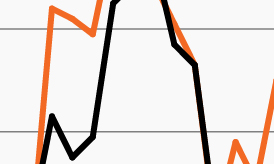

Property price growth: Before and after 2020

Source: Real Capital Analytics, as of August 2021. Latest data available.

- U.S. commercial real estate (CRE) property prices have risen in recent months even as major equity and fixed income indexes have stalled or turned lower. In August, all four major property types (apartment, industrial, office and retail) posted double digit annual returns while the broad-based RCA Commercial Property Price Index (CPPI) grew 13.5%, its highest level since 2005.1

- While massive government stimulus acted as a bridge throughout the pandemic, helping to support prices again as conditions improved in 2020, the CRE market today appears to be on solid footing again as investor sentiment has improved and pandemic-induced distress continues to abate.

- As the chart shows, the pace of CRE property price growth is markedly faster today than the slow-but-steady growth seen before the pandemic.1 (Note that the chart does not include property price growth in 2020, which may have been distorted by the spread of the pandemic and subsequent government assistance).

- The dispersion in returns across CRE property types today remains wide. Yet some of the many changes the pandemic introduced to daily life have been supportive to large CRE property types. Multifamily, for example, has benefited from strong job growth this year while an increasingly expensive housing market continues to stoke demand for apartment rentals. Meanwhile, industrial entered the pandemic in solid shape but has benefited greatly from outsized demand for e-commerce since the start of the crisis.

- Any new expansion brings with it its own challenges and today is no different. Elevated inflation brought on by persistent supply chain issues and a more hawkish Federal Reserve could dampen sentiment toward the sector. Amid broad-based price gains, however, the macro backdrop continues to be supportive to the CRE market.