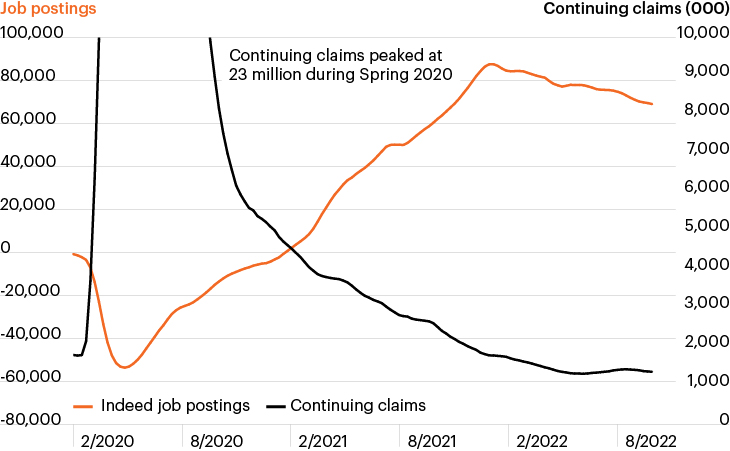

New job postings, continuing unemployment claims (four-week moving average)

Source: Bloomberg Finance, L.P. and Federal Reserve Bank of St. Louis, as of September 30, 2022.

- September’s consumer price index (CPI) report was a stark reminder that inflation remains persistent and broad-based across the U.S. economy, while also offering more evidence the primary drivers have changed significantly over time.

- Inflation was initially dominated by rising goods prices, a trend which likely peaked earlier this year as supply chains snarls have largely eased. More recently, price pressures have largely been driven by higher services costs (most notably shelter), as new household formation and COVID-impacted activity accelerated rapidly.

- The transition has flummoxed Fed policymakers and investors alike, as the CPI has delivered upside surprises in five of the past six months, with much of the recent inflation coming from stickier categories.

- Against this backdrop, all eyes have turned to the labor market, as wages tend to loom large for inflation, particularly in services. The U.S. employment picture has remained surprisingly robust, presenting Fed policymakers with a difficult dilemma moving forward.

- As the chart shows, continuing unemployment claims predictably spiked when the pandemic began while new job postings plummeted.1 Since the initial shock, continuing claims have fallen to near historic lows while companies rushed to post new roles; only this year have new job postings declined, and still only modestly.1

- Clearly, the employment picture has provided a firm foothold for the U.S. economy amid a difficult macro environment. At the same time, its strength poses a unique challenge to Fed policymakers whose rhetoric has remained firmly hawkish. Market volatility around labor market data will likely be particularly acute given its relevance to inflation within the Fed’s framework.