More of our insights

Research Roundtable: Q3 2021 Market outlooks

Members of the Investment Research team gather to discuss their predictions for Q3 2021.

What a red-hot labor market means for the economy

June added 850,000 new jobs, but the underlying trends in the labor market defy any prior cycle in ways that could add to inflation and complicate Fed policy.

Q3 2021: Zooming in on inflation

Inflation is dominating the economic discussion, and with good reason. Rising inflation and the Fed’s hawkish pivot have critical implications for interest rates and investors.

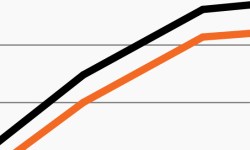

As long rates fall, core fixed income stuck in the middle

Long rates have declined despite rising inflation readings. This week’s chart looks at the declining yield curve and why core FI is in a tough spot.

Rate expectations remain near zero for the long term

Prices have risen, but rates remain anchored. This week’s chart looks at Fed funds rate expectations, noting that the income problem is here to stay.

Despite rate pause, the Barclays Agg remains underwater

The Barclays Agg remains in negative territory YTD despite a kinder rate environment. We compare core fixed income returns in 2020 and 2021.