Key takeaways

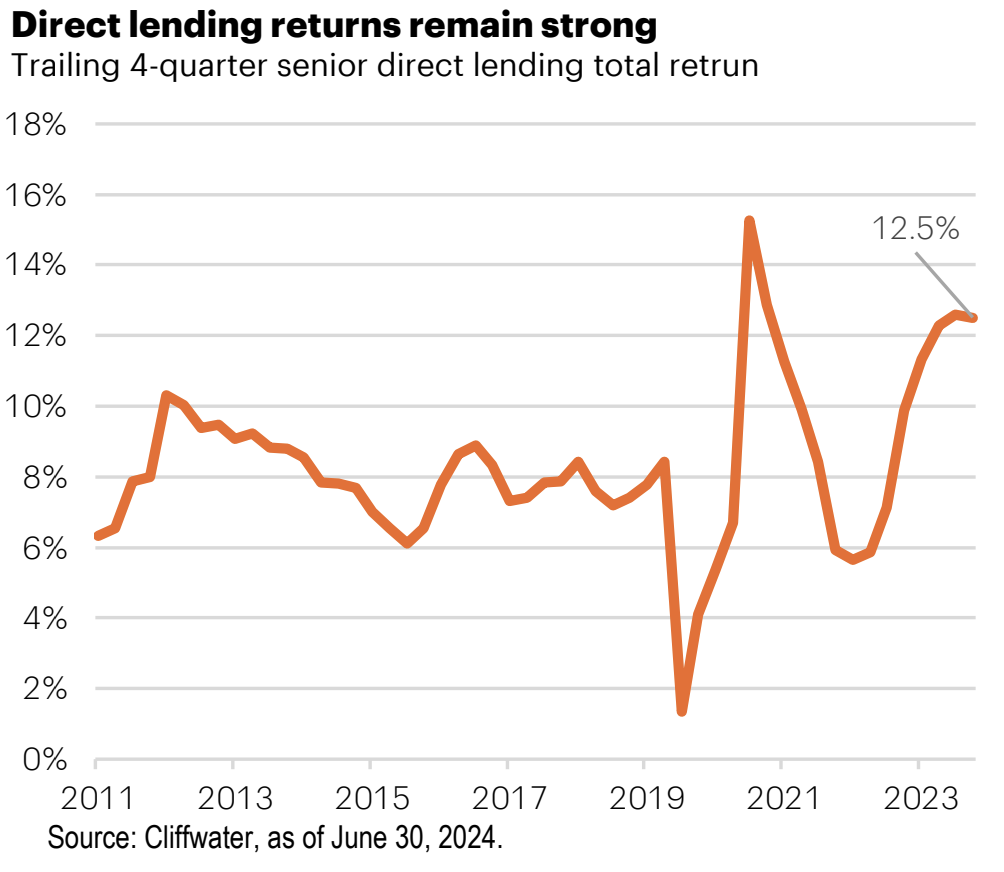

- Senior direct lending has returned 12.5% over the past year, among the top periods in the market’s history.

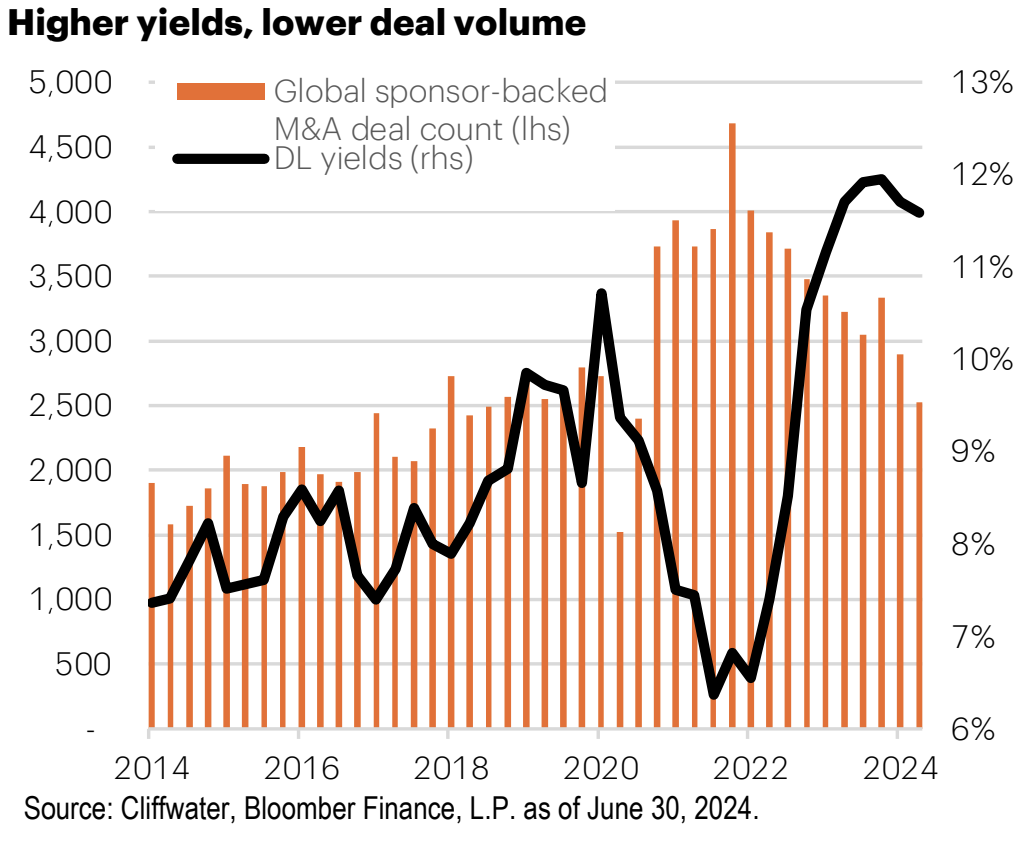

- Deal volume slowed significantly as rates rose, but we expect a reversal to begin in 2025.

- Fundraising has retreated to pre-COVID levels in private credit, with smaller managers bearing the brunt.

The private credit market continues to produce impressive returns as it adapts to its own growth and economic significance. Having now grown to near $2 trillion globally, private credit plays an increasingly pivotal role in economic activity, especially with banks remaining constrained. While pricing and deal volume will oscillate with the market cycle, private credit has shown its ability to generate return in a wide variety of environments.

In 2023, higher base rates increased yields in private credit but also reduced private equity deal activity and related financing demand. With economic uncertainty elevated following the spring bank failures, competition from public markets was low, allowing private lenders to reap wider spreads. Deal activity in 2024 has remained lukewarm but economic confidence has improved, catalyzing issuance in the syndicated loan market. The result has been a tightening in credit spreads across public and private markets.

Private credit fundraising has normalized since the feverish 2021–2022 period and totaled $75 billion in the first half, on par with equivalent periods from 2017–2019. Capital is increasingly flowing toward scaled lenders, with the 10 largest funds garnering half of all inflows last year. Global dry powder currently sits at $460 billion. While a significant sum, it is less than half the $1 trillion sitting in private equity coffers. The deployment of this PE capital would induce financing demand of roughly the same magnitude, to say nothing of future PE fundraising hauls, suggesting private credit—the preferred financing source for LBO sponsors—has significant runway for expansion.

Private credit has returned 12.5% over the past four quarters, comprised of income minus modest realized losses. Even if the Fed begins reducing rates, we see the return outlook for private credit as attractive. In addition, the market should benefit from our call for an improvement in private deal activity over the next six months.