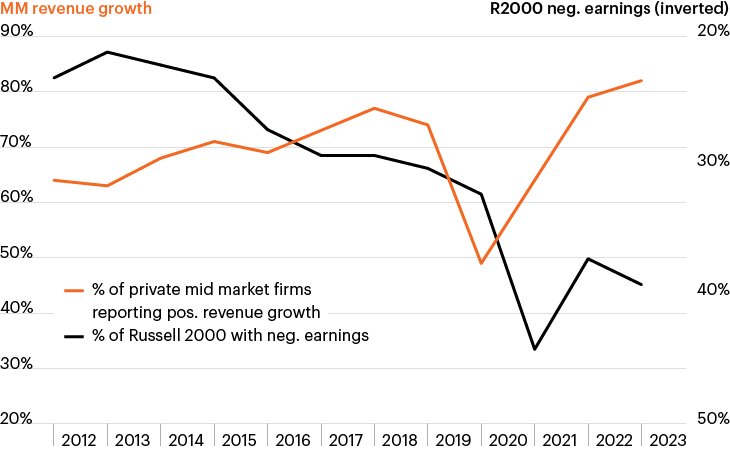

Russell 2000 earnings deteriorate, middle market revenues improve

Source: Macrobond and Bloomberg Finance, L.P., as of December 31, 2023. Annual middle market revenue growth figures represent quarterly averages.

- Stocks’ strong return over the past year may mask a shifting investment opportunity set from public markets toward private investments.

- Most of the S&P 500’s recent growth has been driven by select mega cap technology stocks. Additionally, the number of public companies has significantly declined over the last 20 years due to skyrocketing costs for public companies combined with their need to prioritize short-term analyst expectations over long-term growth.

- What’s more, the percentage of small cap companies generating negative earnings (black line, inverted) has risen from about 25% in 2012 to 40% today.1

- Over the same time frame, the investment opportunity set within private U.S. middle market companies—about 200,000 firms with revenues of $10 million to $1 billion—has become increasingly attractive.2 As the chart shows, 83% of middle market firms reported positive year-over-year revenue growth in 2023, representing the highest number on record.1

- Against this backdrop, investors may be wise shifting their portfolios toward where opportunities have evolved. The private U.S. middle market may offer differentiated sources of growth, income and diversification.