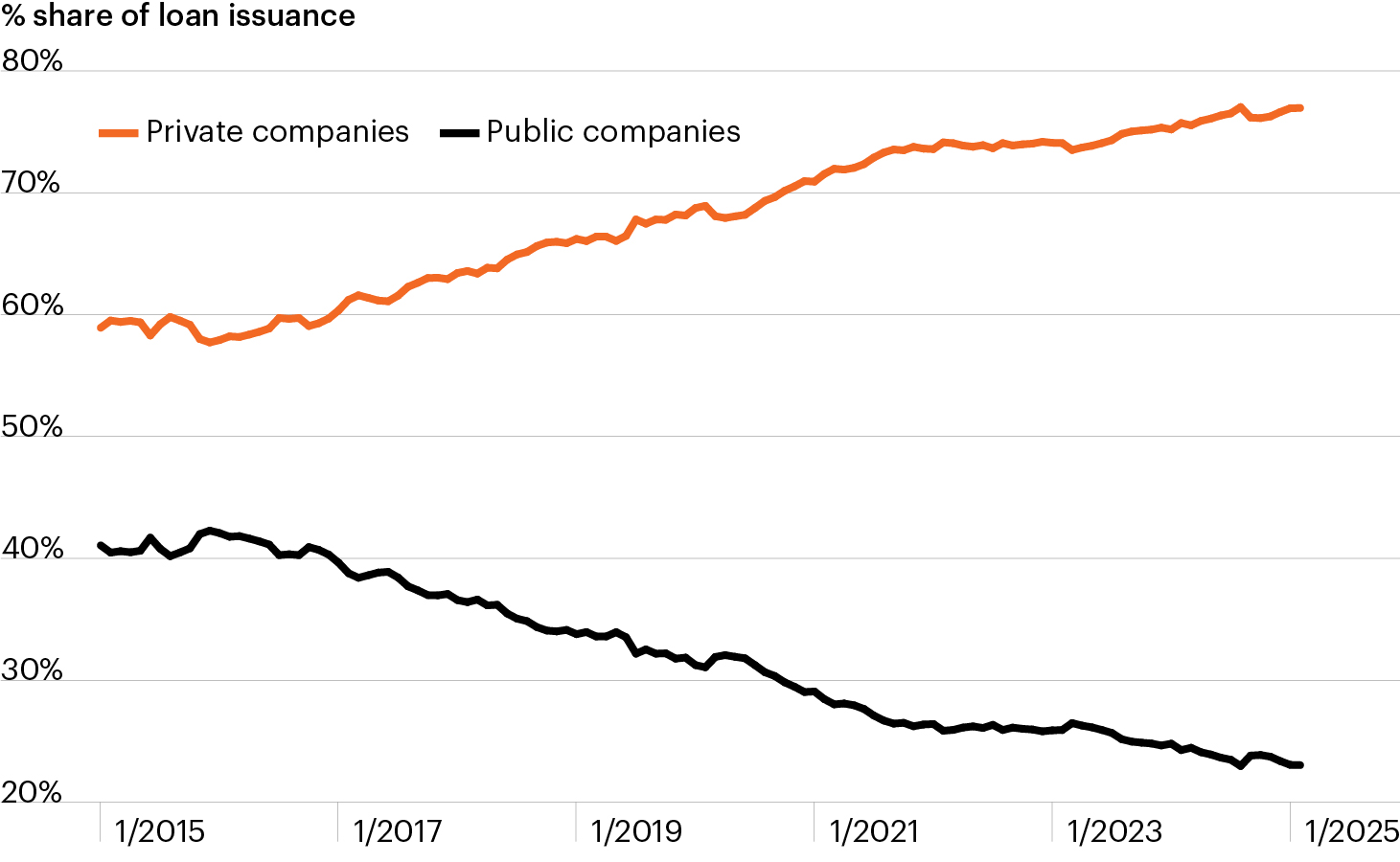

Private vs. public company share of loan market

Source: J.P. Morgan, as of February 28, 2025.

- Since 2014, the private credit market has grown from $217 billion to $1.14 trillion alongside the private equity market. Today, private credit finances more than 80% of U.S. private equity buyouts.1-2

- Private credit has become the venue of choice for corporate borrowers. Private firms now account for 77% of the 1,200-plus issuers in the leveraged loan market—up from 59% in 2015, as the chart shows.3

- These trends have been driven by multiple factors, including a bank pullback from non-core lending activities, investor demand for private credit’s potential yield premium and borrowers’ preference for the certainty of execution, more flexible terms and strong lender-borrower relationships that many private lenders offer.

- Private lenders remain optimistic about the opportunity set in 2025, despite an uncertain start to the year, while demand for private credit remains strong among individual and institutional investors.