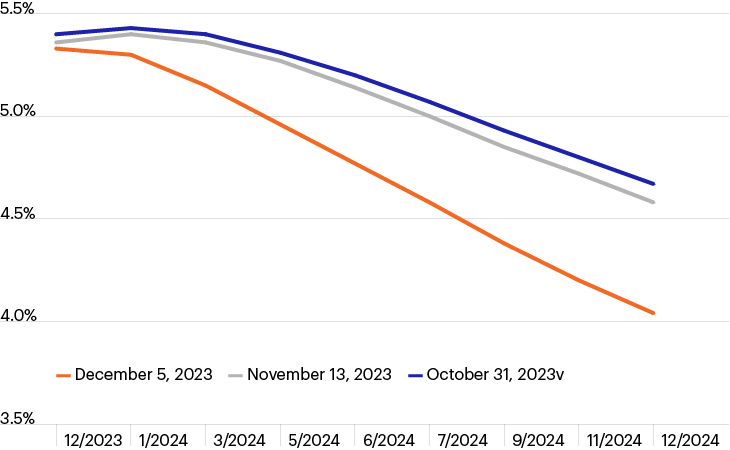

Market-based expectations for Fed fund rate

Source: Bloomberg Finance, L.P., as of December 6, 2023

- Investor sentiment changed dramatically in November as investors quickly adjusted their expectations from a higher-for-longer rate environment toward a Goldilocks-style soft landing amid cooling inflation data and increasingly dovish comments from Fed officials.

- Markets spiked in the process. The S&P jumped 9.1% in November while the Agg returned 4.5% driven by a strong rally across the Treasury yield curve and market expectations for additional rate cuts.1

- In just over one month, the market went from pricing in approximately three Fed rate cuts to a more aggressive five cuts, leaving the market implied Fed Fund rate at approximately 4.0% as of December 2024.1

- A lower rate environment would indeed provide a notable tailwind to markets next year, potentially justifying risk markets’ strong rally.

- Yet the swift change in sentiment also presents potential risks if Fed policymakers’ actions don’t meet market expectations. Alternatively, if the Fed slashes rates by 125 basis points or more over the next 12 months, it would signal a material weakening in U.S. economic growth. Investors may be wise preparing for heightened volatility should either scenario unfold.