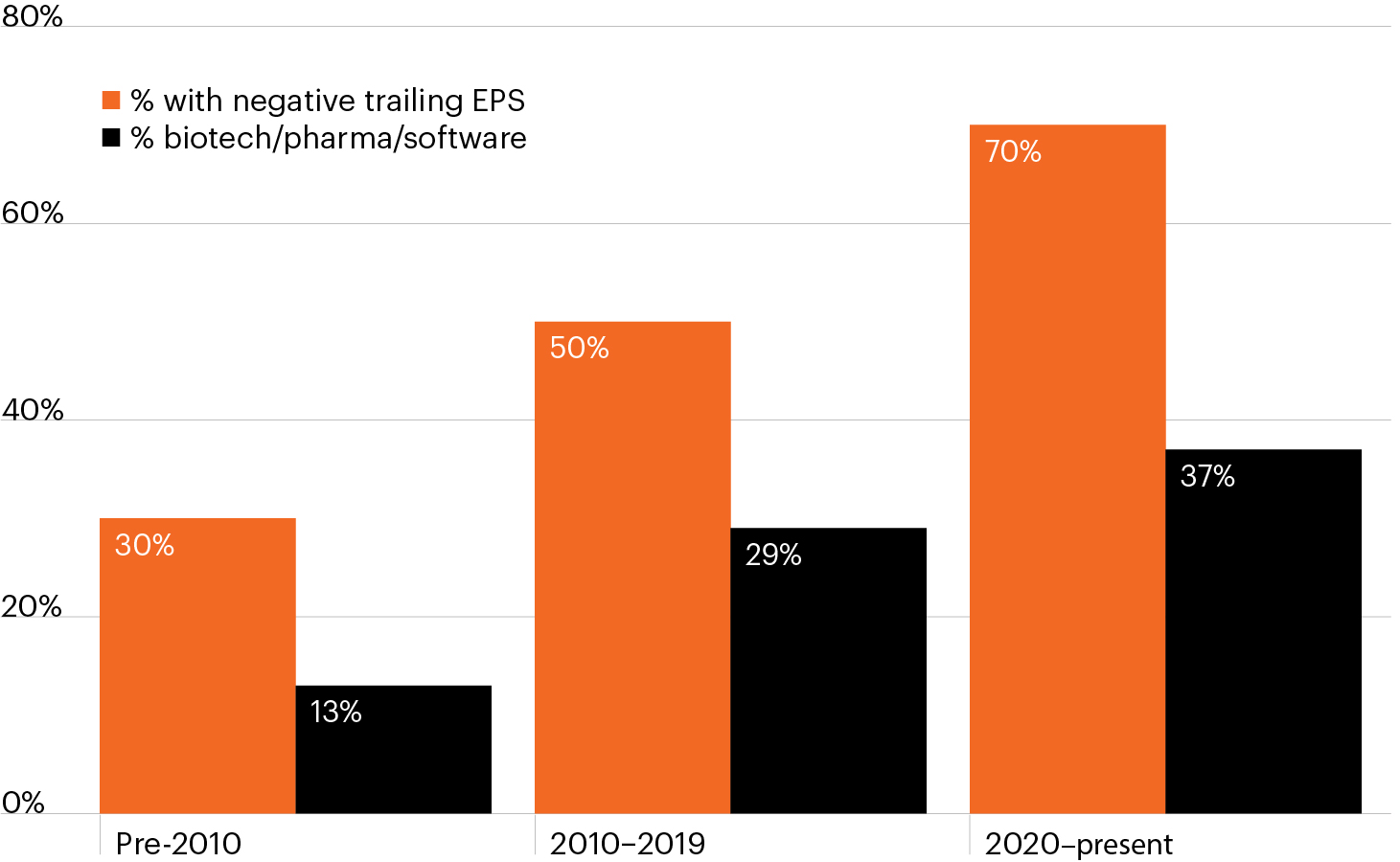

Composition of Russell 2000 members by IPO date

Source: Bloomberg Finance, L.P., FS Investments, as of February 28, 2025.

- Risk assets started the year facing significant volatility, punctuated recently by rising geopolitical tension and trade uncertainty. Amid the market’s broad-based declines, small cap stocks have suffered the greatest losses, down -8.9% compared to -4.6% for the S&P 500.1

- Small cap stocks entered 2025 with significant challenges. Nearly half (43%) of Russell 2000 companies produced negative earnings as of December 2024, up from just 14% in 1994, as the quality of companies that comprise the Rusell 2000 Index has meaningfully deteriorated.2

- As the chart shows, while a moderate 30% of companies with an IPO before 2010 had negative trailing earnings per share (EPS), that figure has since risen dramatically.2 Of the nearly 500 companies that have IPO’d since 2020, 70% have negative trailing EPS.2

- The Index’s deteriorating quality is driven both by higher-quality companies choosing to stay private for longer and the increasing representation of speculative sectors (biotech/pharma/software) whose bottom lines are less linked to U.S. economic conditions.

- Private middle market companies, where revenue and employment trends are more closely linked to those of the broader U.S. economy, may represent an appealing antidote to the lower-quality stocks that comprise the Russell 2000 Index.