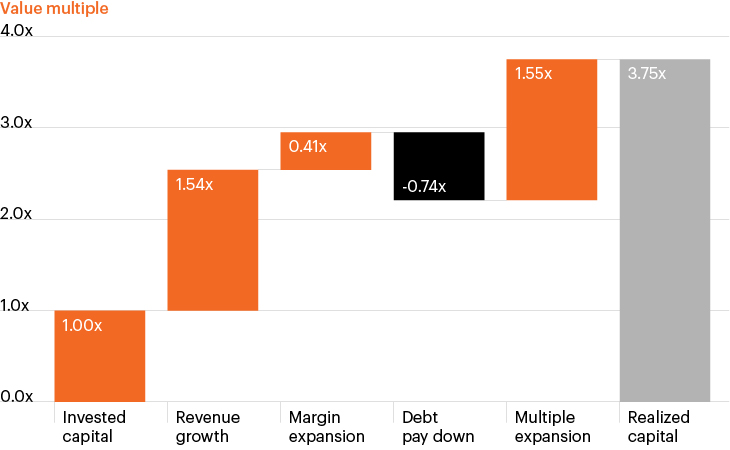

Return drivers for middle market buyout transactions

Source: Preqin, as of February 29, 2024.

- Today’s higher rate environment provides private equity general partners (GPs) with a more challenging environment to derive value than the zero-interest rate period (ZIRP) that dominated since the global financial crisis.

- With higher rates increasing acquisition financing costs, GPs today must rely more heavily on operational improvements such as growing an acquired firm’s revenue, revitalizing management teams or increasing margins to drive value for their limited partners.

- Revenue and margin growth play a particularly important role in the value creation process for middle market companies (those with revenues between $10 million to $1 billion).

- Based on Preqin data, middle market buyout transactions have generated higher realized capital multiples (3.75x) than large cap buyout transactions (3.2x). Compared to large cap buyout transactions, middle market buyouts also derive a higher proportion of value from fundamental improvements like growing revenues than via multiple expansion (selling at a higher valuation than at the entry point). Extremely low financing costs during the ZIRP era helped fuel multiple expansion.1

- Opportunities for revenue and margin growth may increasingly be top of mind for GPs as margin expansion is likely to face higher borrowing costs. Such an environment may provide particularly fertile ground for middle market private equity managers.