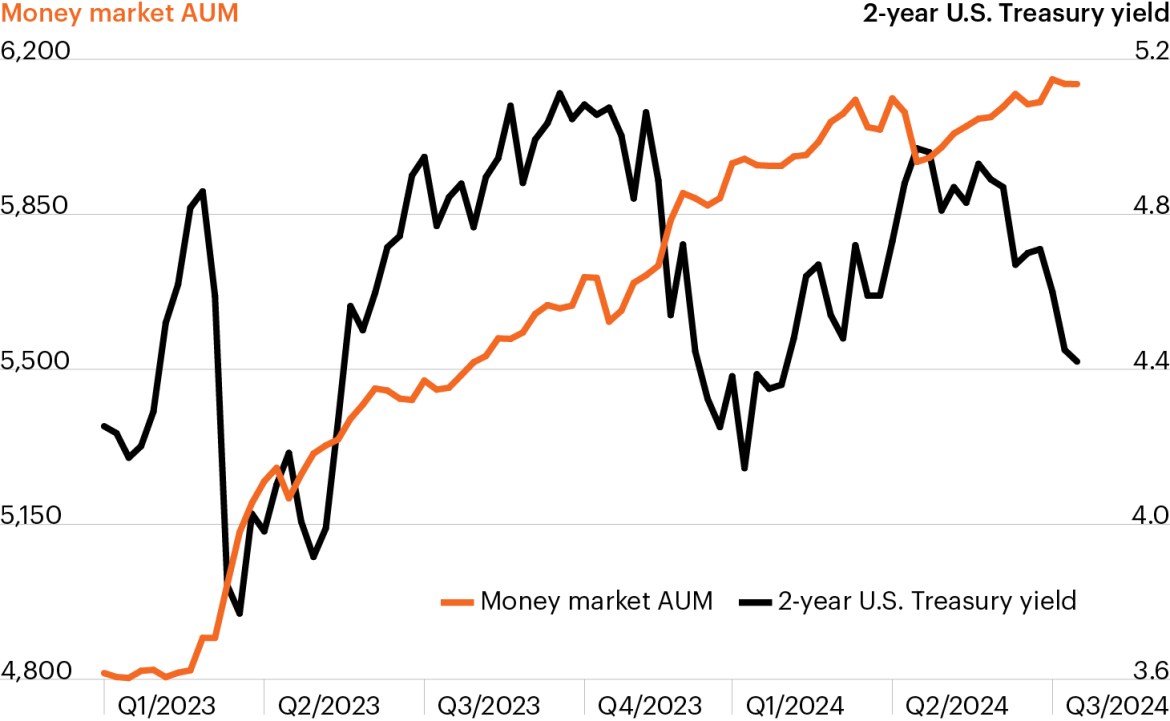

Money market assets under management and 2-year U.S. Treasury yield

Source: Bloomberg Finance, L.P., as of July 17, 2024.

- Fed policymakers have struck a more dovish tone following last week’s downside inflation surprise as they prepare for a potential rate cut as soon as September. But markets do not appear to be waiting for the Fed, staging a remarkable rotation in just a week.

- Small cap stocks have quickly come back to life following an extended period in which mega-cap Magnificent 7 stocks drove nearly all equity returns. In the week since June inflation data was released, the Russell 2000 Index (+9.17%) has far outpaced the S&P 500 (-0.80%).1

- Meanwhile, yields on shorter-dated Treasuries have fallen notably. The 2-year Treasury yield has declined -55bps since mid-April and -69bps since its September 2023 peak.1 Investors have been slow to react, as cash continues to see massive inflows and money market fund assets under management recently topping the $6.1 trillion mark.1

- Cash became a preferred allocation for many investors as the economic fragility of the first half of 2024 evolved into a higher-for-longer rate environment. Yet this past week’s market activity suggests this environment (and thus much of cash’s appeal) may have come to an end.

- Investors should remain mindful of the potentially significant opportunity costs of holding too much cash. Alternative investments that provide less-correlated sources of income and total return may provide attractive entry points for many investors seeking to redeploy cash allocations.