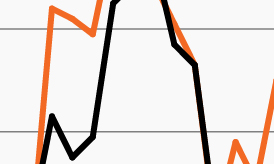

Commercial real estate price growth: Urban vs. suburban

Source: Real Capital Analytics, as of December 31, 2021. Latest data available. RCA CPPI refers to the RCA Commercial Property Price Index. COVID-19 declared a pandemic by the World Health Organization on March 11, 2020.

- The commercial real estate (CRE) market stood out in 2021 even amid the year’s strong U.S. equity rally.

- The RCA Commercial Property Price Index (CPPI) rose 22.9% in 2021, notching its fastest-ever annual growth in the 21-year history of the index as CRE prices were supported by a recovery in rents, excess liquidity, and low interest rates.1

- Industrial and apartment prices led growth during the year. Perhaps the most notable trend was not by property type, but rather in the growing urban-suburban divide, which accelerated as Americans migrated away from expensive states and urban cores during the pandemic.

- Property prices clearly followed the migration patterns. While property prices are up across the board, price growth among urban properties has significantly trailed that of suburban properties since the pandemic began as the chart shows.1 Even within the suburbs, density was a loser as prices for car-dependent suburban properties far outpaced that of highly walkable suburban properties (those closer to a city).1

- The rationale behind American’s flight from density involves both cost — property values in major metro central business districts grew nearly twice as fast non-major metros for the 10-years ended 2019 — and convenience as office employees desire more space in an increasingly remote-work world.1

- The backdrop supporting the CRE markets appears healthy in 2022, yet the dispersion between property types and locations could continue to widen, offering selective investors the opportunity to outperform.