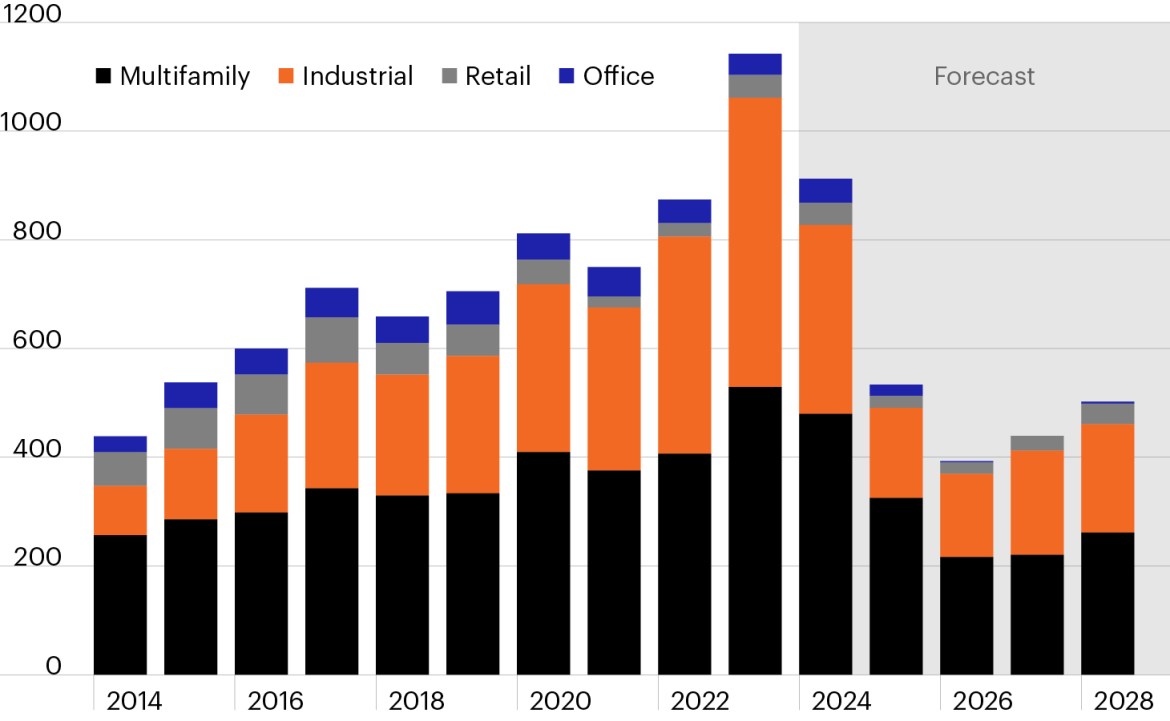

CRE net deliveries by year (square feet completed, millions)

Source: CoStar, as of March 31, 2024. Note: Multifamily data converted from # of units by assuming average unit is 900 sq. ft.

- The commercial real estate market has faced a variety of headwinds over the past two years. A historically large supply wave arrived at roughly the same time as the Fed’s fastest rate hike cycle in decades suppressed deal volume and pricing.

- But the CRE market (outside of office) has weathered the challenges impressively well, as resilient demand has allowed property owners to offset some of the impact of higher interest rates and new construction.

- As we enter the second half of 2024, increased investor recognition that the supply/demand dynamic is set to improve in the coming years could catalyze better sentiment in the near term.

- The Fed’s stated goal of higher interest rates is to temper demand, but an unintended consequence has been the suppression of construction starts for all property types. Multifamily and industrial assets (sectors most impacted by recent supply pressures) have seen construction starts fall to levels last seen in the early 2010s.1 Aggregate construction starts among the four major property types hit a decade low in Q4 2023, presaging a lack of new available space in the coming years.1

- With pending supply constraints all but unavoidable, a continuation of the solid CRE demand environment would likely result in property markets tightening again, driving rent growth higher and vacancy rates lower.