Markets and investors are nervous about the economy again, even as the Fed started a new rate cut cycle with a big 50bps first step. In the fourth quarter, election and employment data are the focus, both of which bring increased policy uncertainty at a time when the economy is likely experiencing an incremental slowdown. Even successful landings can be bumpy.

Key takeaways

- Strong economic growth is likely to moderate in Q4, but we stick with our outlook for an incremental slowdown and a soft landing.

- We look for two more 25bps Fed rate cuts in Q4 and brace for rapidly shifting expectations around easing in 2025 to cause volatility in fixed income markets.

- Business investment in AI leaves the economy, as well as markets, increasingly exposed to the tech sector.

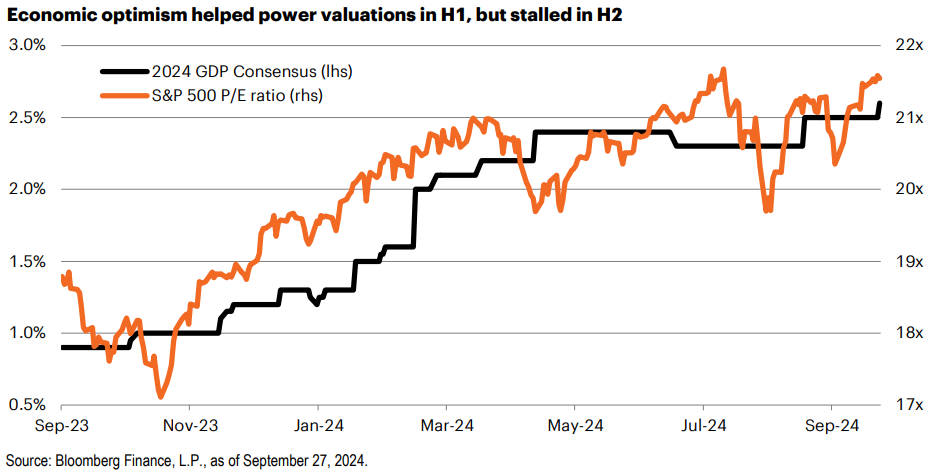

2024 has evolved along a remarkable trajectory, and the fourth quarter may see a continuation of rapidly shifting expectations. At the start of the year, the consensus was looking for anemic growth of just 0.8% real GDP growth for the entire year. That shifted by midyear and culminated in early July with what can only be characterized as peak optimism: A combination of an upgrade of economic growth to a robust 2.5%, signs that rate cuts were on the way and the promise of artificial intelligence (AI)-fueled profits; all of which powered price-to-earnings (P/E) ratios to 21.7x. Since then, however, the path has been rocky, and we think the last three months of the year will bring more uncertainty for investors. Markets have been alternately spooked and soothed by the labor market data, worried about the economy and expectations for Fed rate cuts are—once again—exceeding what the Fed has indicated in its own projection. Add heightened election uncertainty and it isn’t hard to see why markets have struggled to find the next leg up in equity valuations.

Jobs data is the focus in Q4

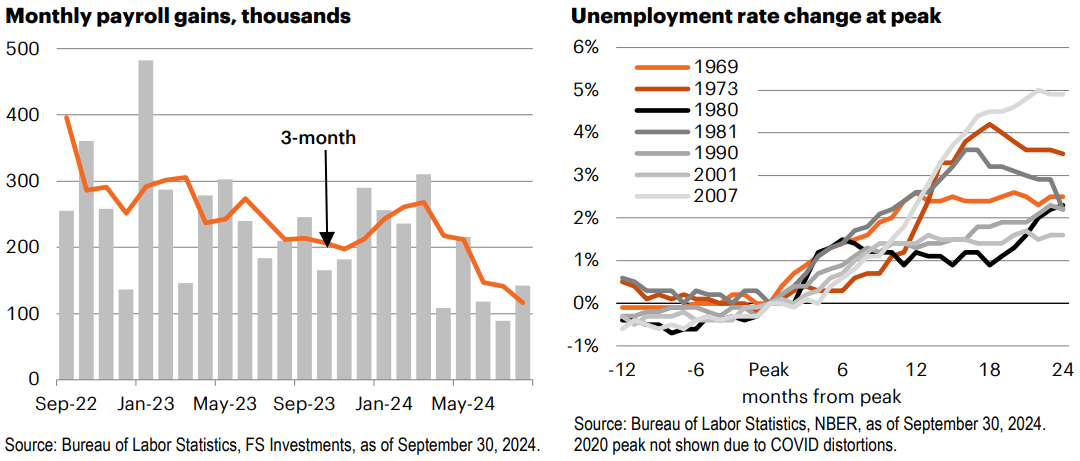

After two years of intense focus on GDP forecasts (that were ultimately too pessimistic), suddenly the attention has shifted to the labor market. And with good reason. The labor market had been red hot by almost every metric through 2023: The unemployment rate hit a low of 3.4% in early 2023 and monthly job gains averaged 251,000 last year.

However, in 2024 the temperature cooled. In July, a double whammy of a weaker-than-expected jobs report, a rise in the unemployment rate to 4.3% and benchmark revisions all showed a labor market that lost steam and had begun to weaken in Q2, sooner than initially understood. In our first article, we spend time looking at the state of the labor market, what we are watching and how possible benign factors could have raised the unemployment rate. Fed Chair Powell was clear in his August address at the Fed’s Jackson Hole symposium: The Fed has no wish to see further deterioration in the labor market. Gauntlet thrown. This is likely to be the focus of markets for the remainder of the year.

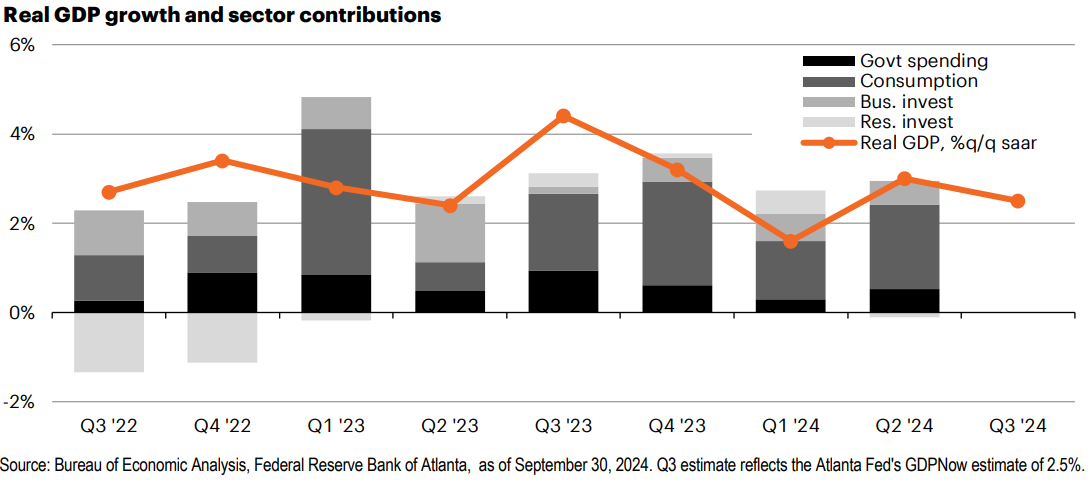

There is good reason to be focused on the unemployment rate and the labor market. Historically, the unemployment rate moves asymmetrically—it goes down slowly and rises fast. A recession is not our base case, but we acknowledge the rise in the unemployment rate increases the risk of a hard landing. We are keenly aware of the risks of assuming “this time is different,” this business cycle has been unprecedented from the start, and multiple historic patterns around recession have given false positives in this cycle. However, the growth data remain strong. Real GDP is tracking 3.1% in the third quarter, according to the Atlanta Fed’s GDPNow model.

Looking ahead, there are multiple tailwinds likely to support growth momentum and hiring in Q4 and beyond. Government spending has been adding significantly to GDP and more spending is in the pipeline. This includes state and local government spending, which is being supported by higher property taxes (given appreciation in home values).

Businesses investment is fueled by the need to implement AI and we look at how the economy is benefitting—and exposed—to strong spending in the tech sector. The housing sector could be a small tailwind. Lower interest rates should foster some recovery in construction. And elevated home values have already caused homeowners to use HELOCs to unlock home values.

Our forecast includes an incremental slowdown to a more sustainable pace of real GDP of 2.0% in Q4 and 1.75%–2.00% in 2025. Household consumption is arguably overdue for a deceleration. However, we are confident the economy can absorb an incremental slowdown without a significant further rise in the unemployment rate and widespread job losses.

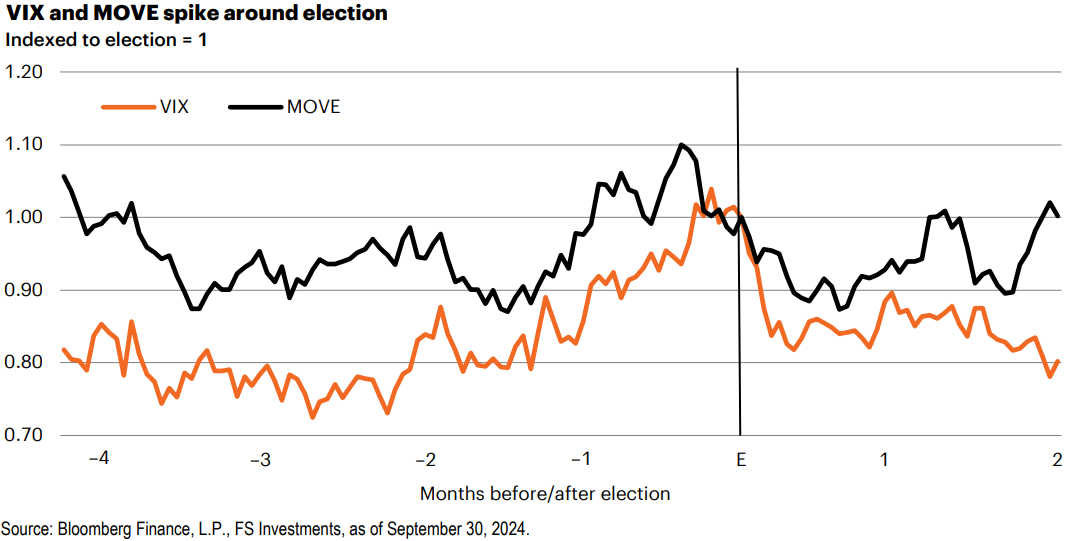

The election is here, volatility is a running mate

The 2024 Presidential Election is the big event dominating the fourth quarter. The polls remain too close to call in most of the seven swing states that will decide an electoral college victory. Looking ahead to the policy implications of election outcomes also needs to include assumptions about down ballot races and when it comes to possible policy outcomes, Congress matters. Both candidates are currently espousing significantly pro-growth policies, and we dissect their proposals and what it means for growth. More importantly, in the fourth quarter, we expect volatility to increase notably in both stock and bond markets, as it has in previous election cycles.

Fed rate cuts in a soft landing will scramble expectations

The Fed rate cut cycle finally arrived with an outsized 50 basis point rate cut on September 18. This year, Fed rate cut expectations have been highly fluid, and we expect rapidly shifting rate cut expectations to be a key feature of the fourth quarter. It was easy to argue for rate cuts in

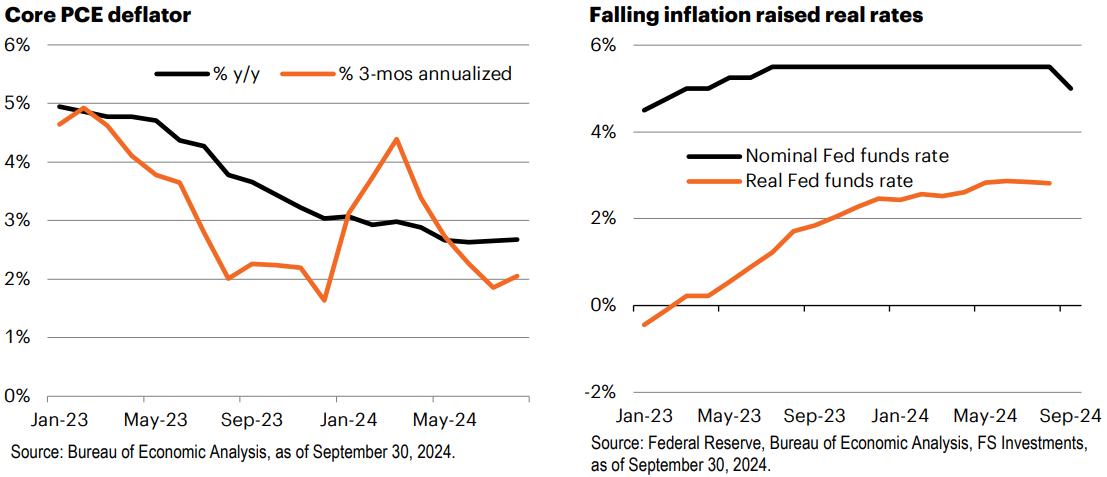

September. The flurry of disappointing employment data and a window of benign inflation data opened a clear window for action. The PCE deflator edged down to 2.2% year over year (y/y) in August on the back of continued falling goods prices and some relief on rent inflation. The core PCE deflator has been stickier, and has hovered at 2.7% y/y. But on a 3-month annualized basis, it has decelerated to 2%.

The Fed is also prompted by the real Fed funds rate, which has risen as inflation has faded. In other words, just by holding the Fed funds rate steady, monetary conditions were tightening. This alone sets up the Fed for the 100bps of tightening total in 2024 that the dot plot reflects.

Here is where our outlook deviates from market expectations, and the consensus. While we expect the Fed to round out Q4 with two more quarter-point rate cuts at the November 7 and December 18 meetings, we aren’t bullish on fixed income across the curve. We expect the Fed to hold rate cuts in the new year and reassess. If the economy remains as resilient as we expect, then we think markets will once again have to walk back exuberant rate cut expectations.

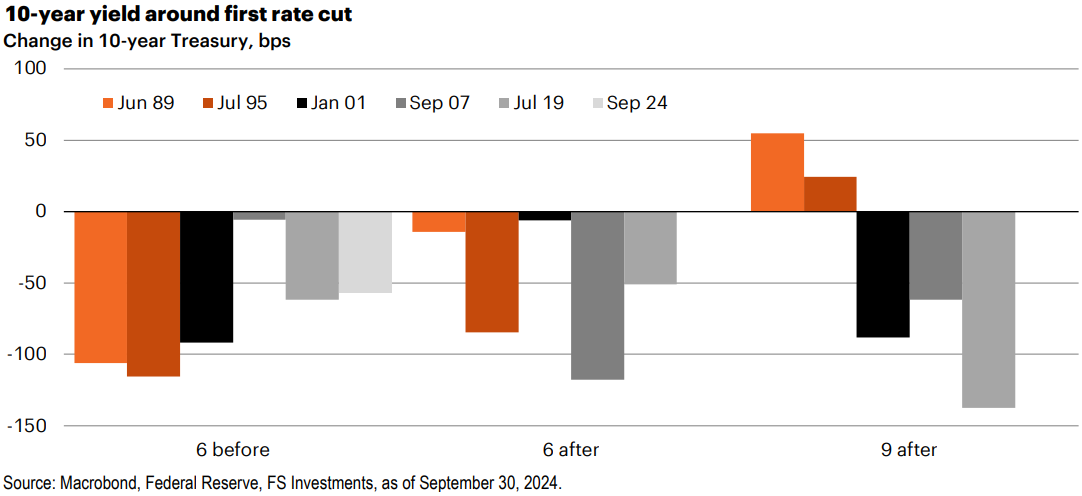

Our expectations for long-term rates also differ from markets. The consensus that the interest rate complex will be shifting down now that rate cuts are here misses the idiosyncratic nature of non-recessionary rate cuts. Long-term rates start to fall as soon as markets anticipate rate cuts, and typically, most of the decline in 2- to 10-year rates happens before the first rate cut. If a recession occurs, rates continue falling in the first six months after the first rate cut. If a recession is long or deep, then rates stay low. But in cases where a recession is shallow or—as in the mid-1990s—the economy avoided a recession, then by nine months after the first rate cuts, long-term rates are already higher than before the first rate cut. Today, the economy is arguably stronger than in all of these prior episodes of rate cuts. Indeed, since the September 18 rate cut, the 2-year and 10-year Treasury yields are a tad higher than prior to the rate cut.

We include an article page on yield curve renormalization because in our opinion this is a topography of financial markets that is not getting enough attention. We think yield curve steepening will happen through a combination of lower short-term interest rates but higher long-term interest rates. We think Q4 will see the 10-year treading water and yields could move higher in 2025.

Equity valuations face great expectations

We started our Q4 outlook by looking at how economic optimism and upward revisions to growth helped drive valuations higher in the first half of 2024. Looking ahead, the market is running out of catalysts to propel valuations to the next level. While we expect economic growth to remain solid, it is unlikely to maintain the 2.5% pace it has sustained over the past two years.

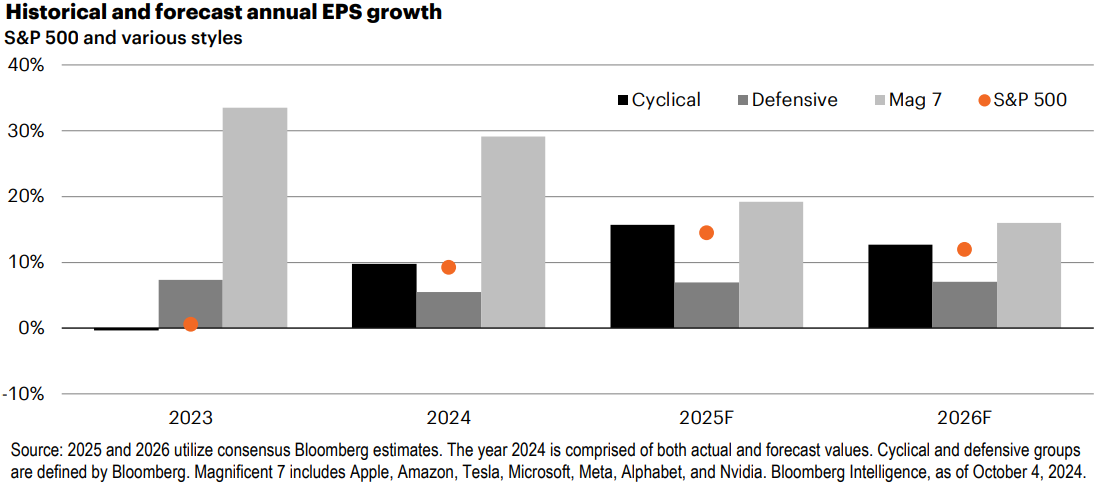

Our last article page is on equities. The consensus forecast for earnings growth implies outstanding economic growth. Not a soft landing, but no landing, from today’s frothy pace. The outlook for double-digit earnings growth for the S&P 500 of 15% in 2025 and 12% in 2026 includes expectations that cyclicals, defensives and the Mag 7 will all see strong earnings growth. In the consensus crystal ball, there is almost no cross-sectional volatility—everything is expected to contribute. Mag 7 earnings growth is expected to be 15%–20% into perpetuity. The consensus also looks for an early-cycle type boom in cyclical earnings, as well as durably solid earnings in defensives. It’s a lot that has to go right.

Our outlook for the economy is far from pessimistic, but given the implied growth priced into publicly traded equities, our forecast for an incremental slowdown risks being internalized as a significant disappointment.