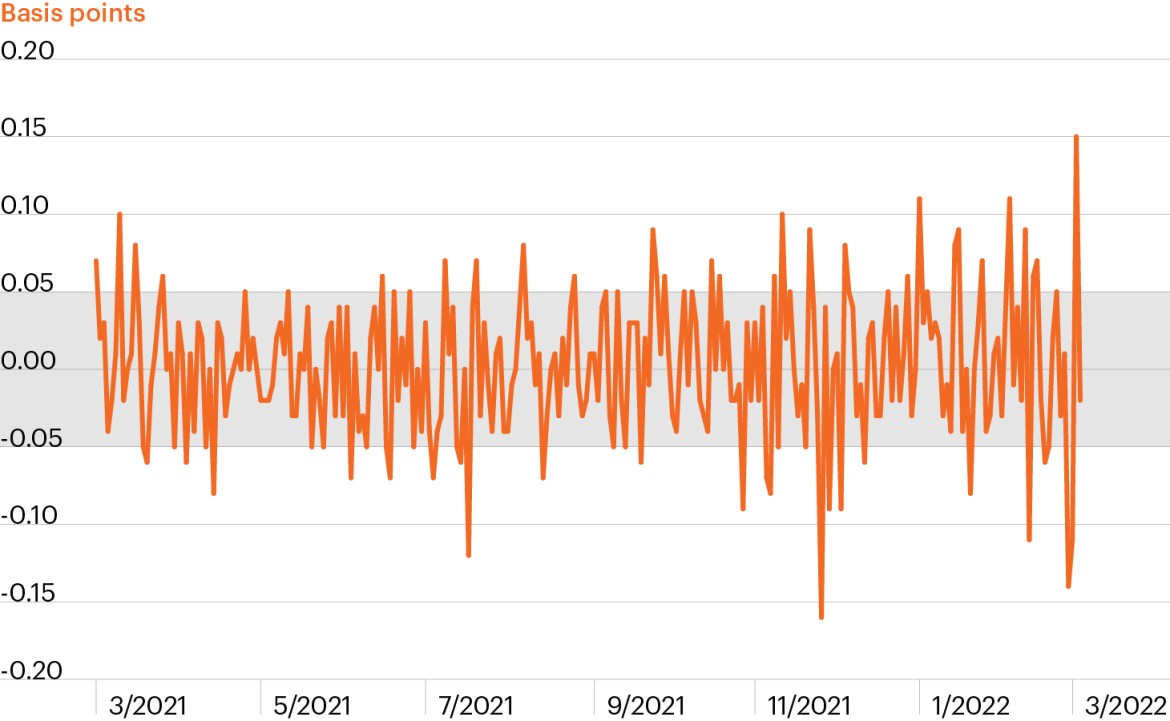

Daily changes in 10-year U.S. Treasury yield

Source: Federal Reserve Bank of St. Louis, as of March 3, 2022.

- The combination of increasingly intense fighting in Ukraine, growing Russian isolation and spiking commodity prices have added a new layer of volatility to an already choppy start to the year, driven by concerns of an overly hawkish Fed and multi-decade high inflation readings.

- Treasury rates reflect the increased volatility as investors attempt to make sense of competing market drivers between massive headline risks (geopolitical risks in addition to supply chain challenges, evolving global central bank policy and inflation) and the continued resilience of the U.S. economy.

- The 10-year U.S. Treasury saw relatively mild daily movement of 5 basis points or fewer for most of the past year. The 10-year’s fluctuations have been exaggerated this week, however, as it has moved 10+ basis points in three of the four trading days through Thursday.1

- Investors often look to the 10-year as a proxy for economic expectations. It seems fair to say that today’s investment environment appears murkier than ever. Against this backdrop, investors may be wise to adopt an active approach to navigate quickly changing markets and seek alternative ways to generate returns and manage risk.