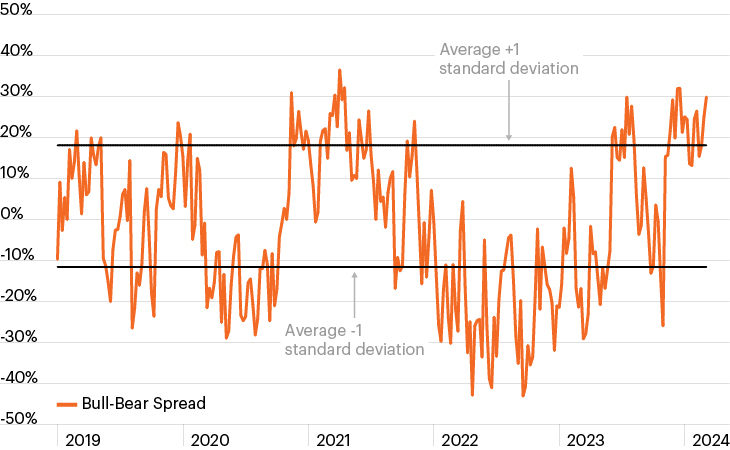

AAII Investor Sentiment bull-bear spread

Source: American Association of Individual Investors, as of March 6, 2024

- Investor sentiment moved sharply higher late last year and has remained elevated as equities continued their Q4 2023 rally into the first quarter of 2024. The market rally continues to be driven primarily by exceptional tech outperformance while markets have shrugged off rising Treasury yields as the result of an economic acceleration.

- As the chart highlights, the spread between bullish and bearish investors today looks stretched, sitting far above its average (6.6%) since the inception of the survey in March 1987.1

- Yet with equity multiples near historically expensive territory and markets faced with the prospect of adjusting to less aggressive (or no) rate cuts this year, it’s fair to wonder whether investors continue to price equities for a perfect, Goldilocks scenario.

- Indeed, even if the U.S. achieves the soft-landing scenario that many investors believe it will, forward-looking indicators continue to point toward the potential for slowing growth, continued rate volatility and ongoing geopolitical uncertainty.

- Against this backdrop, today’s environment in which U.S. stocks sit at an all-time high while macro uncertainty looms perhaps larger than normal may represent an opportune time for investors to trim their exposure to traditional stocks in search of less correlated sources of growth and diversification.