In this strategy note, we will examine the potential risks and opportunities in private senior secured commercial real estate lending. For more context on key trends in private credit, check out my previous strategy notes on the broad strokes top-down and bottom-up opportunity set in private credit, and the latest on private middle market corporate lending with a complementary focus on asset-based loans.

Private senior secured CRE lending: Historically attractive absolute returns

A key data point for why CRE lending may be an essential investor allocation is the fact that senior commercial real estate and private corporate lending strategies were two of a handful that provided attractive absolute returns in 2022—a period when both equities and bonds were a complete trainwreck.

The fact that private corporate loans and commercial real estate lending were posting mid-single-digit returns when equities and bonds were simultaneously getting obliterated was even better than protecting capital, and a true win for those that embraced noncorrelated/low beta return streams. After all, a key attribute of any alternative strategy is the potential to preserve capital when markets get ugly.

Neither CRE loans nor private corporate lending have had as much upside as U.S. equities since equity markets bottomed in October of 2022. But they have continued to outperform real estate equity, fixed income (bonds) and cash by a wide margin. That’s worth keeping in mind as allocators seek opportunities to put languishing cash to work in strategies where they can potentially increase income and total return without taking uncomfortable levels of risk.

The right side of the wealth transfer from owner/operator to lender

Remember, the core strategy has always been to focus on short maturity (three-year loans with two, single-year extension options), acquisition, development and transitional financing. After the recent real estate downturn began, acquisition and development (A&D) and transitional loan flow slowed substantially as buyers and sellers grappled with price discovery for individual properties, and much higher borrowing costs.

However, now that the consensus in the real estate market is that we have (at best) already bottomed in price or (at worst) are very close to a sustainable bottom in price—A&D/transitional loan flow has started to pick back up, particularly for industrial and multifamily properties.

This is a welcome development indeed since, in general, as an alternative lender, you would always prefer to have your core historical opportunity set opening back up, while simultaneously taking advantage of the two more recent market opportunities: 1) the rolling loan opportunity set and 2) buying loans directly from banks.

1. The rolling loan opportunity set

The opportunity to lend to borrowers on high quality/trophy properties as existing loan maturities come due remains robust because of the following.

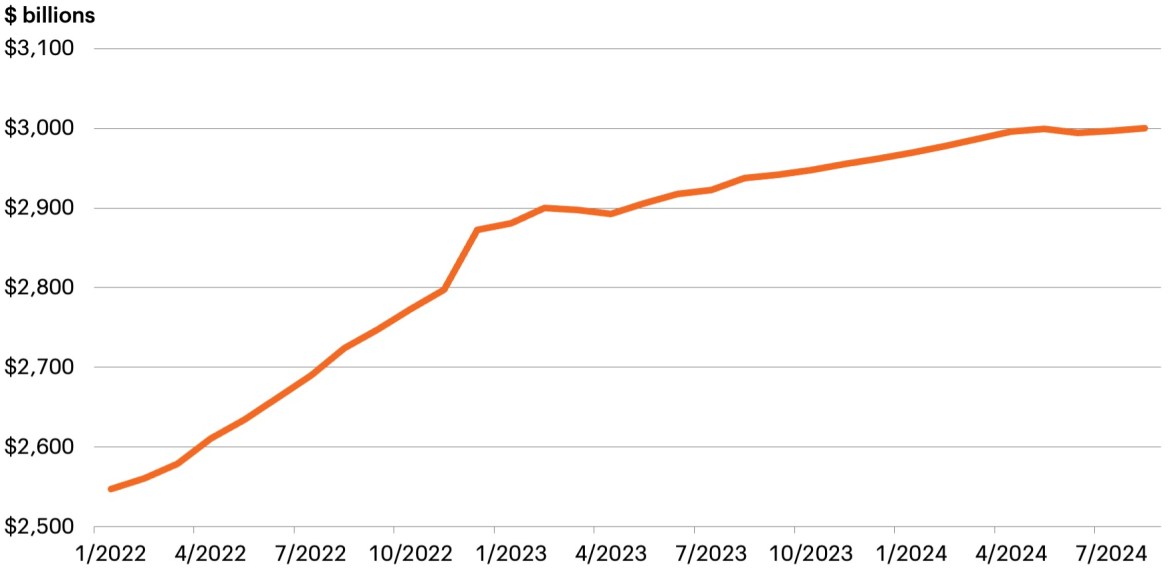

- Banks are growing their loan and lease books at a much slower pace relative to nominal gross domestic product (GDP) than in the past.

- Bank CRE lending has completely flatlined since April of this year.

- Many listed alternative lending strategies (like mortgage REITs) are tapped out on capital.

This opportunity first presented itself back in late 2022 and is still going strong today. From our perspective, a majority of the higher quality opportunities over the past 20 months and for the next several years have been and may continue to be providing financing to borrowers that need to roll their loans, aka the “rolling loan opportunity set.”

Around $2.6 trillion of loans will have to be rolled in CRE through 2028 so the opportunity set is vast. This has continued to primarily drive robust opportunities for industrial loans at lower loan-to-value (LTVs) and wider spreads at a much higher base rate (secured overnight financing rate—SOFR), and, less frequently, in multifamily and trophy lodging.

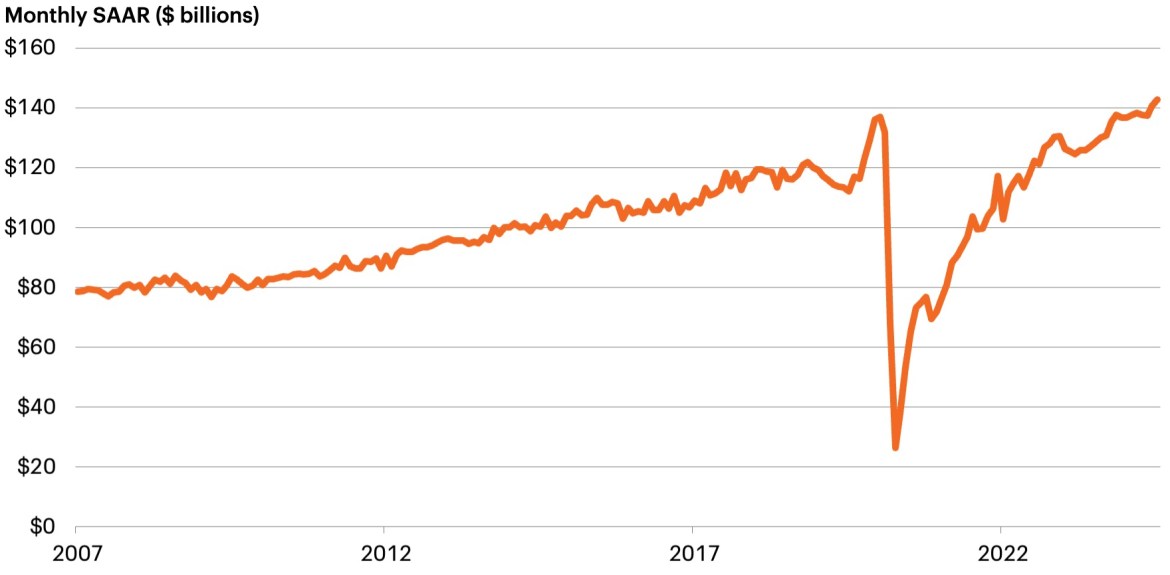

Bank CRE loan growth

Source: Board of Governors of the Federal Reserve System (US), As of September 19, 2024.

2. Buying loans directly from banks

More recently, the opportunity has materialized to buy loans directly from banks as they seek to “rebalance” their loan books away from a historically heavy emphasis on CRE loans.

Remember, when banks were failing last year, the loan auctions conducted were rapid, often contained lower quality office loans in subpar locations and provided little if any ability to negotiate on price with the Federal Deposit Insurance Corporation (FDIC) or to select the best loans within the pools. Now that we are well past the acute stages of our recent mini banking crisis (if you can call the failures of the second, third and fourth largest banks in U.S. history a “mini” banking crisis—though let’s face it, the crisis had little impact if any on the U.S. economy), bank management teams can patiently “rebalance” loan books away from CRE by selling higher quality loans at modest discounts. The result is often beneficial to all participants involved.

- Bank management wins because they can show progress on reducing CRE exposure.

- Regulators win because banks increase their liquidity and regulatory capital profiles (the amount of capital that regulators require banks to hold to protect depositors).

- Bank shareholders win because the stigma of higher exposure to CRE is reduced.

- Investors in senior mortgage REITs win because they increase their opportunities to gain exposure to a high quality loan pool at an attractive spread/income level and at a reasonable LTV (meaning potentially more income with less risk).

At the time of this writing, it is unclear how much longer this unique opportunity will last, but we’re hopeful it will continue for at least a few more years.

Opportunities to seize in CRE lending

Now, without further ado, here are the opportunities to seize in CRE lending, whether they be through rolling loans, standard A&D/transitional financing or buying from a bank.

Optimum locations

Loans on properties in geographies with strong population and income growth (location, location, location) present potential opportunities, and stand in stark contrast to the well-publicized challenges faced by poorly located office and retail.

Industrial and warehouse

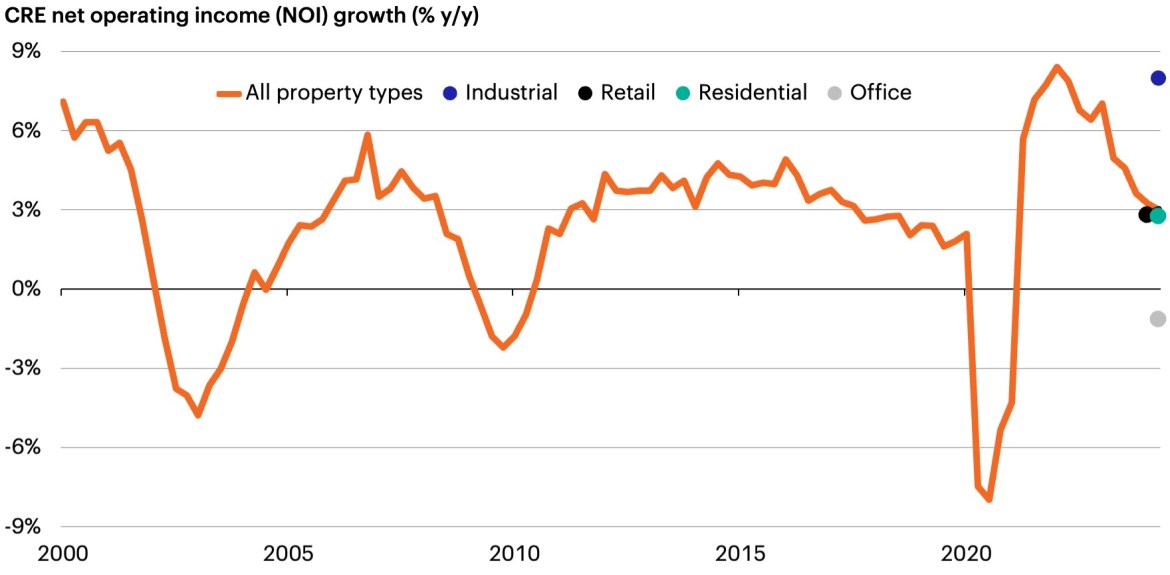

LTVs and spreads became a little too frothy by the summer of 2021, driven by unrealistic expectations for post-pandemic ecommerce demand and revenue growth. Now that gravity has reasserted itself, LTVs have come down and spreads have widened meaningfully. Thus, the industrial and warehouse sector has been back in favor from a lending perspective since the end of 2022. Lower LTV, S+280 to 375 industrial A&D/transitional and “rolling loans” are arguably the best risk/reward available in CRE today.

NOI growth has moderated, but remains healthy

Source: NAREIT, as of June 30, 2024.

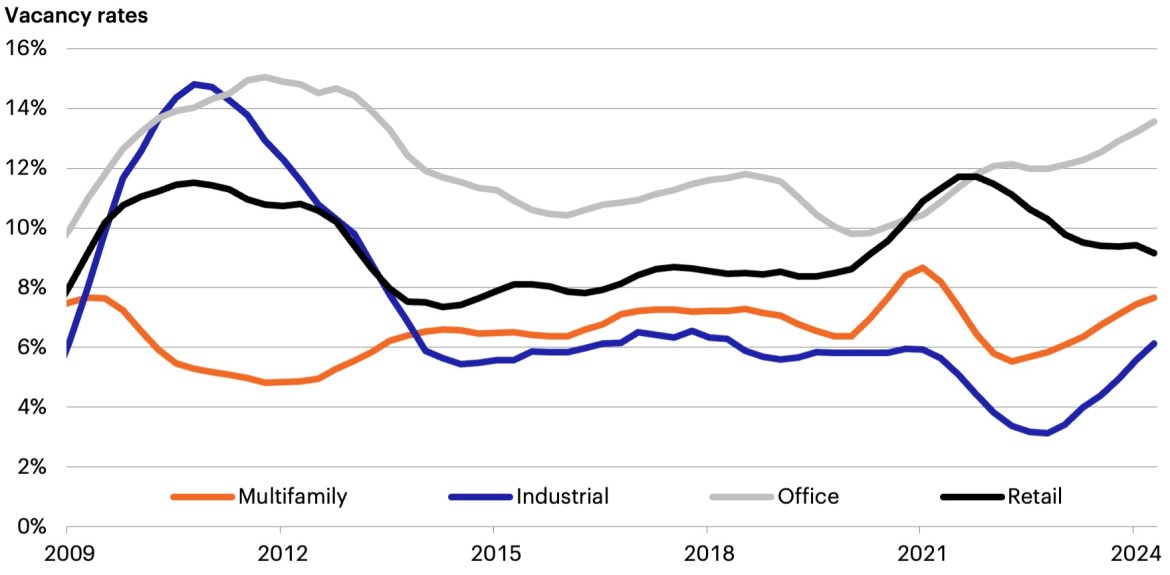

Outside the office sector, occupancy remains healthy

Source: MSCI Real Capital Analytics, as of June 30, 2024.

Multifamily

Even though property owners have taken a short-term price hit as borrowing costs have climbed and cap rates have inevitably creeped higher (cap rates that may or may not yet be fully reflected in fund net asset values), the fundamentals for lenders still look strong; that is, given relatively tight supply, high occupancy levels and a continued lack of sufficient construction or supply of single-family homes (so much for the residential housing market contributing to GDP growth…the few quarters that it did so were fun while they lasted).

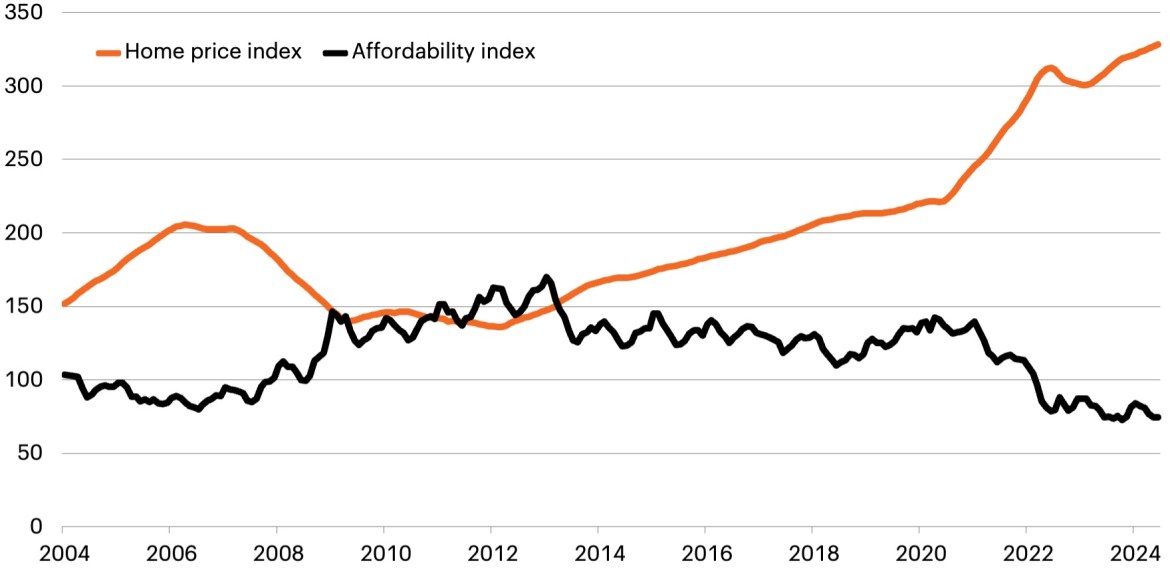

On top of that, with home prices rebounding, homeowners are reluctant to sell because they don’t want to move from a 3% mortgage to a mortgage at 6.5%. Since home affordability has plunged to new all-time lows, the economic advantage of renting as opposed to buying has surged back—and is close to 17-year highs.

Also, since we’re in an election cycle, and I’ve been reading a lot about a surge in undocumented/illegal immigration recently, it’s probably fair to apolitically point out that, when there is a massive surge in shelter demand and no accompanying increase in supply, rent and residential housing costs should be/will be/have been driven structurally/secularly higher.

Thus, forward rent growth is looking much rosier today than 20 months ago.

Premium to buy vs. rent

Source: NAR, U.S. Census Bureau, as of June 30, 2024.

Home prices and affordability

Source: S&P Dow Jones Indices LLC, National Association of Realtors, Macrobond, as of June 30, 2024.

Hospitality and lodging

We’re very much past the revenge-travel stage of the post-pandemic leisure travel boom and we’ve effectively settled back into the long-term trend line of growth for hospitality, hotels and motels.

Given the always present lower LTVs and wider spreads in hospitality loans (to compensate for greater economic sensitivity to recessions), and the occasional remaining opportunities in trophy lodging, we are still constructive on the highest quality hotel loans. However, prudent lenders typically limit their exposure to around 15% of a loan portfolio, just to mitigate exogenous/endogenous/black swan risk (for example, a second Global Financial Crisis, another pandemic, China invading Taiwan, Putin losing his mind even more, rogue nations deploying nuclear weapons, etc.) no matter how attractive the relative risk/reward may appear compared to other sectors.

Real U.S. consumer spending on hotels and motels

Source: U.S. BEA, as of July 31, 2024.

Brick-and-mortar retail

How wonderful it is that the original secular slow-motion trainwreck in CRE is even further in the rearview mirror than the immediate pre-pandemic period—or even a year ago. Now, prudent private lenders can lean into opportunities in the right locations with the right borrower(s).

The ridiculous growth in retail spending post-pandemic is clearly over now. However, in a stronger-for-longer nominal GDP growth environment (remember, transactions are made in nominal GDP, meaning real GDP plus inflation), it is unrealistic to expect a non-black-swan-driven decline in retail spending growth anytime soon. Much more realistic is brick-and-mortar retail sales growth of nominal GDP minus 0.5% to 2% to account for the secular trend of online commerce growth.

As has been the case for some time, if you are investing in CRE retail at all, stick to senior secured loans! And again, similar to hospitality, limitations in concentration should be applied.

Johnson Redbook retail sales

Source: Johnson Redbook, as of September 1, 2024.

Risks to avoid in CRE lending

Now let’s consider some of the risks present in today’s private CRE lending landscape—and why (and how) investors may avoid them.

Highly concentrated mortgage REITs

You may have read or heard about some challenges in large central business district office towers located in high tax, business-unfriendly locations suffering from population exodus (driven by the secular post pandemic trend of remote work, a population and business exodus caused by insufferably high taxes and regulation, and a desire to have a lower cost of living).

Since major metro office towers are now the second secular slow-motion train wreck to hit CRE in the last 25 years, it would be wise to avoid investing in mortgage real estate investment trust (REITs) that have a heavy concentration there. Instead, consider investing in those with little exposure or, better yet, de minimis exposure—whether that be through luck, skill or a combination of both.

Highly concentrated mortgage REITs

If a senior CRE loan is credibly originated by an experienced CRE lending team, it is unlikely for that recently originated private CRE loan to default. That’s because a default would require an extremely rapid economic, geographic regional, sector and/or property fundamental deterioration to cause it.

Since typical LTVs are below 70%, it would also be unlikely that a loss would be realized in the event of that default, as long as the property value did not drop by 30% or more in a short period of time. However, we all know weird, unpredictable things can occur in life from time to time.

If you invest in a mortgage REIT that has greater than 20%, 30% or (holy cow) 40% of net asset value (NAV) exposed to one loan or several loans, if something unforeseen does go wrong, it can leave a big dent indeed. Remember, every lending or credit strategy (including private credit) is about earning income and keeping losses as low as possible. If you are earning 7%–8.5% tax equivalent income/yield, you don’t have much room to eat a 5% NAV hit. Now that’s an unlikely outcome for sure but, unlike in perpetual business development companies (BDCs) or regulated investment company (RIC) structures, REIT concentration limits to property are much higher, or put another way, diversification tests are much less stringent—which is a fact not well articulated in our industry.

So, make sure you are investing in a diversified portfolio!

Highly levered mortgage REITs and/or those without termed-out financing

As many of us have learned over the past 26 years that included the Long-Term Capital Management (LTCM)/Russian Default crisis of 1998, the Global Financial Crisis and more recently the pandemic, markets can stay irrational longer than investment strategies can stay solvent. Leverage can be a prudent tool to modestly enhance returns for investors without taking uncomfortable levels of risk. However, the higher the leverage, the higher the risk. So, we would always recommend staying at or below three turns of debt for every unit of equity in all environments—and preferably two units of debt for every unit of equity in a market downturn. If leverage exceeds 3.5X, it could lead to discomforting outcomes in the future.

Additionally, having leverage termed out (so you are never forced to sell at inopportune times) is also critical. Relying almost exclusively on bank-provided short-term repurchase financing can be dangerous because we have all seen banks choose or be forced to cut off credit lines in major market dislocations.

Finally, two other key considerations for CRE investors include: 1) the diversity/heterogeneity of the asset class and 2) the way in which floor protection keeps building for CRE loan income.

1. Vast diversity/heterogeneity of CRE lending

CRE lending is a $5.8 trillion asset class that has tremendous heterogeneity/diversity in terms of geography and sector. So, the name of the game is optimizing loans based on the diverse factors available, including:

- LTV

- Spread to SOFR

- Sector

- Geography

- Quality of borrower

With three-year average life loans or less, the ability to evolve a private CRE loan portfolio is also an attractive attribute that most private strategies do not possess.

2. Floor protection

As time has gone moved on, and our higher-for-longer interest rate environment continues, the floor protection keeps building for CRE loan income.

The majority of floors these days are set at 3.5%–4.5%. If the Fed does what we expect and gradually takes the front end to 3% over the next several years, the floors will kick in a bit and protect a small but meaningful amount of income on loans originated from 2023 onward. However, if something crazy happens and the Fed is yet again forced to take interest rates to zero, well, we’ll be happy newly originated CRE loans actually contain floors well above 1%.

Conclusion: Roll up the capital structure/Stay at the top of the capital structure

It’s a great time to be a lender if you have dry powder to seize the opportunity. The “Dare to Dream” scenario is only one part of the dramatically improved opportunity for private lenders. When one turns back to the efficient frontier,1 we are in a unique period where greater income on total return can potentially be generated in the senior part of the capital structure than the equity part of the capital structure, and with the potential for dramatically less risk.

So, you know what you have to do: Roll up the capital structure in real estate and corporate balance sheets or “stay at the top of the capital structure.” After all, private credit is democratized, and The Time for the Right Alts is Still Now!

Coming up next: Multi-strategy investing

The next strategy note will focus in on how multi-strategy funds may benefit from the Dare to Dream scenario, covering timely investment themes within multi-strategy investing.

Investing in alternatives is different than investing in traditional investments such as stocks and bonds. Alternatives tend to be illiquid and highly specialized. In the context of alternative investments, higher returns may be accompanied by increased risk and, like any investment, the possibility of an investment loss. Investments made in alternatives may be less liquid and harder to value than investments made in large, publicly traded corporations. When building a portfolio that includes alternative investments, financial professionals and their investors should first consider an individual’s financial objectives. Investment constraints such as risk tolerance, liquidity needs and investment time horizon should be determined.