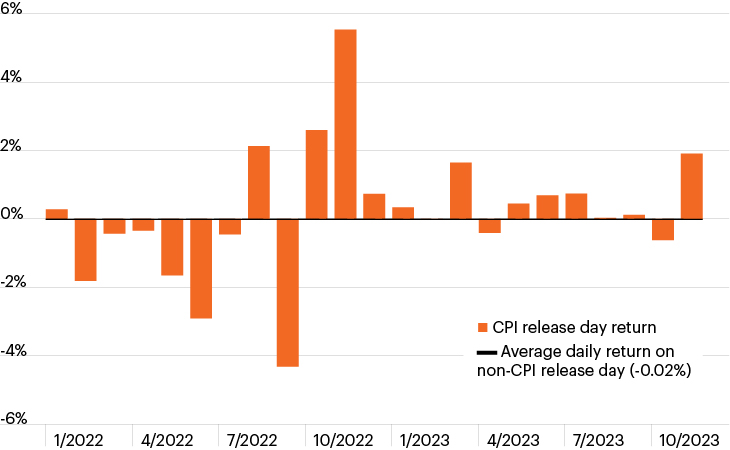

S&P 500 daily returns: Day of CPI release vs. other days

Source: Bloomberg Finance, L.P., data from January 1, 2022 through November 15, 2023.

- Stocks jumped on Tuesday following October’s softer-than-expected inflation reading while Treasury yields plunged as the market grew increasingly confident the Fed may have completed its rate hike cycle.

- In fact, investors viewed the inflation reading as a sign the U.S. economy may be nearing the long-elusive soft landing, and the market now expects Fed rate cuts by mid-2024.

- While Tuesday’s inflation data appeared to be an inflection point marking improved investor sentiment, market activity was generally in line with other days over the past two years when inflation data has been released.1

- Said another way, markets have seen dramatically higher volatility on days when Consumer Price Index (CPI) data is released. The highest and lowest daily returns during CPI release days since January 2022 were 5.5% and -4.3%, respectively, while the S&P 500’s average daily return on the other (non-CPI release) days was about flat (-0.02%).1

- Investors have been rightly focused on inflation and monetary policy over the past several years. However, such an intense focus on macro variables like these may also leave them vulnerable to the potential for downside volatility if monetary policy or CPI data do not align with expectations.