The U.S. economy experienced significant positive momentum in 2018, but headwinds are building in 2019 that could cause growth to slow. This possible deceleration would amplify market uncertainty and continue to challenge core fixed income returns. Investors will need to continue to actively seek the most from the income portion of their portfolio.

Growth accelerated rapidly from 1.9% at the end of 2017 to 3.0% by Q3 2018.1 The Fed expects the economy to grow 3.1% in 2018,2 which would be the fastest since 2005. Tax reform and fiscal spending helped supercharge growth this year. But heading into 2019, the pulse of fiscal spending could fade, and tax reform should recede as a tailwind. Fed rate hikes have cooled some sectors of the economy, like housing. As 2019 dawns, the economy is likely to decelerate to a more sustainable pace that aligns closer to estimates of long-run equilibrium growth.

This slowdown in growth may not be dramatic, but for investors it could prove challenging. For equities, the virtuous combination of liquidity and growth helped propel valuations into the top quintile in 2017.3 Both of these equity market supports are eroding, however, as the Fed moves rates closer to neutral and as the outlook for earnings reflects more moderate growth expectations.

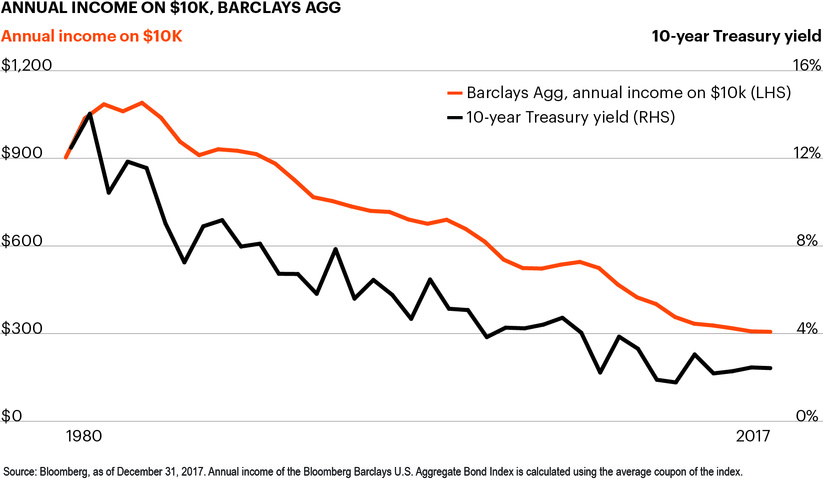

All of this means investors will need the income share of their portfolio to start performing better. Over the past five years the S&P 500 has risen 11.3% per year, which has somewhat masked underwhelming core fixed income performance.4 Over the same period, the Barclays Agg has returned only 1.8%, barely enough to keep up with inflation.5 As the chart shows, in 1984 a $10,000 investment in the Barclays Agg would receive annual income of $1,090. By 2017 that had fallen to only $306.

This has been part of a long-run trend. Core fixed income yields broadly track long-term interest rates, which have been on a structural decline. The demographics of the baby boomer cohort and the increased average length of retirement have caused global demand for income products to rise and interest rates to fall. This has been amplified by post-crisis monetary policies.

Income is an important way to augment returns, whether you are relying on income for withdrawals as a retiree or in the growth phase of savings accumulation. Harnessing investments with a floating-rate structure could bolster returns in an environment where the Fed is expected to raise rates further and push short-term rates up. Investors need to look beyond core fixed income to generate improved performance from their income investments.