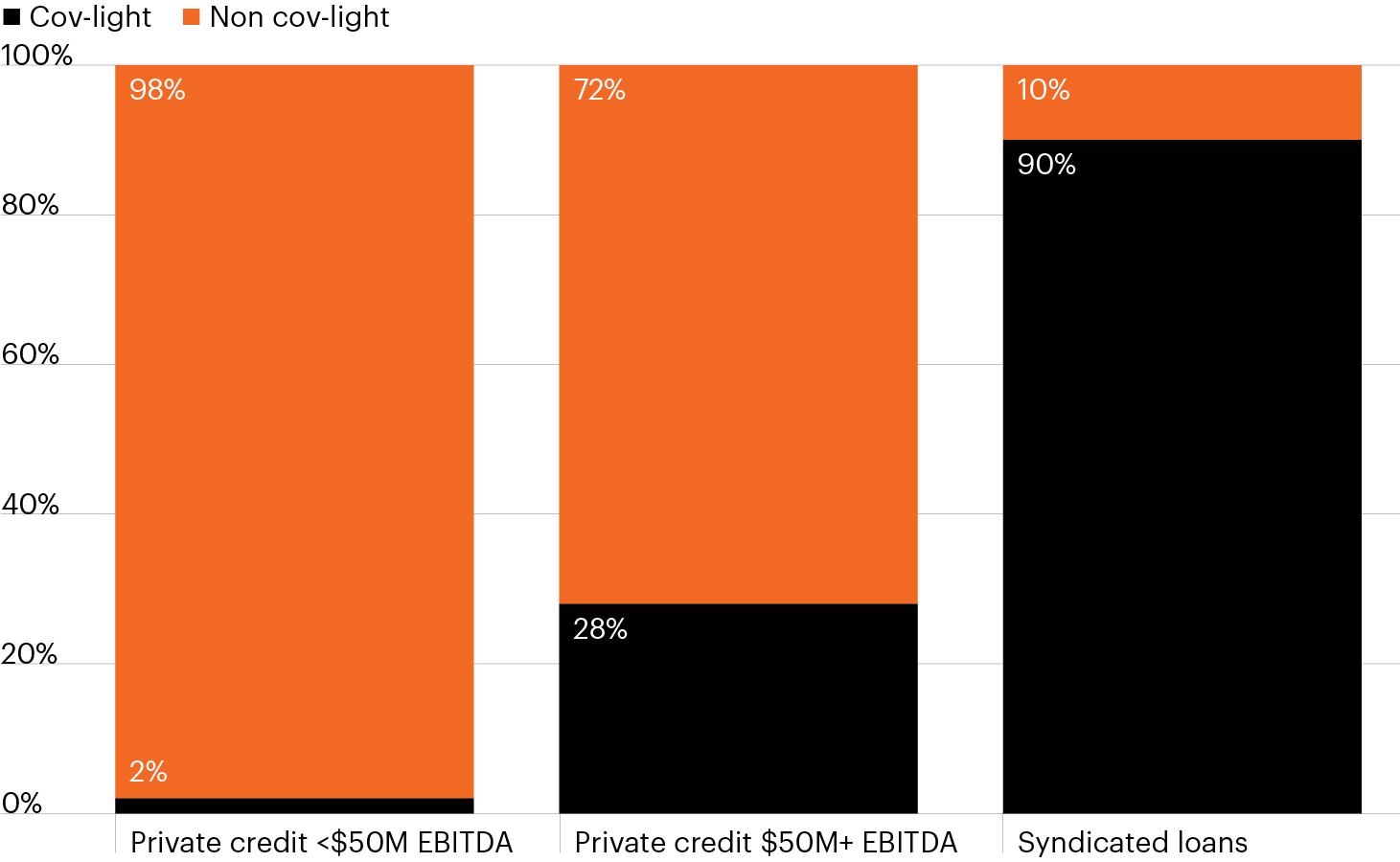

2024 new issuance volume by loan type

Source: KBRA DLD Research, as of December 31, 2024, latest data available.

- Private credit has been a particularly attractive investment in recent years, given its healthy yield premium over similarly rated public debt. Recent volatility highlights another important potential benefit of private credit: Tighter deal terms.

- The chart highlights the massive gap in lender protections between private and public credit markets. Just 10% of syndicated (public) loans issued in 2024 included a covenant aimed at protecting lender interests compared to 72% of upper middle market deals and nearly all (98%!) of lower middle market deals.

- This wide disparity reflects a fundamental difference: Syndicated loans are carved up and distributed to many investors, often hundreds, and price is typically the only negotiated term. Private credit is typically held by one or a few lenders who conduct their own due diligence and underwrite the loans with the intent to hold through maturity.

- Periods of economic or market dislocations can create attractive buying opportunities across select public credit investments as spreads widen, but volatility also highlights the importance of strong covenant protections. Private credit, particularly in the lower and core middle market, has long relied on covenants as a tool to help mitigate credit losses.