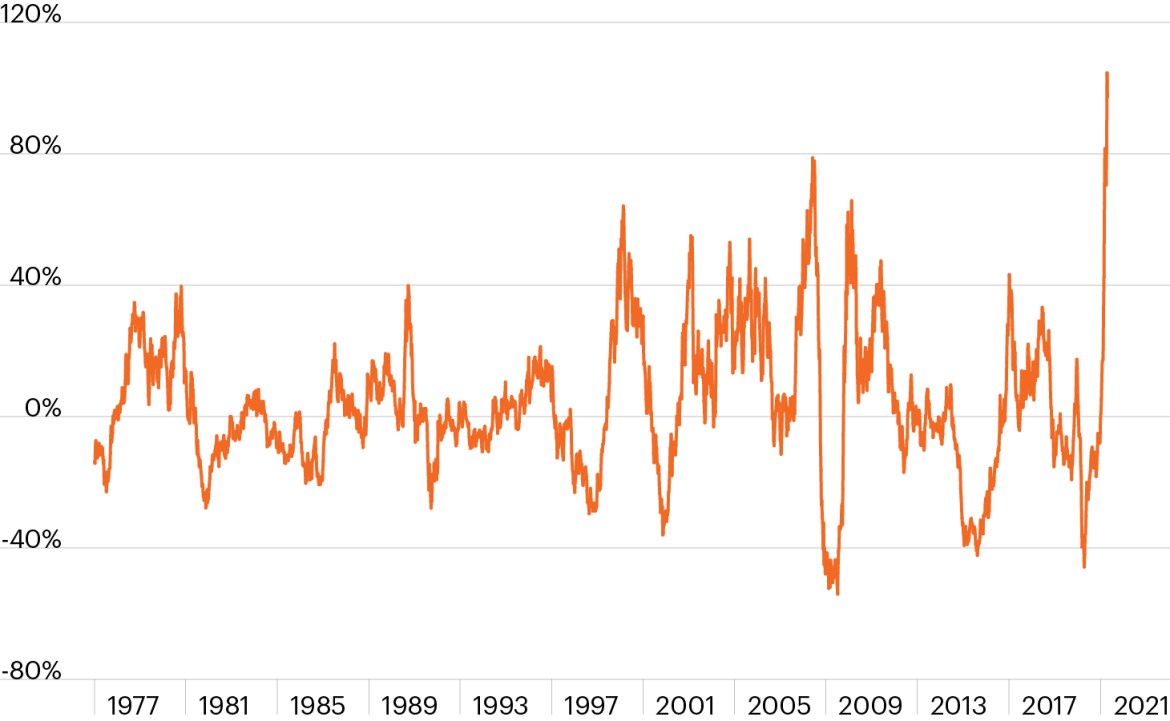

S&P GSCI price change, y/y

Source: Bloomberg Finance, L.P., as of April 30, 2021. The S&P GSCI is an index measuring the performance of a basket of 24 major commodities.

- Fears surrounding rising rates and inflation again took center stage this week as Treasury Secretary and former Fed Chair Janet Yellen briefly rattled markets, noting that the Fed may have to raise rates to prevent the U.S. economy from “overheating.”

- For their part, Fed officials have generally remained on script recently, noting that the inflationary pressures expected in the coming months are likely to be transitory, the result of the “base effect” calculation caused by slumping prices in 2020.

- The contrasting views on inflation among such high-profile officials are notable, but also simply representative of the competing views among investors today. Against a backdrop of rapidly accelerating economic growth and the fastest-ever appreciation in commodity prices, as shown in the chart, it would be fair for investors to be skeptical that pending inflationary pressures are just transitory.1

- Futures markets, however, support the idea that inflation of commodity prices, at least, may be passing. While the year-over-year change in the S&P GSCI is unprecedented, major commodity markets are also showing the steepest backwardation in more than a decade.1 Said another way, spot prices are higher than prices trading in the futures market. This has historically been a sign that investors believe today’s high prices are a short-lived reality and not necessarily indicative of a new, higher-inflation regime.

- Of course, one side in this argument over inflation will ultimately be proven wrong. As we wait to see which side is right, however, what seems certain is that rate-sensitive fixed income and equity markets could see sustained choppiness as the debate rages on.