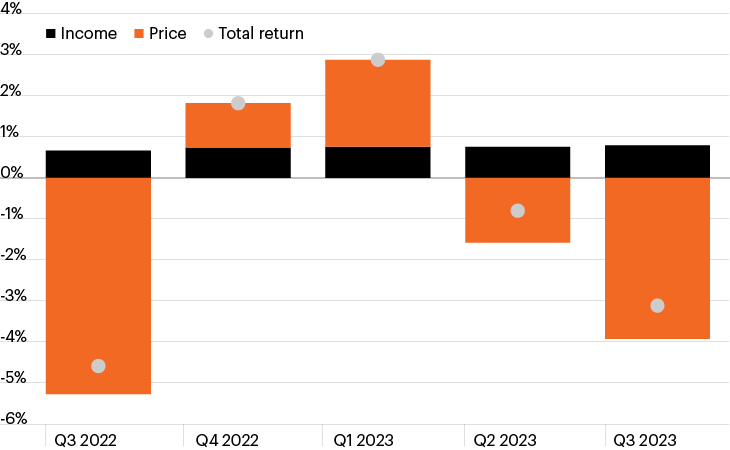

Barclay Agg return composition

Source: Bloomberg Finance, L.P., as of September 29, 2023.

- Rate volatility has been the major market driver for most of the past six weeks as longer-dated Treasury yields rose relentlessly and investors have increasingly come to accept the Fed’s higher for longer messaging.

- Stock declines accelerated in the wake of the Fed’s September meeting, but perhaps the more notable damage has taken place among more rate sensitive fixed income securities.

- The Agg—long a staple of the traditional 60/40 portfolio—has turned in negative quarterly returns for each of the past two quarters and largely reversed the short-lived momentum it had begun to gather in Q4 2022, when yields briefly turned lower.1

- Following declines of -1.5% and -13.0% in 2021 and 2022, respectively, the Agg is currently on pace for its third consecutive annual decline this year, challenging core fixed income investors unlike any they have faced in over 100 years.1

- Core fixed income’s long-held place as a portfolio ballast to volatile equity markets has increasingly been called into question. Against this backdrop, investors’ need for alternative sources of diversification and total return opportunities has become ever more important.