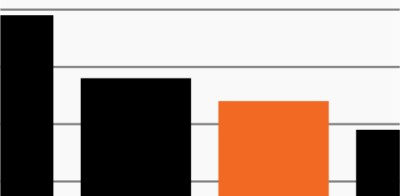

GDP recoveries, then and now (indexed to 100)

Source: Federal Reserve Bank of St. Louis, as of November 5, 2020. Chart shows the path of real GDP during the past two recessions: the Global Financial Crisis (Q1 2007–Q4 2010) and the current recession to date (Q3 2017–Q3 2020).

- Investors’ initial reaction to what seems to be an increasingly probable outcome of the 2020 election – a divided government – has been very positive. Stocks were up more than 7% through Thursday while the Barclays Agg has risen nearly 1%, benefiting from rates’ steep decline.1

- Despite the initial optimism, the swift reversal in rates – the 10-year U.S. Treasury fell back down to 0.77% from a recent peak of 0.90% – underscores the cloudier macro environment that seems likely to take shape in 2021. That is, the prospect of less fiscal stimulus points to the idea that the economic recovery could from here move into a more moderate phase.

- The chart compares real GDP growth during the recession in 2008–09 with today’s pandemic-driven recession and highlights their varying paths to recovery.2 For example, the recovery in the years following the Global Financial Crisis was a long, slow process, as GDP didn’t reach its pre-crisis peak until Q3 2010, a full 16 quarters later.2

- The current recovery, of course, has taken a very different shape as it was initially fueled by massive amounts of monetary and fiscal stimulus. Looking ahead, however, a divided federal government could pose significant challenges to the next leg of the recovery.

- Expectations for Q4 2020 GDP were on the decline through September and October, and J.P. Morgan analysts now expect Q4 2021 GDP growth of just 1.7% – approximately 4% below its pre-crisis path.3

- Despite investors’ initial glee at the current election results, the Treasury curve may be viewed as a reminder of the potential economic slog still ahead of us. Against this backdrop, investors may find generating competitive income and total return opportunities across traditional asset classes a difficult proposition.