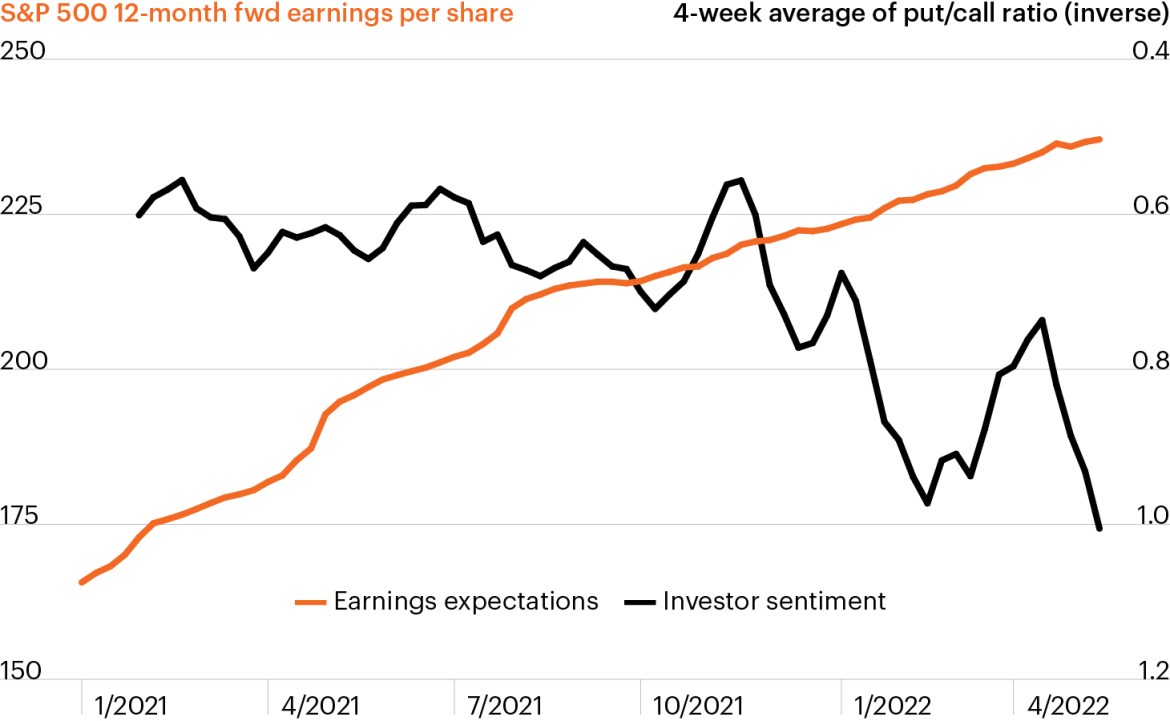

Earnings expectations and investor sentiment

Source: Bloomberg Finance, L.P., FS Investments, as of May 12, 2022. Earnings expectations refer to expectations 12-month forward earning per share for the S&P 500. Investor sentiment shows the put-call ratio. Put options allow investors to sell an asset at a predetermined price; call options allow investors to buy an at a predetermined price.

- The April Consumer Price Index (CPI) report released this week dealt another blow to investors who hoped it would shift the narrative on inflation. Instead, headline and core CPI both rose notably above expectations, driving markets lower as they have moved for much of the past month.

- Not surprisingly, investor sentiment (the black line) plummeted in April and has generally trended lower since November 2021 as investors attempt to manage through multiple simultaneous drivers of volatility. At the same time, economists have begun to debate how significant an economic slowdown the U.S. may experience this year.

- Despite the souring mood in the market, the bottom-up picture looks very different as corporate fundamentals (the orange line) have held up well. About 75% of companies reporting Q1 2022 earnings have reported revenues above estimates, while nearly 80% have reported earnings per share above estimates. For the annual period, analysts expect 10.1% annual EPS growth for S&P companies as the anticipated slowdown simply hasn’t happened.1

- Sentiment and fundamentals are clearly engaged in a battle, one that could take months to resolve. In the meantime, investors may be wise to focus on the tactical while also emphasizing investments with limited correlation and downside protection potential to traditional markets as volatility could remain with us for some time.