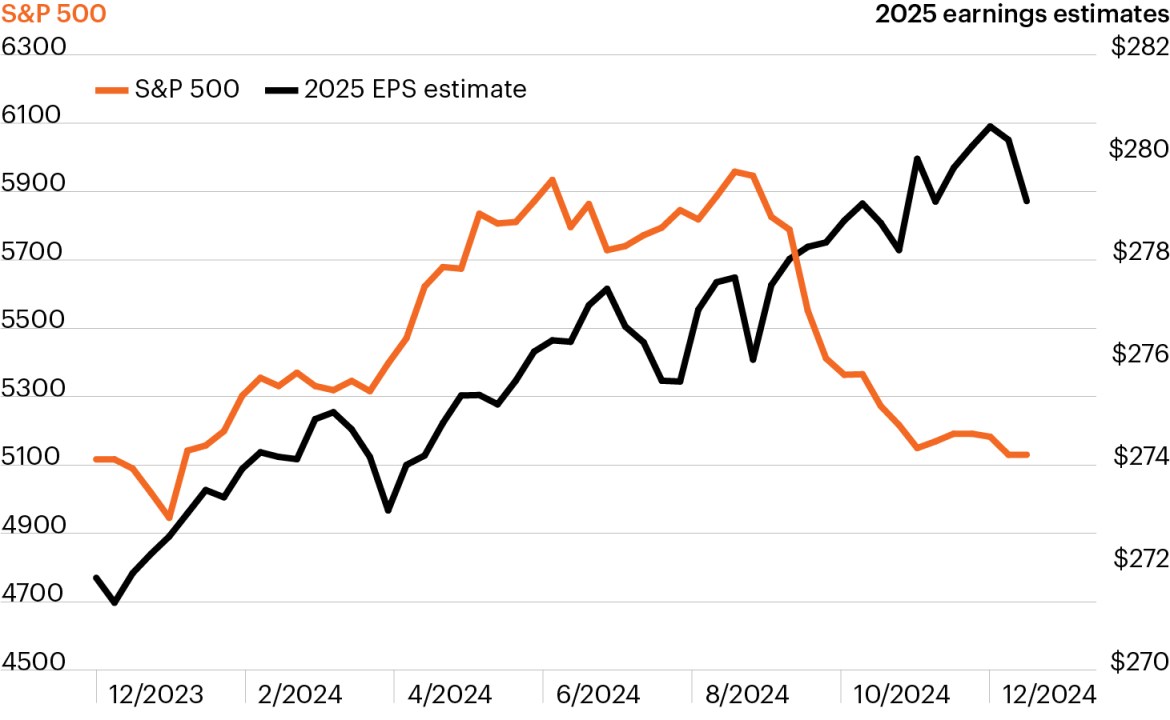

S&P 500 and full-year 2025 earnings estimates

Source: Bloomberg Intelligence, as of December 19, 2024.

- Despite recent volatility, the S&P 500 is near finishing its second straight year with gains of 25% or more (which would be the first such occurrence since the late 1990s). On top of stocks’ banner year-to-date performance, investor sentiment has spiked following the U.S. presidential election.

- U.S. households have never been as confident that stocks will rise over the next year, according to the Conference Board’s latest investor survey, driving massive inflows into equities since the November election.

- Market indicators (equity index levels and investor sentiment) reaching such extreme levels might represent an opportune time to consider stocks’ forward path given how much positive news is already priced into them.

- As the reaction to Fed Chair Powell’s perceived hawkishness this week shows, public equity markets continue to face challenges. The S&P has steadily climbed in 2024 despite a more challenging earnings picture. It also remains extraordinarily concentrated while sticky inflation readings could pose further monetary policy disappointments.

- Against this backdrop, alternative investments, including private markets, may offer unique growth, income and diversification opportunities.