Education > Know your alternatives > Structures + offerings

Alternative investment structures + offerings

Access alternatives through diverse investment structures and offerings

Ways to access alternatives

Business development companies

Business development companies (BDCs) are closed-end funds that primarily invest in private U.S. companies.

Closed-end funds

Closed-end funds pool shareholder assets to invest in a wide range of securities including alternatives like private equity and private credit.

Evergreen funds

Evergreen funds are perpetually offered and allow investors to purchase or redeem shares on a periodic basis.

Interval funds

Interval funds are a type of closed-end fund that offers the ability to invest across a wide range of strategies, securities and asset classes.

Mutual funds

Mutual funds are open-end investment companies that provide access to professionally managed, diversified portfolios of securities.

Private placements

Private placements are securities sold to a limited pool of pre-selected investors—typically higher net worth individuals or institutions.

Real estate income trusts

Real estate income trusts (REITs) are companies that own, operate or finance income-producing real estate assets—allowing investors to earn dividends from these properties.

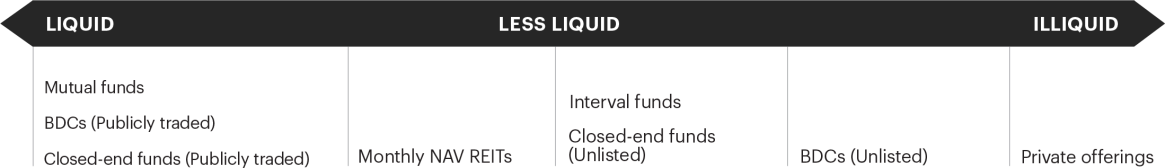

Understanding the liquidity spectrum

Funds that allow investors to purchase or redeem their investment on an intraday or daily basis are referred to as liquid. On the other hand, funds that limit redemption frequency over longer intervals are referred to as less liquid or illiquid. Some less-liquid funds offer liquidity on a monthly, quarterly or annual basis, while illiquid funds may require hold periods of up to ten years.

Liquidity is the ease with which an investment can be bought or sold without significantly impacting the price of the security.

Liquid investments are investments that can be easily bought or sold.

Illiquid investments are investments that cannot be easily bought or sold.

There are two ways liquidity applies to investing:

- The liquidity of individual securities

- The liquidity of the fund or investment vehicle used to invest in those securities

Thinking about liquidity as a spectrum may help investors understand how liquidity relates to different assets.

Investor considerations

Investing in alternatives is different than investing in traditional investments such as stocks and bonds. Alternatives tend to be illiquid and highly specialized. In the context of alternative investments, higher returns may be accompanied by increased risk and, like any investment, the possibility of an investment loss. Investments made in alternatives may be less liquid and harder to value than investments made in large, publicly traded corporations. When building a portfolio that includes alternative investments, financial professionals and their investors should first consider an individual’s financial objectives. Investment constraints such as risk tolerance, liquidity needs and investment time horizon should be determined.

A deeper dive

Interval funds

Our interval funds seek to generate an attractive level of current income and potential for capital appreciation.

Market updates from our Chief Market Strategist

Your guide for making the most of your assets. Stay up to date on market and industry trends with insights from our experts.

Explore our funds

FS Investments provides access to a broad suite of alternative asset classes and strategies.

Interval funds

Our interval funds seek to generate an attractive level of current income and potential for capital appreciation.

Market updates from our Chief Market Strategist

Your guide for making the most of your assets. Stay up to date on market and industry trends with insights from our experts.

Explore our funds

FS Investments provides access to a broad suite of alternative asset classes and strategies.

Powering your portfolio

FS Investments is committed to providing greater access and transparency to investors in the alternatives space. Through our investment teams and investment partnerships, in-house research experts and valuable programs that help to educate and engage advisors and their clients.

The largest impediment to more productive client conversations about alternatives is likely a knowledge gap. Investors may be hesitant to expand into alternatives due to their unfamiliarity with, and lack of exposure to alternative investment strategies.