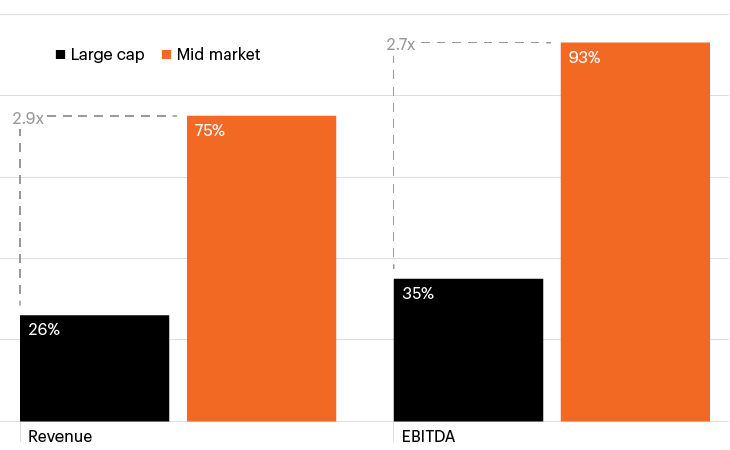

Weighted average changes from sponsor entry to exit

Source: Morgan Stanley Investment Management as of June 30, 2023. Data represents a sample of 166 total transactions including only U.S. deals, excluding Morgan Stanley transactions—37 large cap and 129 middle market—that report on enterprise value, revenue, EBITDA, net debt, public/private company. Middle market is defined as a transaction value of $500M or less.

- The private U.S. middle market, comprised of 200,000 business with revenues between $10 million and $1 billion, has served as a driving force of the domestic economy for decades representing one-third of private sector gross domestic product (GDP) and employing approximately 48 million people.1

- Given the smaller size of middle market companies and highly fragmented nature of the middle market, middle market private equity managers often have greater options at their disposal to grow revenues and margins than their large cap peers through a combination of customer acquisition, new product launches and market expansion, as well as operational improvements.

- As the chart shows, middle market managers have increased revenues and EBITDA by 75% and 93%, respectively, from the time of purchasing a business to the time of their exit, nearly tripling the growth generated by large cap peers.2

- Fundamental changes in financial markets and the global economy in recent years have created many challenges for investors looking for reliable sources of growth and diversification. Amid a more muted outlook for public equities, the private U.S. middle market may serve as a diversified source of growth within investors’ portfolios.