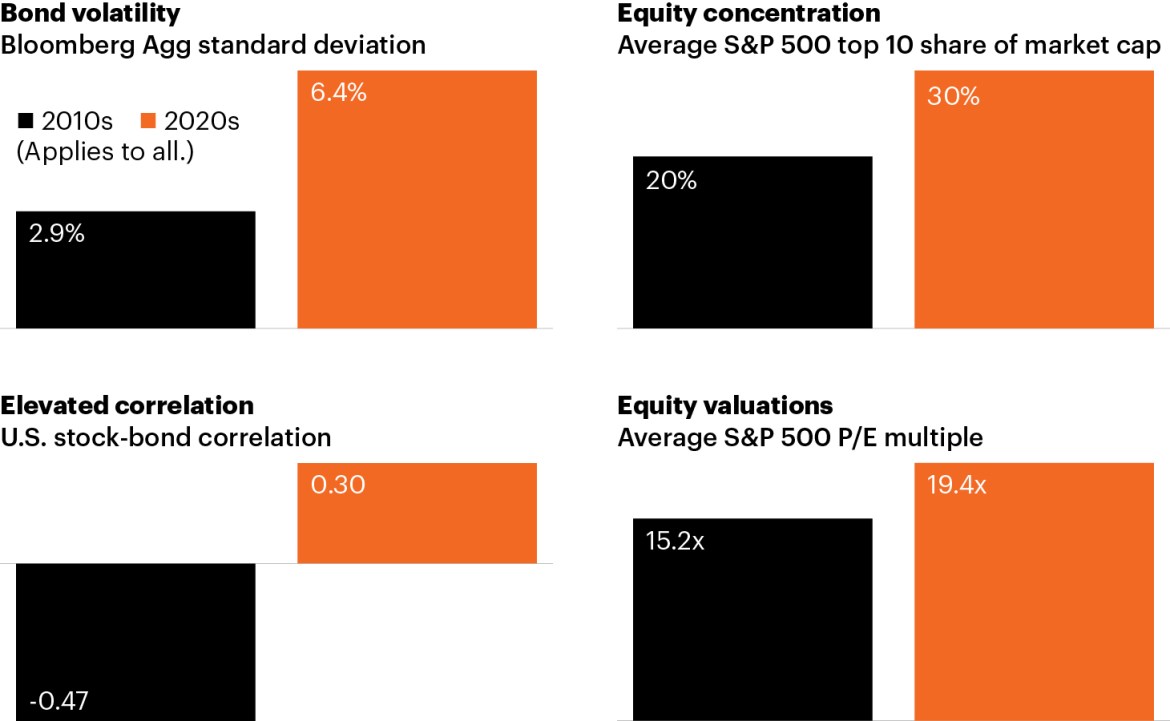

Source: Bloomberg Finance, L.P., as of June 30, 2024, for each of the four charts. Data reflect averages for each respective time period.

- The investment case for alternatives has rarely been more attractive as today’s macro environment has evolved in ways that are notably less conducive to the traditional 60/40 portfolio. The above charts highlight four important reasons why alts may be well-positioned within today’s macro backdrop.

- Driven by significant interest rate volatility, core fixed income is more volatile today than during the 2010s (upper left chart).1 Equity and fixed income markets are also more correlated today than during the 2010s, when core fixed income provided a balance against volatile equity markets (lower left).1

- Meanwhile, investing in the S&P 500 increasingly implies a concentrated bet on the Magnificent 7, an inescapable group of U.S. tech and tech-related firms. As the charts at right highlight, the Index is significantly more concentrated—and expensive—than during the 2010s, calling into question stocks’ forward-looking return potential.

- Allocating to alternative investments may provide investors with differentiated sources of current income, growth and diversification at a time when traditional assets face headwinds.

- Alternative investments have also garnered increased attention as advisors are learning that alts may help them differentiate their practice and win wallet share among new and existing clients.