the growth and diversification potential that private markets may offer has rarely been more compelling.