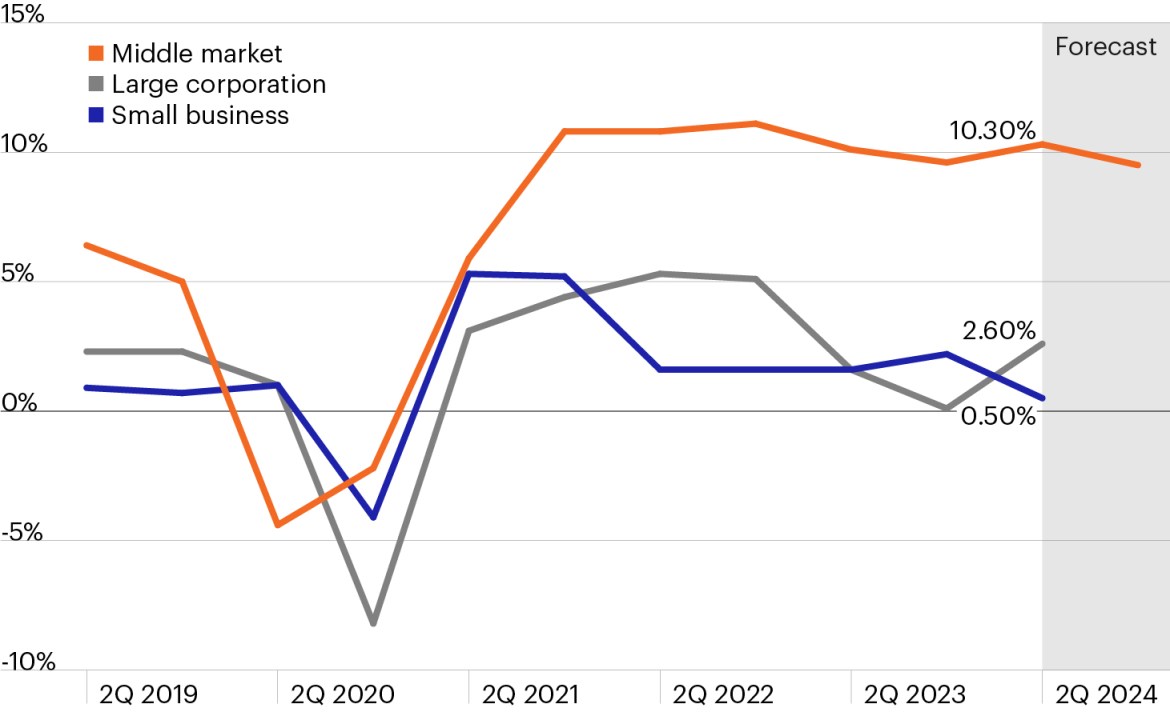

Employment growth rates for U.S. firms by size

Source: National Center for the Middle Market, Mid-Year 2024 Middle Market Indicator.

- Markets have soared following the Fed’s 50 basis point rate cut last week. Yet it’s important to remember that a weakening employment picture was at the heart of policymakers’ decision to cut rates and will continue to be a primary focus through the coming months as any additional policy moves remain highly data dependent.

- Against this backdrop, the chart highlights the wide gap between the annual employment growth rates for middle market companies, which have grown at a 10%-plus clip since Q4 2021 and project to remain in that range through mid-year 2025.1

- Employment growth across middle market firms has also been widespread as 60% of these firms expect to see annual job growth through the second quarter of 2025.1

- The U.S. middle market, which represents one-third of private sector gross domestic product (GDP) and employs approximately 48 million people, has served as a driving force of the U.S. economy for decades.1

- While the vast majority of middle market companies are privately held, individuals and institutions have a growing number of solutions dedicated to expanding access to private markets. As companies are opting to stay private for longer, these strategies may offer the potential for diversification and growth at a time when public equity valuations remain historically high and the outlook for rates remains uncertain.