Stock performance and market sentiment

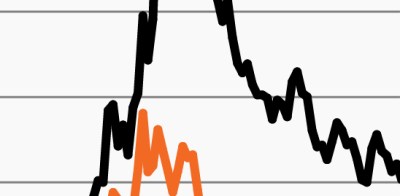

Source: American Association of Individual Investors (AAII) Investor Sentiment Survey, via Bloomberg Finance, L.P., as of September 24, 2020, latest data available. Investor sentiment represented by the 4-week moving average of percentage of bulls minus bears.

- Despite a several-week pause in September, the S&P 500 recorded a strong gain of nearly 9% in Q3. Combining that return with an approximately 20% move higher in Q2, the S&P 500 turned in its best two-quarter performance since the second and third quarters of 2009.

- As the market has moved steadily higher through the past six months, however, it has grown increasingly divorced from investor sentiment.

- The chart compares the performance of the S&P 500 with the AAII Investor Sentiment Survey, which measures individual investors’ expectations for the stock market in the next six months.1 As it highlights, stocks were pretty closely aligned with sentiment for much of 2018 and 2019. Beginning in March 2020, however, as the S&P began its strong recovery, performance began to decouple from sentiment. As investor sentiment has remained relatively bearish since May, the gap between the two has grown notably wider.

- Predicting the market’s direction for the next week or month is always difficult. It’s fair to say, however, that something must give. Either stocks continue to rise and sentiment adjusts, or they hit another patch of volatility and again match investors’ more subdued expectations.

- Given the considerable health, economic and political risks markets must contend with today, investors may be wise in seeking to prepare their portfolios for potential equity volatility ahead.