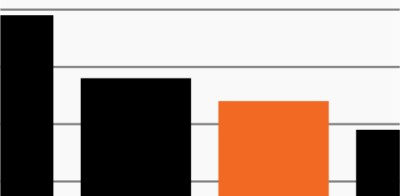

S&P 500 and S&P 500 Equal Weight Index returns (indexed to 100)

Source: S&P Dow Jones Indices, as of August 20, 2020.

- U.S. stocks have climbed approximately 55% off their late-March lows, bringing the S&P 500 up more than 5% YTD.1 The rally has been spurred on at various points by a mix of massive fiscal and monetary stimulus, positive economic surprises, vaccine-related optimism and improvements in high frequency indicators.

- The technology sector’s growing prominence within the S&P 500 has also played a major role in the recovery. Information technology stocks account for approximately 30% of the S&P 500 Index today compared to about 18% in 2009.1 The largest five tech companies – also the largest companies in the S&P 500 – have seen their stock prices rise approximately 40% this year compared to negative returns for the other stocks in the index.1

- The chart highlights this dispersion. It shows YTD total returns for the S&P 500 Index as well as the S&P 500 Equal Weight Index, which reduces the return impact from the largest names in the index (many of which are tech companies).2 Buoyed by the tech sector, the S&P 500 Index experienced a shallower decline and stronger recovery than that of the equal-weight index.

- Tech stocks, of course, could continue their astounding rally through the rest of the year. Given technology’s heightened concentration within the S&P 500 and the regulatory uncertainty surrounding the results of the upcoming U.S. election, however, now may be a good time for investors to review and consider lowering some of the inherent concentration risks within their portfolios.