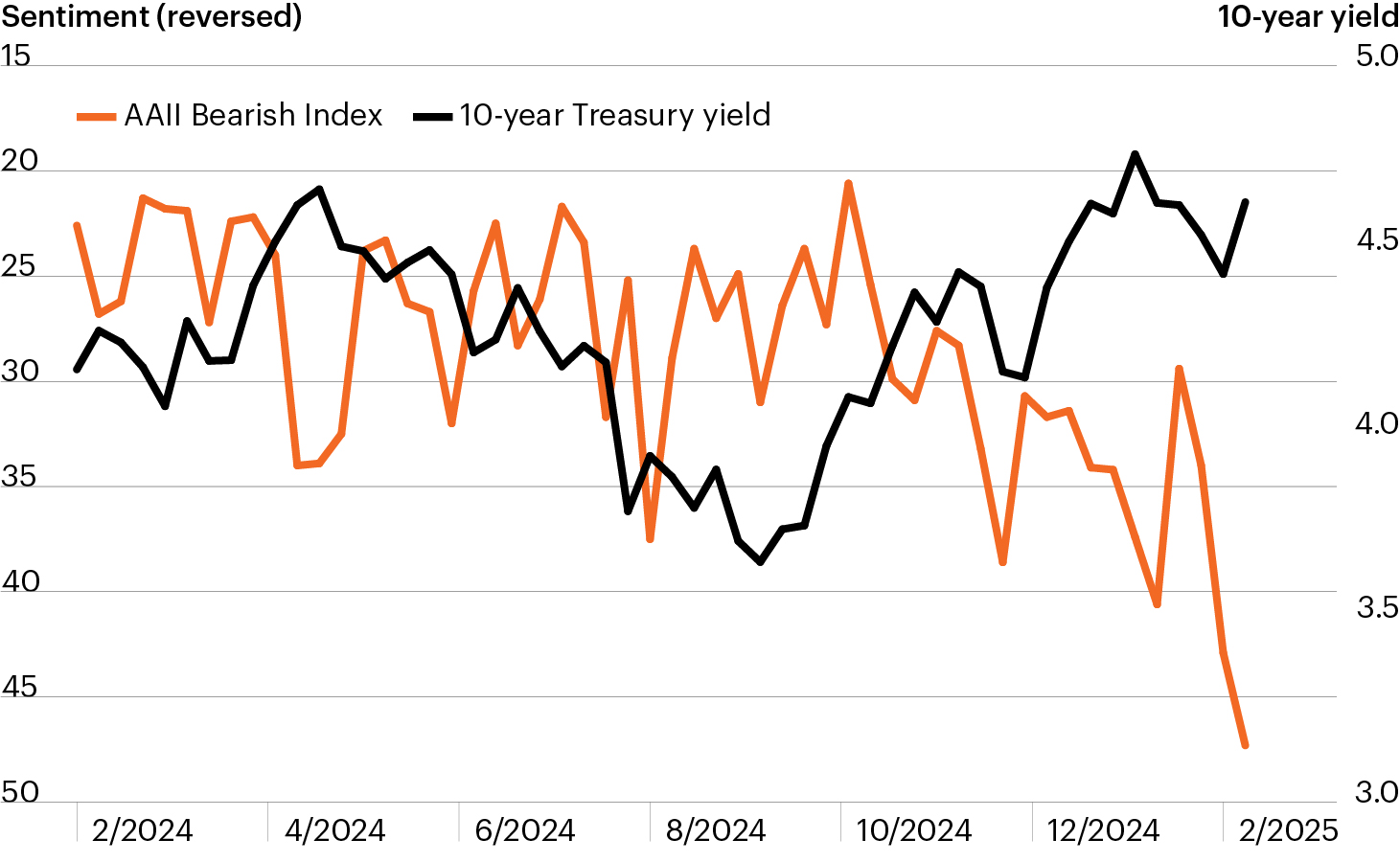

Bearish sentiment, 10-year Treasury yield

Source: Bloomberg Intelligence, L.P. as of February 13, 2025. AAII Bearish Index refers to the percentage of investors surveyed by the American Association of Individual Investors (AAII) who believe stocks will decline over the next six months.

- Bearish market sentiment among individuals (orange line) reached its highest level since November 2023 this week. Risk appetite among investment professionals has followed a similar trajectory, according to the S&P Investment Manager Index (IMI).1

- Sentiment declines stem from a range of investor concerns that have moved to the foreground. For example, the 10-year Treasury yield (black line) has risen meaningfully as investors expect rates to remain higher-for-longer.1

- IMI survey participants also cited elevated equity valuations and the political environment as top challenges, as trade conflicts move from potential to reality.

- Against this backdrop, the case for looking outside the traditional 60/40 portfolio, and toward U.S. middle market companies where sentiment still shines bright, remains particularly compelling.

- Investing in the U.S. middle market may provide a unique opportunity for growth, income and diversification potential at a time when challenges have mounted across public markets.