Key Takeaways

- Transaction volume remains well below even pre-COVID levels, suggesting a lingering bid/ask spread.

- Investors have chosen to wait for the market to recover instead of selling into an unwelcoming market.

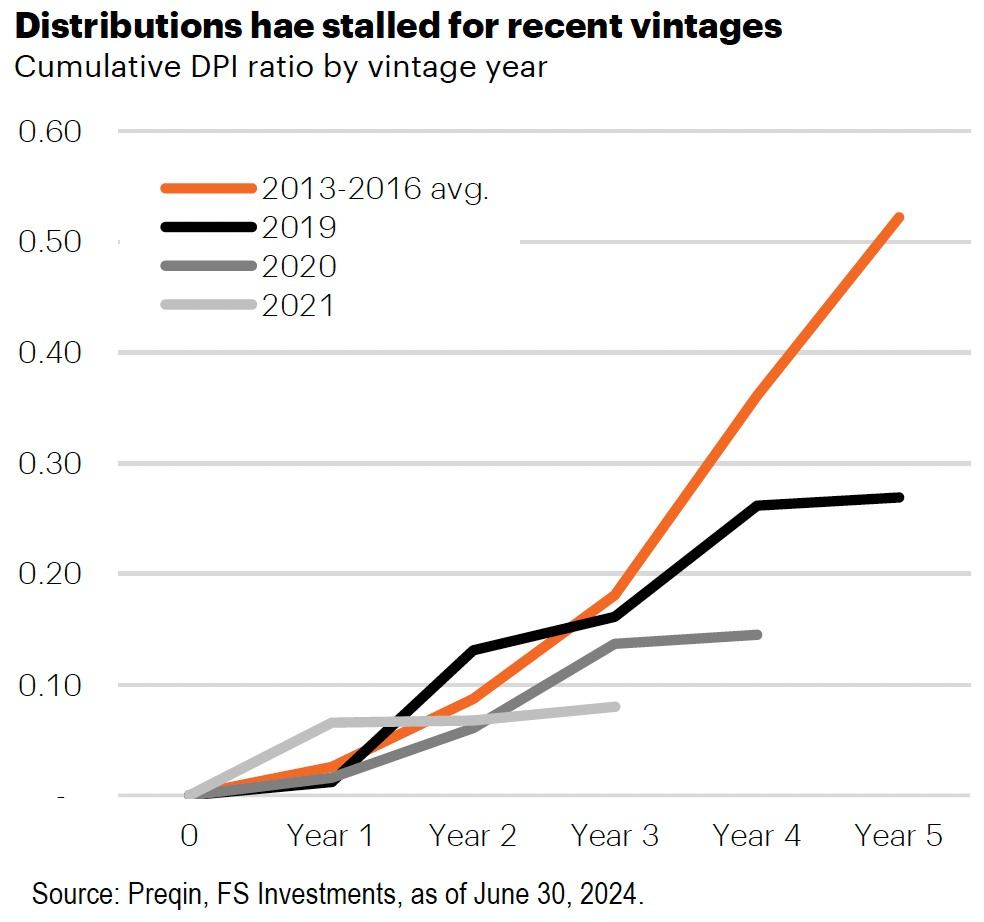

- The consequence has been that LP distributions have plunged, driving demand for secondary deals.

While certain signs indicate the real estate market is set for a rebound, the lack of recovery in deal flow thus far suggests pressure on property values remains. A low level of property turnover indicates buyers and sellers have yet to fully close the pricing gap wrought by higher interest rates. Resilient economic fundamentals have allowed investors to hold onto assets to the detriment of market liquidity, with the prevailing sentiment that the combination of Fed rate cuts and steady income growth would close the bid/ask spread over time.

While wide dispersion exists, values of transacted properties have largely stopped declining. In fact, the MSCI RCA CPPI rose 1.5% in the three months ending August 31. Still, it would be premature to suggest this represents an inflection point given the value of transactions generally remains -40% below pre-COVID norms. Clearly, not all the tension has been relieved from valuations, and it appears these transaction-based indexes may be suffering from a selection bias—investors are selling only those buildings that can fetch attractive valuations.

Fund managers have been grudgingly reducing the value of their holdings to the tune of a -23% cumulative decline since late 2022, as appraisal lag has been on display.

Why have sellers not capitulated by bringing more deals to market, which would provide much-needed price transparency? The calculation appears to be that with property income growth solid and the Fed set to reduce rates, they are willing to wait out the market and allow it to grow into its valuation without the need for further large price reductions.

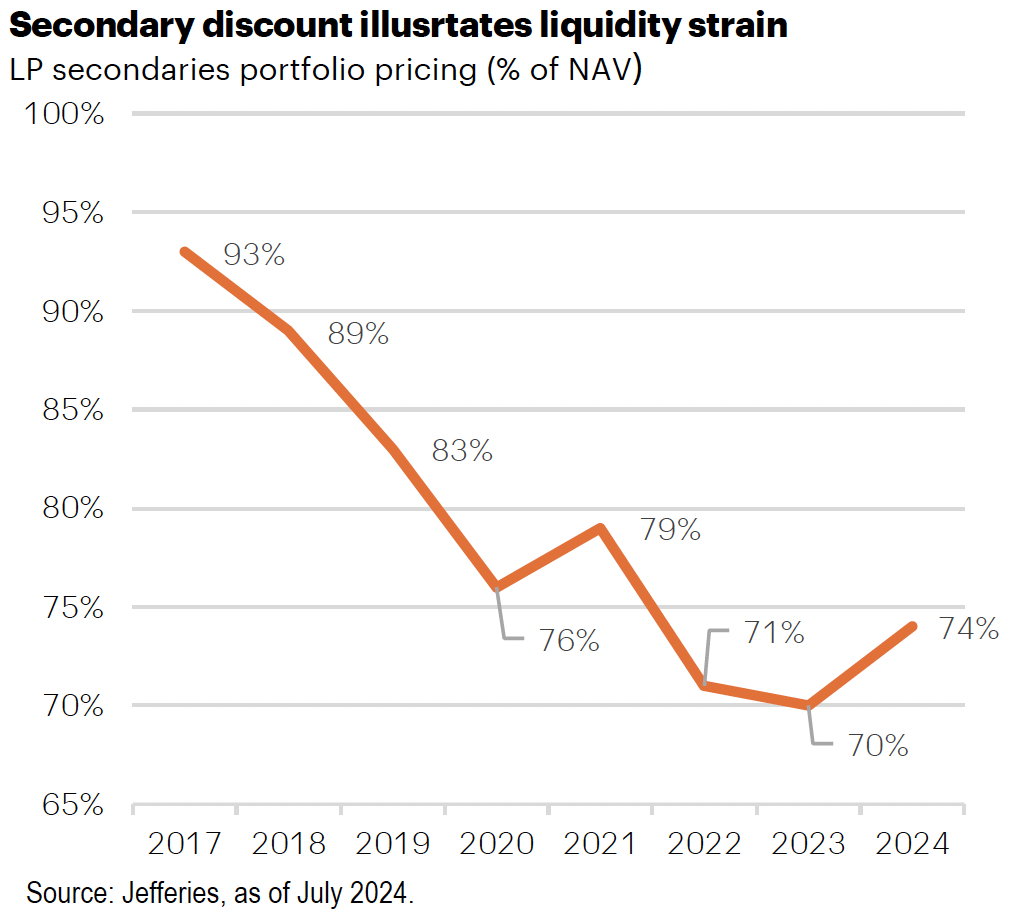

The trade-off has been painful, especially for investors who have dealt with portfolio markdowns and a distinctly slower pace of distributions. While pricing may be in the process of forming a trough—undoubtedly a positive for the market—the process will likely take time, suggesting a more gradual improvement in transaction activity. For liquidity-strapped investors, this suggests distributions may remain elusive, leaving the nascent real estate secondary market as one of the only release valves. Discounts in this market currently sit around 25%of NAV, suggesting funds may be in for more write-downs and highlighting the generational opportunity for providers of liquidity.