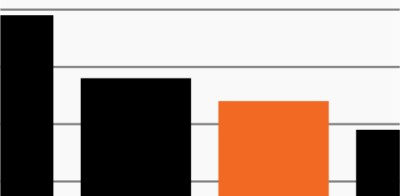

Annual change in state and local government employment

Source: Federal Reserve Bank of St. Louis, S&P Global Market Intelligence, as of November 19, 2020. 2020 YTD employment data is an estimate based on monthly figures provided by the U.S. Bureau of Labor Statistics.

- Positive vaccine news in each of the past two weeks has jolted stocks, propelling the S&P 500 to a new all-time high and a nearly 10% return month to date. Sentiment quickly brightened as investors began to expect that both the U.S. economy and daily life could “return to normal” in early 2021.

- Vaccine optimism may be warranted, but the road back to a pre-pandemic environment remains perilous. Rising COVID-19 case counts might continue to temper the mood, while this week’s weaker than expected retail sales and employment data have confirmed the U.S. economy’s recent downshift.

- The results of November’s election also make the path forward murkier as hopes for further significant federal stimulus dim. Against this backdrop, the sizable fiscal squeeze facing state and local governments could serve as an additional factor moderating a post-vaccine economic recovery.

- The chart shows annual changes in employment among state and local governments. Looking back to the Global Financial Crisis, the significant drawdown in employment among state and local governments didn’t even begin to recover until three years after the recession ended and finally reached pre-crisis levels in 2019.1

- In today’s environment, we expect that the massive revenue shortfall experienced by local economies could lead to a similar, years long decline in local government spending and employment.

- With a still-difficult part of the economic recovery likely ahead of us, investors may be wise to remain prepared for further volatility ahead.