Well, I hope you enjoyed the last strategy note on the election impact on middle market private equity. As promised, here is some more short but sweet holiday reading; this time homing in on private credit, private real estate lending and liquid multi-strategy funds.

The election impact on private credit

In private credit focused on middle market private lending, we already see a significant acceleration in lending opportunities for mergers, acquisitions, takeouts (when a public company is taken private) and private-sold-to-private transactions. Deal volume had been starting to build pre-election but has accelerated substantially since the election took place.

Remember, since the end of 2022, investors have seen:

- The Fed’s rapid raising of interest rates and substantial tightening of financial conditions

- The bank failures in Q2 of 2023

- The stagnation of bank lending combined with a desire for banks to de-lever their balance sheets

With that in mind, we have been heavily focused on refinance opportunities, receivable asset-based lending to high quality companies in a temporary liquidity pinch, lifting (in some cases) optimal loan packages off bank balance sheets at attractive prices and spreads, and providing liquidity to capital-starved sectors of the U.S. economy (we’re as patriotic as they come when the liquidity we provide is on great terms to our investors) such as homebuilders and auto lending.

As we look at the forward pipeline, we expect the lending opportunities to pivot back to classic middle market corporate financing. As we have often discussed, the ability to pivot back and forth from corporate cash flow lending to asset-based lending—as the relative opportunity sets wax and wane—is a clear differentiator and source of alpha for our investors.

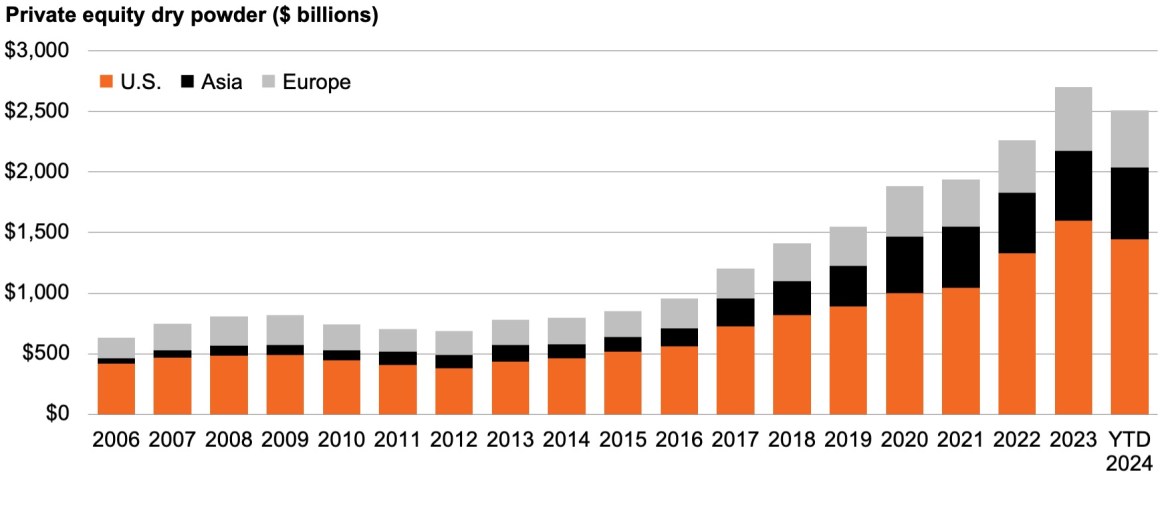

Additionally, as the massive cash hoards in private equity are gradually put to work, typically every dollar of equity needs a dollar of debt—and approximately half of that need will be financed by private credit (the rest will be financed via syndicated bank debt and banks).

Demand for private credit should expand substantially

Source: Preqin as of October 30, 2024.

The election impact on senior commercial real estate lending

Pivoting to senior commercial real estate lending, now that the CRE market has clearly bottomed, we have seen a significant increase in classic alternative lending opportunities such as acquisition and development and construction loan takeouts (with transitional/property improvement expected to soon follow).

As a reminder, over the past several years, the majority of lending activity in CRE was to serve the borrowing needs of property owners whose loans were maturing and whose existing lender did not have the capacity to roll the loan. With over $2.5 trillion of CRE loans maturing by the end of 2028, this opportunity set is certainly not going away anytime soon. Similar to broader asset-based lending, there have also been opportunities in CRE to purchase optimal loan pools at attractive prices and spreads. However, we are now seeing much more symmetry in lending opportunities, with roughly one-third targeted to rolling loans, one-third to A&D and one-third to construction takeout.

This blossoming of lending opportunities should allow us to ramp up the balance sheet in order to expand our distribution spread to the risk-free rate as the Fed gradually cuts rates over the next several years.

Swapping CRE debt for equity

Additionally, where appropriate, the opportunity has arisen to swap CRE debt for CRE equity in performing properties that struggled to meet increased debt service costs given how much higher interest rates are today vs. the beginning of 2022.

Since CRE clearly bottomed in price sometime between late 2023 and Q2 of 2024, and modest future price appreciation is expected going forward (particularly in the industrial, multifamily, hospitality and retail sectors), it is crystal clear the golden oldie of swapping debt for equity in any asset class at a market bottom to drive performance is back!

As a reminder, whether it is corporate debt or CRE debt, swapping debt for equity at a sector or market bottom typically leads to outsized absolute and risk-adjusted returns. During this century, the first dramatic example of this was the debt for equity swapped in bankrupt telecom firms that temporarily overinvested in fiber optics. Following that, it was the majority of corporate or CRE debt swapped for equity coming out of the Global Financial Crisis. The pandemic was too short-lived and there was too much stimulus money thrown in to provide compelling opportunities during that time.

It’s a shame that lenders can’t swap more of their debt for equity at the recent market bottoms (and that the opportunity will be fleeting), but given the continued strong fundamentals of CRE in everything but central business district office towers, opportunities will be few and far between. However, when they materialize, investors have the opportunity to own a cash flowing/performing property at a market bottom with a highly asymmetric risk/reward in their favor!

Will bank lending activity increase?

Turning to potential negatives of the election outcome (from an investment standpoint, they are rather tough to find), I am often getting asked how bank lending activity will expand with lighter touch capital standards and regulation. Well, it is really only the too-big-to-fail banks that will be impacted by less onerous future capital standards.

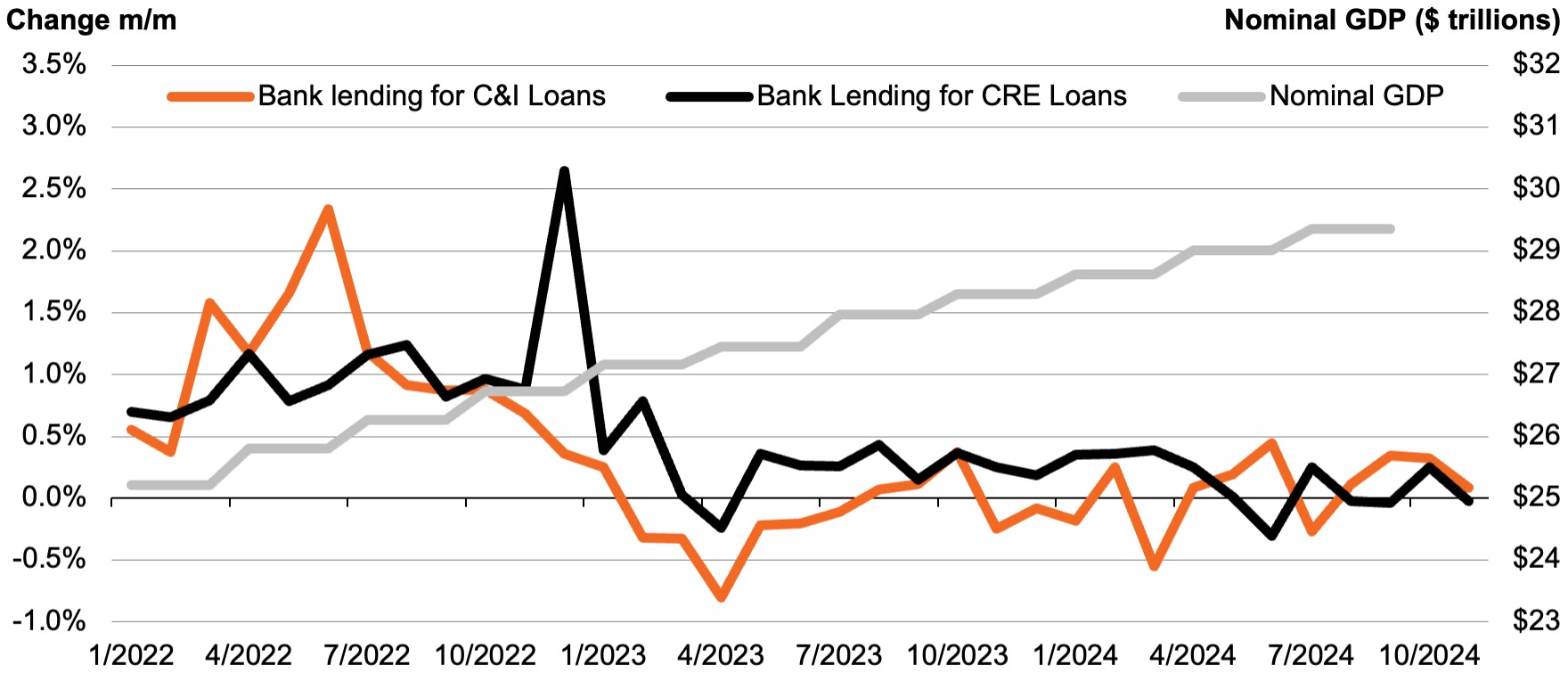

In general, private lenders compete far less with too-big-to-fail banks than with smaller regional lenders. Over the next few months and quarters, it will be interesting to see if there is any material pickup in loan growth vs. nominal gross domestic product (GDP) (so far at this point, four weeks post-election, there has been no material movement at all).

Bank lending for commercial & industrial loans, CRE loans and nominal GDP

Source: Federal Reserve, nominal GDP as of September 30, 2024, bank lending data as of December 4, 2024.

Another way of thinking about this is, before the spread of expected bank loan and lease growth to actual loan and lease growth has a chance to compress, it first has to stop expanding! After all, you have to crawl before you walk and walk before you run.

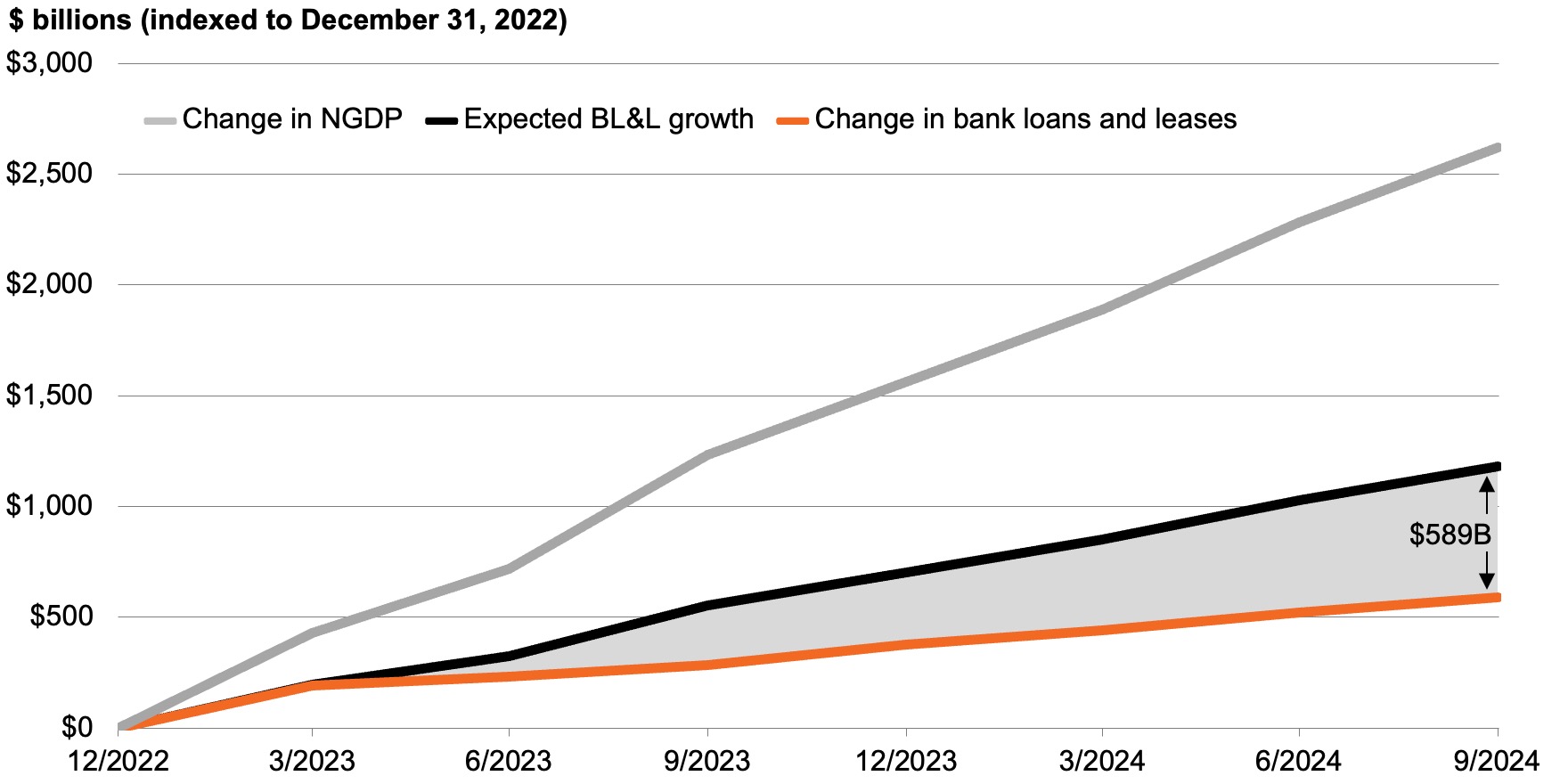

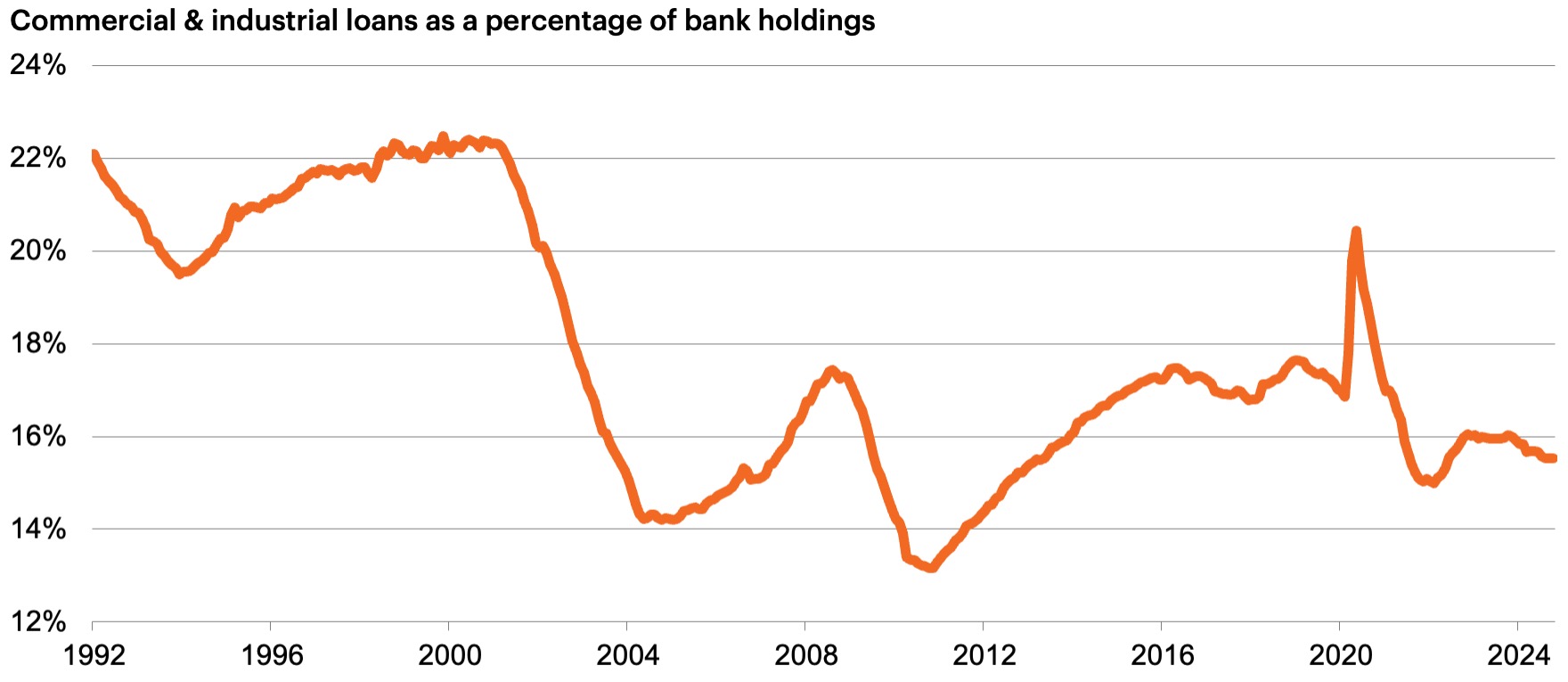

Bank lending for commercial and industrial loans

Source: Federal Reserve, as of September 30, 2024.

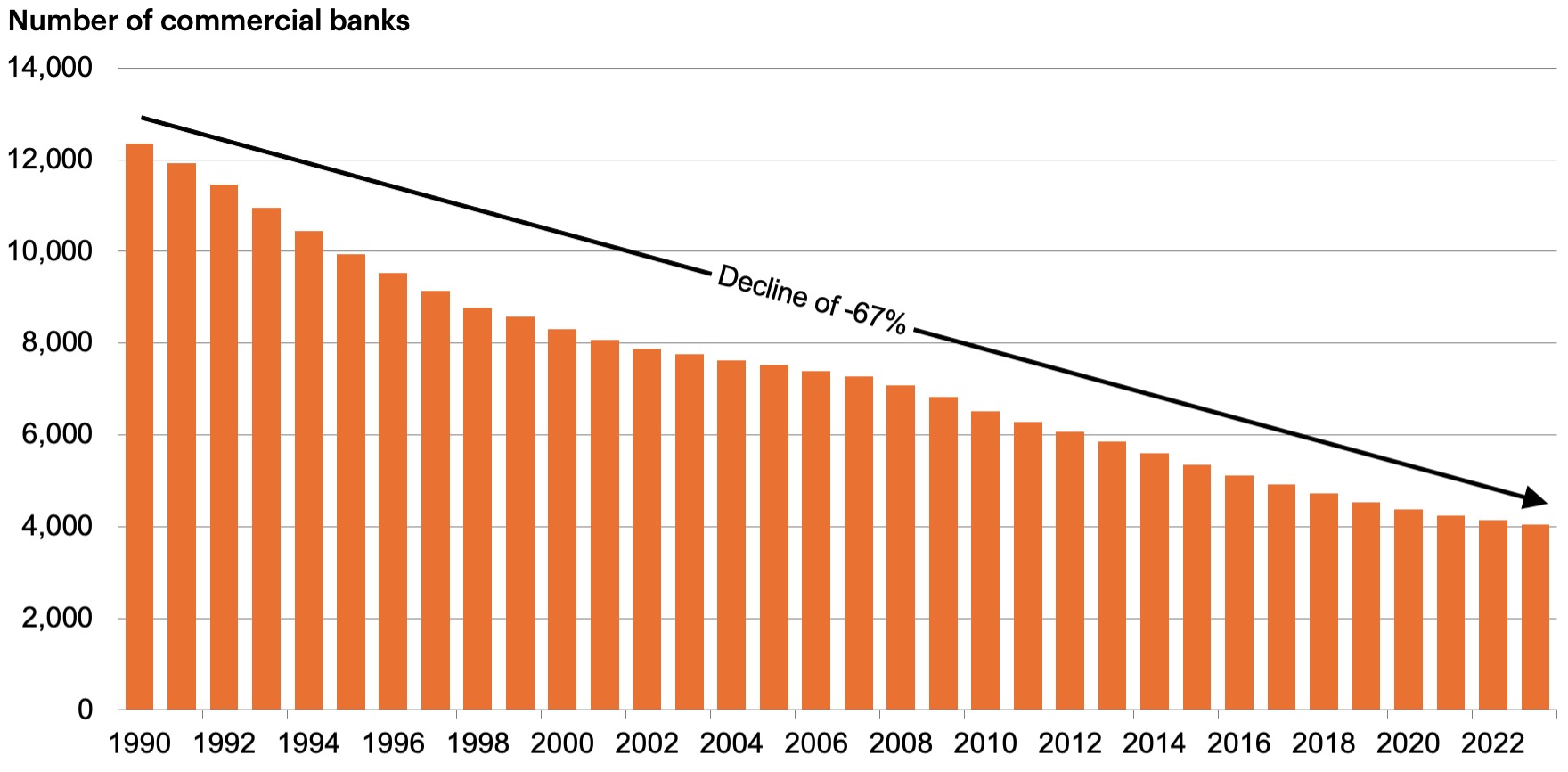

And finally, does anyone think the election outcome will change the trajectory of the megatrend in bank consolidation?

Not to mention that, over time, banks have dedicated fewer balance sheet dollars to commercial and industrial (C&I) loans in fits and starts. I could see this percentage going up, but that will mainly be a function of those banks “rebalancing” away from CRE loans—as opposed to lending like crazy again via C&I (as dollars lent shrinks to CRE, dollars lent percentage to C&I could naturally rise).

The two charts below show that as the number of commercial banks has declined, corporate lending has declined as well.

As the number of commercial banks has declined…

Source: FDIC, as of September 30, 2024.

…corporate lending has declined

Source: Federal Reserve, as of September 30, 2024.

The election impact on liquid multi-strategy funds

Pivoting to liquid multi-strategy funds, I would say (as expected) the biggest sub-strategy/theme beneficiaries of the election outcome should be merger arbitrage and regional/community bank consolidation.

The last several years have been pretty challenging for merger arbitrage as the government has intervened in more mergers during this period than the majority of recent history. This has led to a higher percentage of deal breaks (9% vs. 5%) or almost double than usual.

Going forward, it is pretty clear that for deals not associated with mega cap tech acquisitions, there will be a “reversion to the mean” where the government more than likely only intervenes when there are clear and obvious anticompetitive ramifications.

Merger arbitrage: The new “Dare to Dream”

We first came up with the term Dare to Dream in August 2023 to describe an economic scenario in which the U.S. economy could comfortably avoid recession while inflation mercifully retreated. Over time, most rational market participants have embraced this as their base case, which is where it still remains.

The new Dare to Dream scenario is what merger-arbitrage-strategy–focused investors started to do post-election and will continue to do over the next four years.

Just to be clear, we’re not saying merger arbitrage is suddenly going to become the greatest investment strategy in the history of mankind. All we’re saying is that the ability to generate high-single-digit to low-teens returns in a fairly noncorrelated fashion should return—which, in a balance-sheet-unconstrained multi-strategy fund construct, should lead to marginally better returns for investors.

However, one does not need to be a political maven or an economic policy expert to understand the hostility to acquisitions of domestic corporations by foreign buyers will continue.

Additionally, other than “get tough on China,” one of the only areas of bipartisan agreement currently is that mega cap tech has become too powerful. Thus, there is little if any probability mega cap tech will be allowed to get back into acquisition mode anytime soon.

Regional and community bank consolidation

In terms of regional and community bank consolidation, we’re clearly now in a green-light-go environment.

All the ingredients have been lining up for another wave within the megatrend exhibited above, and with this new bank-and-business–friendly administration, we are optimistic attractive returns may be generated through a fairly beta-neutral hedged basket of acquisition targets. The election outcome led to an immediate surge in bank stocks (you don’t see the KRE Bank Index up 13.5% or the KBE Bank Index up 11.9% every day!), but going forward, there should be a slow and steady drip of consolidation.

Conclusion: U.S. growth pulls ahead

I hope the data above sheds a little light on the election impact on private credit and multi-strategy funds.

Always remember, regardless of your political views, the U.S. is the greatest economic power the world has ever seen, and its economy has pretty much re-achieved escape velocity with strategic competitors. China had its chance, but Chairman Xi blew it with various self-immolating policy choices—the country will now have to grapple with the challenge of growing old before it grows rich.

Never forget that to generate earnings/EBITDA growth you need revenue growth, and to achieve revenue growth, you need nominal GDP growth. Guess which developed nation has been running circles around the world with nominal GDP growth? Which country is dominant in all of the critical secular growth sectors? Oh yeah, the good old U.S.

So, as you enjoy the holidays with friends and family, have at least one toast to how fortunate we are to have access to this bastion of economic might.

Investing in alternatives is different than investing in traditional investments such as stocks and bonds. Alternatives tend to be illiquid and highly specialized. In the context of alternative investments, higher returns may be accompanied by increased risk and, like any investment, the possibility of an investment loss. Investments made in alternatives may be less liquid and harder to value than investments made in large, publicly traded corporations. When building a portfolio that includes alternative investments, financial professionals and their investors should first consider an individual’s financial objectives. Investment constraints such as risk tolerance, liquidity needs and investment time horizon should be determined.