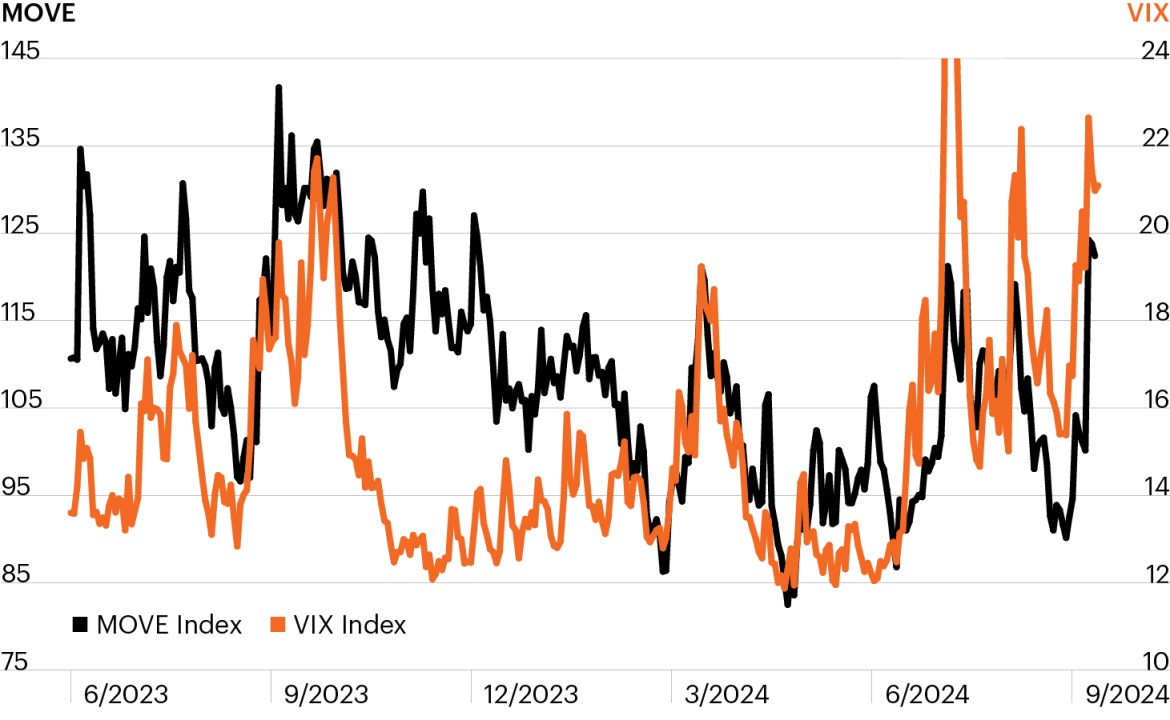

Expected equity and rate volatility spikes in October

Source: Bloomberg Finance, L.P., as of October 10, 2024.

- A sense of anxiety has begun to crash the exuberant party investors have enjoyed for most of this year.

- While equity markets raced to all-time highs driven by increased acceptance that the Fed can engineer a soft landing and a steady decline in Treasury yields, sentiment has recently softened as markets realize that landings can be bumpy.

- Expectations for rate volatility (black line) and equity volatility (orange line) have both spiked this month as the 10-year has retraced part of its decline. Renewed uncertainty surrounding monetary policy has been one recent driver as the Fed navigates uncooperative inflation data and signs of a softening jobs picture.

- Even absent the macro questions, elevated volatility is entirely consistent with the pattern that normally prevails in the months ahead of a U.S. presidential election, which have historically triggered volatility.

- The range of potential volatility drivers remains plentiful. Against this backdrop, the case for alternatives that offer diversification and growth potential continues to be attractive.