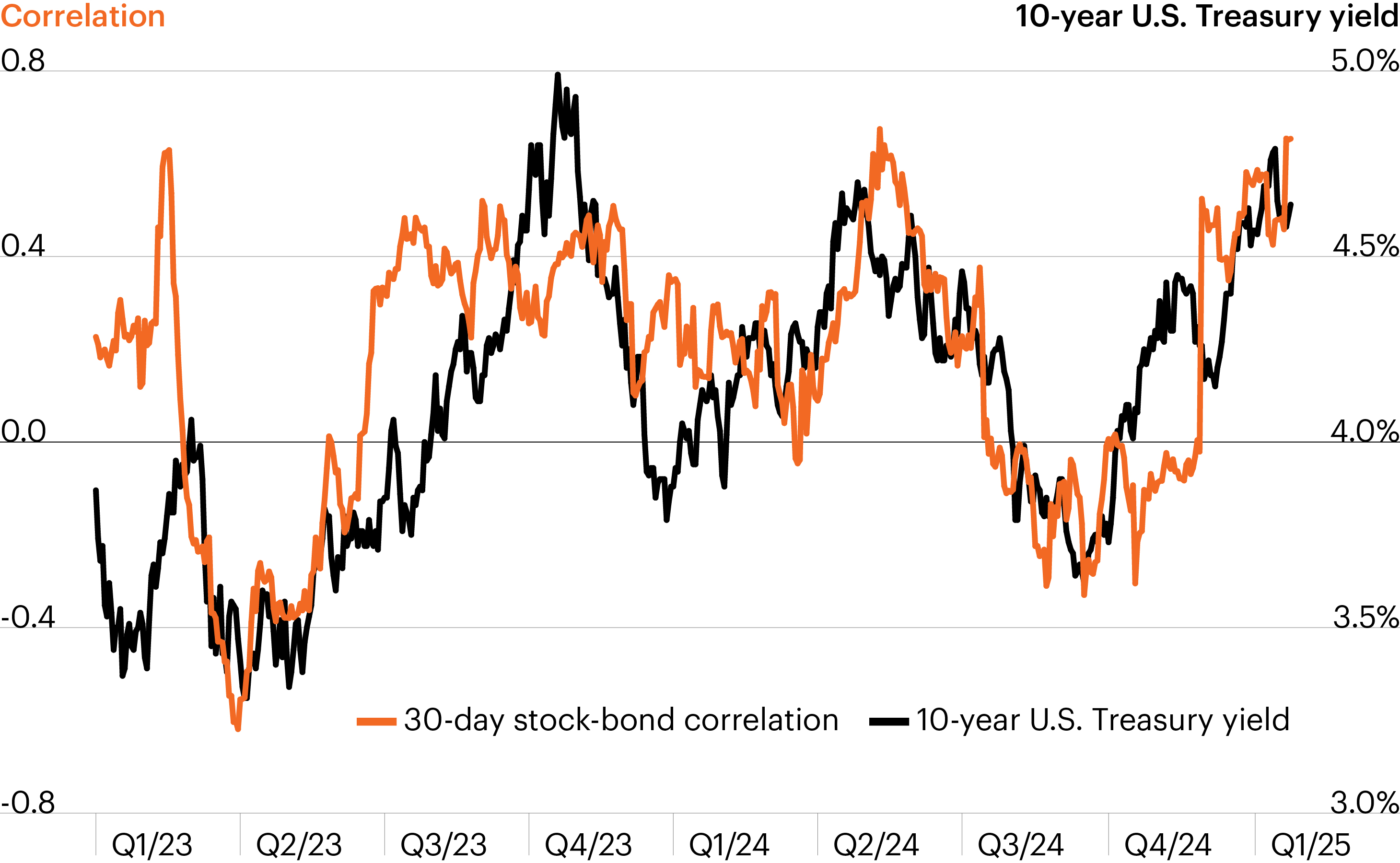

Stock-bond correlation and the 10-year U.S. Treasury yield

Source: FS Investments, Bloomberg Finance L.P, as of January 31, 2025. Stock/bond correlation is represented by the 30-day correlation between the S&P 500 and the Bloomberg U.S. Aggregate Bond Index.

- Investor sentiment has turned increasingly negative in 2025 driven by fears of slowing economic growth and a growing acceptance that rates may stay higher or longer, a belief that has been exacerbated by surging inflation expectations.

- As investors adjust to a higher-for-longer rate environment, the era of easy diversification (where fixed income acted as a ballast to volatile equities) may be over. An elevated rate environment has historically led to higher correlation between stocks and bonds.

- The chart shows the 30-day rolling correlation between stocks (S&P 500) and bonds (Bloomberg U.S. Aggregate Bond Index), along with the 10-year Treasury yield, which have moved in tandem over the past year.1

- The rolling 3-year correlation between stocks and bonds began to spike in early 2002, as the Fed began to aggressively hike rates, and today sits at a 75-year high of 0.67.1

- Against this backdrop, the potential for alternative investments as a source of diversification appears particularly compelling.