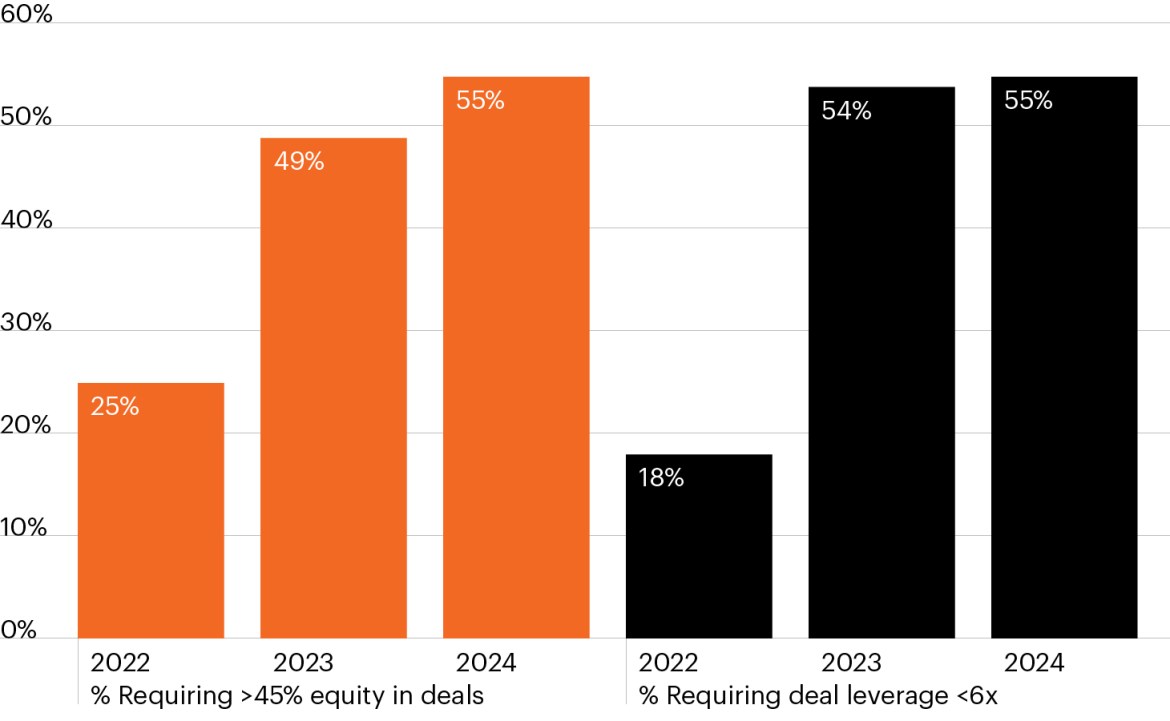

Equity, leverage requirements in deals by year

Source: Proskauer, as of Q1 2024.

- The private credit asset class has grown from a niche corner of institutional investor portfolios to a multitrillion dollar market accessed by a wide variety of investors. This extraordinary growth has led to questions about whether this market could represent a bubble.

- When comparing historical bubbles to today’s credit landscape, however, the differences are stark.

- Total private sector debt-to-GDP increased just 1% during the past decade, a period when the size of U.S. private credit grew more than fourfold.1 The lack of growth in private sector indebtedness contrasts starkly with historical bubbles (Great Depression and the Global Financial Crisis) and may defy the notion that private credit is fueling a bubble.

- Perhaps most importantly, lenders tightened underwriting guidelines over the past two years. As the chart shows, lenders are demanding more equity and lower earnings leverage in deals, which is a clear contrast from the trend toward deteriorating underwriting standards that marks the most prominent bubbles.2

- Private credit’s impressive growth has been driven by broad private asset growth, a restrained banking sector and healthy demand for financing. Hard data exploring private credit trends, however, do not point toward an inflating bubble.