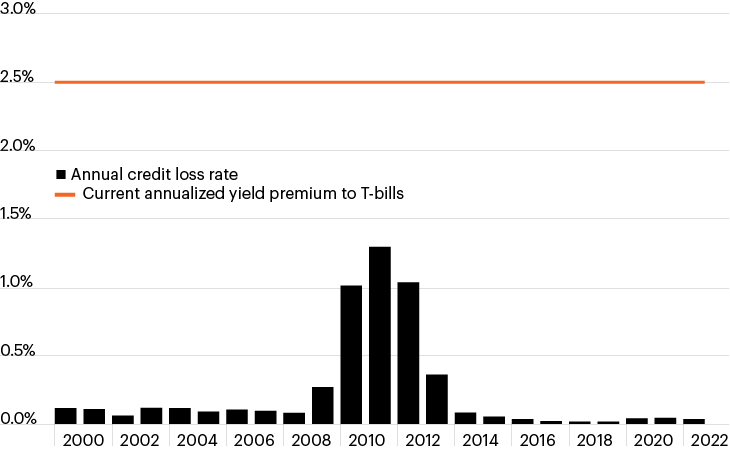

Private CRE debt yield premium and annual realized credit losses

Source: Giliberto-Levy, NCREIF/CREFC, as of September 30, 2023

- The commercial real estate (CRE) market continues to endure a correction that began 18 months ago as interest and mortgage rates surged.

- These conditions have provided a challenging backdrop for property owners as prices have steadily declined. But conditions for lenders have rarely been better.

- Private CRE debt yields of approximately 7.9% remain elevated while loans are generally being made on lender-friendly terms—for example, most loans today are originated with conservative loan-to-value ratios below 65%.1

- Cash is a more attractive investment than it has been in recent years, but CRE debt continues to command a yield premium of about 250 bps over the 3-month Treasury bill, as the chart highlights.1 Even considering historical realized CRE loan loss rates, which peaked at 130 bps during the height of the global financial crisis, CRE debt’s yield premium remains notable.1

- While 2024 could represent another year of uncertainty as the CRE market comes to terms with higher financing costs, lenders could find themselves in an increasingly attractive position as the composition of CRE returns evolves toward current yield and income growth, rather than price growth.