Key Takeaways

- Private wealth comprises 15% of global alternatives AUM but will drive 26% of growth in the next decade.

- High-net-worth individuals represent an $80 trillion opportunity—one that asset managers are focused on.

- Growth in private wealth will benefit the industry overall, contributing scale and diversifying capital bases.

The migration of private wealth assets into private alternatives is a defining trend in the asset management industry on par with the rise of passive investing. For individual investors, it holds the potential to improve portfolios by giving them access to strategies long employed by large institutions. For the industry, it is the fastest-growing distribution vertical and requires managers to reconceptualize everything from structures, to liquidity, to education.

Global wealth has grown to more than $300 trillion, more than half of which sits with individuals. Currently, only about $4 trillion of that roughly $160 trillion—or 2.5%—is comprised of alternative assets such as private equity, private credit and real estate. Institutions, on the other hand, hold about $22 trillion—or 16%—in alternatives. Over the next decade, individuals’ allocation to alternatives is forecast to more than triple to $13 trillion, with the largest untapped opportunity being high net worth(HNW) and very high net worth families ($1 million to $30 million in assets).

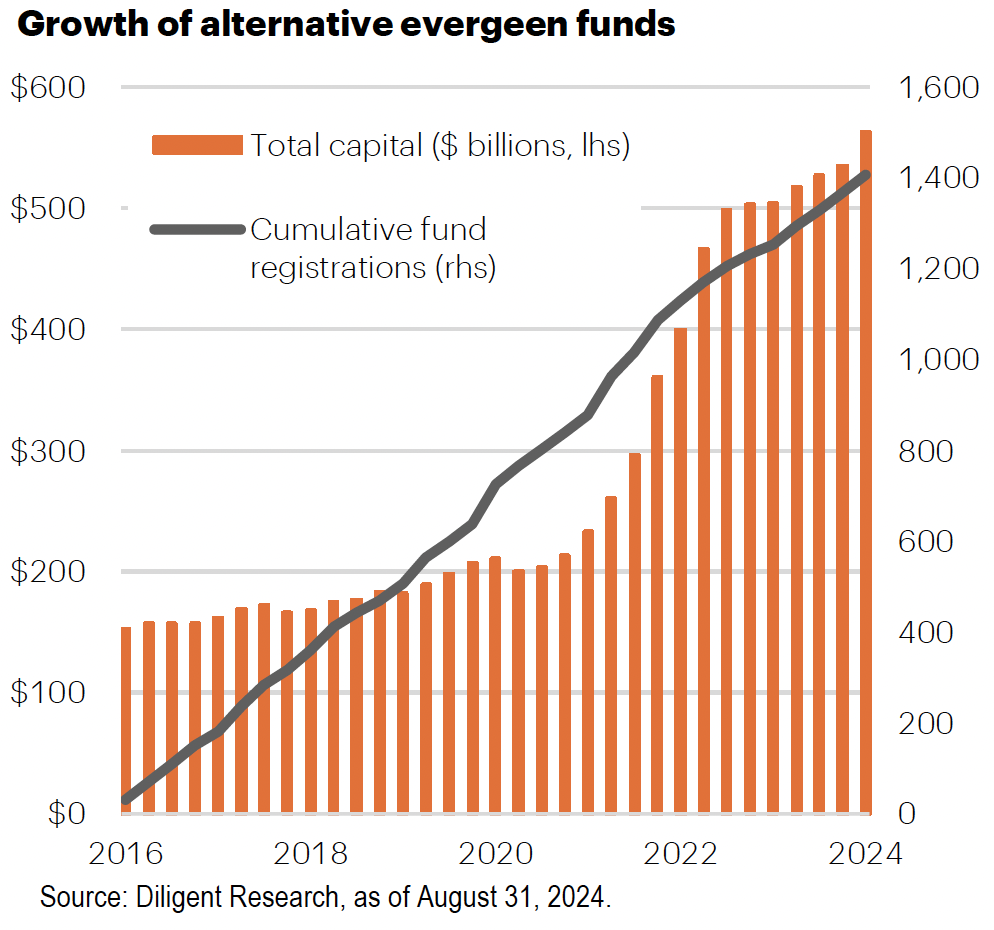

We can observe the growth of alternative investments within the private wealth space in the increasingly popularity of evergreen fund structures. These perpetually offered funds—which include interval funds, BDCs, non-traded REITs and tender offer funds—generally appeal to individual investors due to their periodic liquidity, simplicity of commitment and 1099 tax treatment. Assets in U.S. evergreen funds have grown from $182 billion in 2019 to $562 billion today, a rate of growth that nearly doubles that of U.S. alternative assets overall. Evergreen funds are certainly not the only way that individuals gain access to alternatives, but they do represent the bulk of the opportunity for the aforementioned HNW cohort.

Asset managers clearly see private alternatives in private wealth as a core growth market, and the largest players in asset management have all entered the space in some form or fashion. We view the growth of this segment as a positive for the market overall—it will better allow managers to scale and commit larger checks while diversifying their capital base. Individual investors and their advisors will be sensitive to their experiences as they dip their toes into alternatives, heightening the importance not only of performance, but of market education as well. The trajectory of growth in this segment appears clear, but the winners will need to employ a strategy that meets the specific needs of private wealth, which can differ greatly from those of institutions.