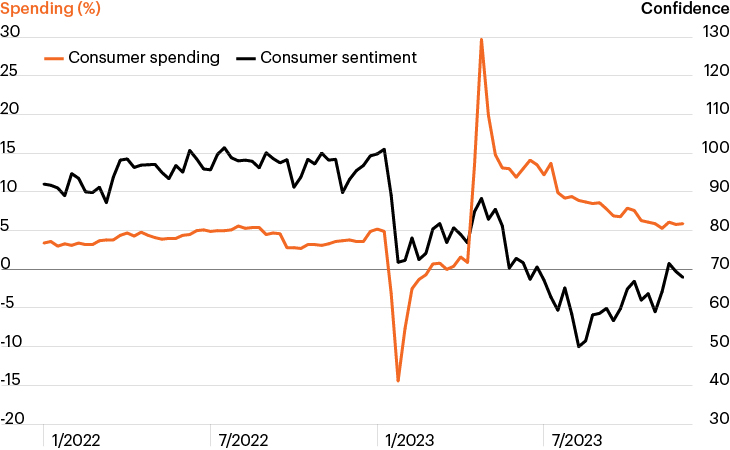

Consumer sentiment falls while consumer spending approaches pre-COVID levels

Source: Bloomberg Finance, L.P. as of September 30, 2023, latest data available. Consumer spending shows the annual change in Personal Consumption Expenditures. Consumer sentiment as measured by the University of Michigan Index of Consumer Sentiment.

- Market sentiment has swung wildly over the past several weeks as risk markets moved significantly higher following Fed Chair Powell’s dovish tone at his most recent press conference. This rapid reversal highlights a still-murky investment environment.

- Was the late summer risk-off trade the correct read of the prevailing economic environment, including an oncoming recession? Or does the market’s newfound optimism signal a potential path toward a soft landing and room for a prolonged rally?

- The chart highlights conflicting signals markets are navigating. Consumer sentiment (black line) plunged at the onset of the pandemic and has remained depressed since. Yet consumers’ actions—spending—belies the dour sentiment.

- Consumer spending is well off its COVID-era peak, but continues to defy expectations, settling into a range in line with the 2015—2019 average, despite higher credit card payments, reduced savings and the specter of student loan payments.

- Investing amid a market characterized by mixed signals can be uniquely challenging. Against this backdrop, investors may be wise seeking alternative sources of growth and income that have the potential to generate attractive total returns across multiple market environments.