S&P 500 performance attribution

Source: Bloomberg Finance, LP, FS Investments as of January 10, 2023.

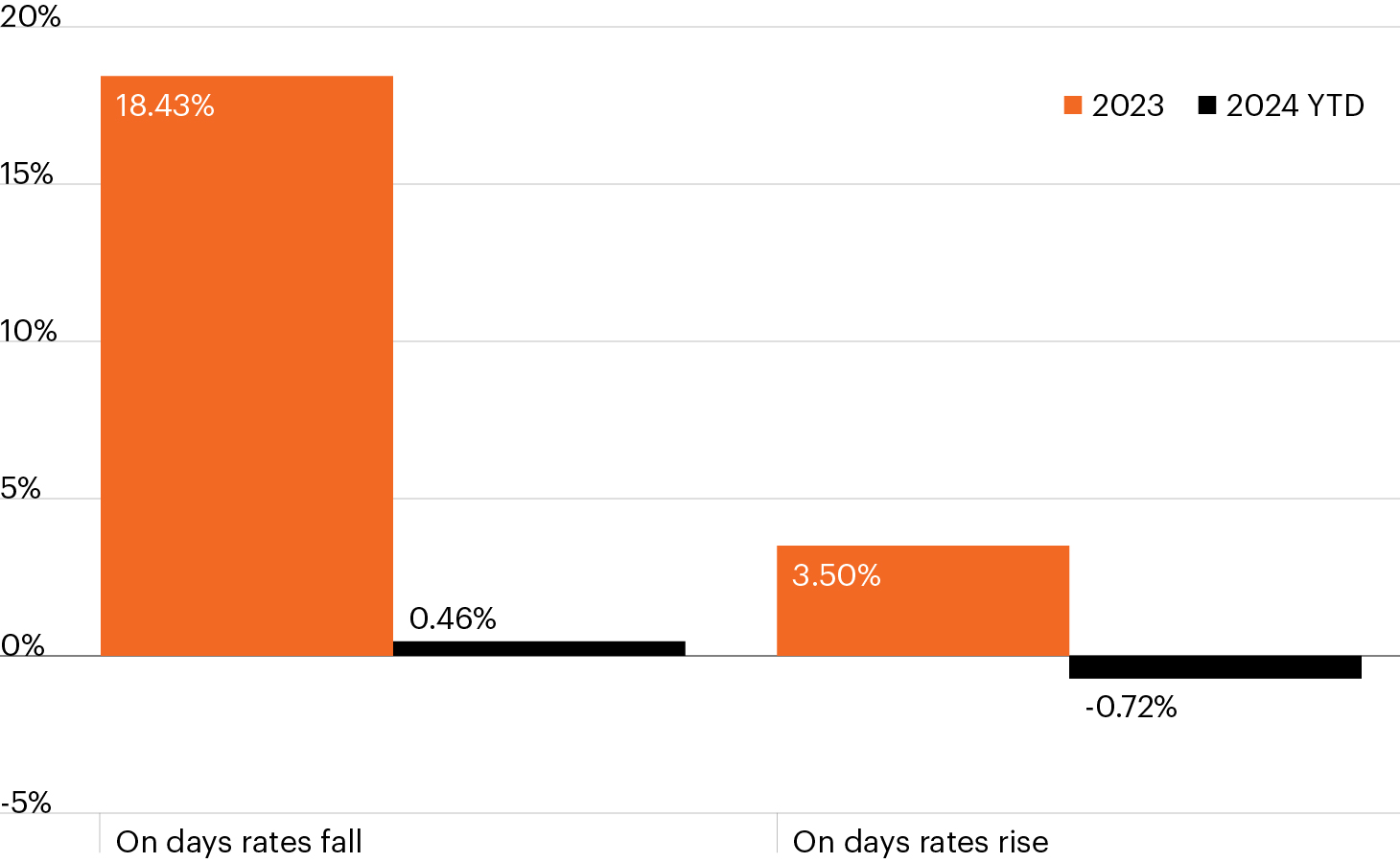

- 2023’s strong rally took place amid a concerning pattern as nearly all the S&P 500’s 23% return came on days when long-term Treasury yields fell. The rally became exaggerated when rates plunged in Q4 2023 as the soft-landing euphoria increasingly took hold.

- While 2024 is barely two weeks old, stocks’ reliance on rates has shown no signs of abating. The S&P 500 declined as rates rebounded to start the year, then recouped those losses as bonds rallied over the past week.

- This data underscores the extraordinary rise in stock/bond correlation since the start of the decade. From 2010 through 2019, the average 6-month correlation between stocks and bonds was -0.30.1 Since 2020, it has averaged +0.18, and today sits at a multidecade high of +0.68.1

- Falling yields or any number of factors could drive stocks higher again in 2024, as they did in Q4 2023.

- Yet it is important investors remain aware of traditional stocks rate sensitivity and its impact on portfolio diversification, especially at a time when rates remain highly volatile as expectations for policy and the economy gyrate.