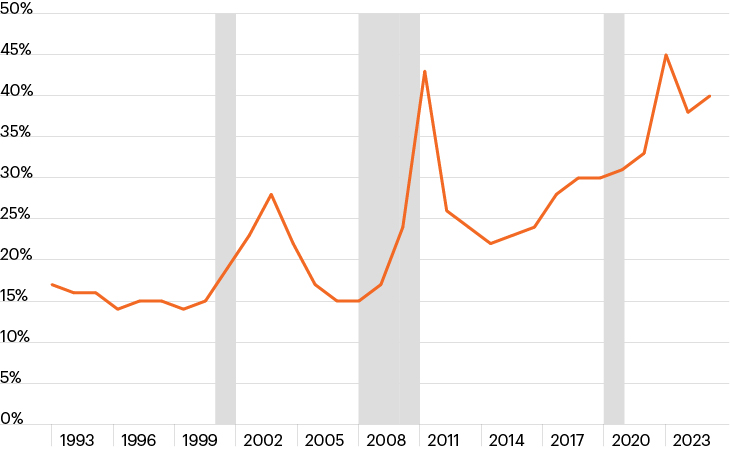

Percentage of Russell 2000 companies with negative earnings

Source: Bloomberg Finance, L.P., as of November 21, 2023. Shaded areas represent economic recessions.

- The number of public companies has significantly declined over the last 20 years due to the skyrocketing costs of being a public company combined with the need to prioritize short-term analyst expectations over long-term growth. Not only is the public investing pie getting smaller, but the growth outlook for many public companies has also become cloudier.

- While the top seven, mega-cap growth stocks in the S&P 500 are up an astronomical 80% year to date, the other 493 stocks in the Index are about flat on the year.1

- Small cap markets are even more challenged as the growth outlook has weakened for many small and medium-sized businesses. The Russell 2000 Index has generated a headline return of just 3.9% year to date while approximately 40% of the companies in the Index are producing negative earnings, up from about 15% in the 1990s.1

- Against this backdrop, investors may be wise to diversify their portfolios, including integrating investments in private middle market companies as they seek to better match the shifting opportunity set available to growth-oriented investors today.