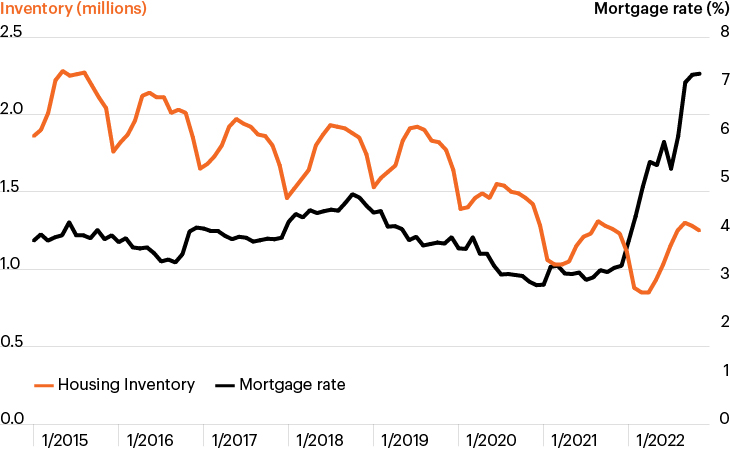

Inventory has fallen as mortgage rates rise

Source: Bloomberg Finance, L.P., as of November 9, 2022

- Markets jumped on Thursday as October’s consumer price index (CPI) release showed inflation rose at its slowest pace since January, finally bucking the trend of notable upside surprises for most of 2022.

- While the positive inflation is certainly welcome, the Fed’s work is clearly not done. Following the CPI report, market-based Fed rate expectations fell, yet investors still expect another 100 bps of Fed rate hikes to reach a terminal rate of approximately 4.85% in May 2023.1

- Housing price growth has stalled recently in the face of rapidly rising mortgage rates (black line), stoking fears among some of a major downturn ahead. But home prices could remain more resilient than expected simply because supply has become tight.

- Residential housing starts have plunged at their fastest rate ever this year while inventory has trended consistently lower since 2015.1 Said another way, developers have significantly cut back new home construction this year while the inventory of existing home sales has slowed significantly.

- In sharp contrast, multifamily commercial real estate has largely remained resilient and could be reinforced by the single-family market’s troubles. Multifamily transaction volume and rent growth have clearly slowed from their peaks of 2021, yet the fundamental picture remains sound. Apartment rent growth continues to outpace core CPI this year while vacancy rates and cap rates are at or near their historic lows as prospective home buyers continue to rent.